Decentralized Social (DESO) is a layer-1 blockchain specifically designed to support social media and DeFi applications. DeSo carries a vision of a creator-focused, user-owned open internet where millions of developers can build on top of each other. The DESO token serves as the network’s native currency to cover transaction fees and is used for staking in the Revolution Proof of Stake consensus.

What is Decentralized Social (DESO)?

The DeSo blockchain was built from scratch to power storage-intensive applications. Posting a 200-character “Tweet” on Ethereum costs over $100, on Solana over $2; but on DeSo, this cost is one ten-thousandth of a cent. The same advantage applies to financial content; for example, storing a limit order. This storage superiority gives DeSo the ability to combine social content with crypto for the first time and develops DeFi primitives.

Centralization of Social Media

Today, social media is more centralized than the pre-Bitcoin financial sector. A handful of private companies control public discourse and reap monopoly profits from the content created. Content creators, due to the old ad-focused model, receive low pay, low engagement, and are deprived of monetization.

The ad model forces platforms to keep content in walled gardens; external developers are prevented from innovating or building apps. Users and creators are forced to use apps controlled by these companies. The problem stems from user data and content being privately owned by a handful of companies; it is not a public utility open to access.

Only these companies can build competitive feeds, develop new features, and monetize content – even though the content is not theirs. The cycle works like this: Users use these apps due to content monopoly, creators provide content for reach, companies grow stronger against creators and society.

These companies monopolize the private content pool with global network effects. Combining content in a single pool is valuable for curation, but a central gatekeeper manages the pool. The solution is to shift network effects to a public content pool that no entity controls.

What Does DESO Aim For?

All problems can be solved by decentralizing social media just as Bitcoin and Ethereum decentralized finance. Bitcoin disrupted finance by storing transactions in a non-monopolizable public ledger; this technology can be scaled for the first time to operate social networks.

Bitcoin and Ethereum showed that dominant platforms can be built around open code and data. This open model is disrupting financial institutions; now it can disrupt social media giants and ad models.

If we put social media content on a public blockchain, we can rival and surpass the economies of scale created by traditional giants. We solve the collective action problem among independent publishers; individual rational contributions create a global shared pool, intermediaries cannot be removed, and no single company controls it.

Ultimate Vision

A post uploaded to Instagram, TikTok, or Twitter belongs to those companies; not the creator. Monetization mostly goes to the companies. DeSo stores all data on a public blockchain; anyone can run a node exposing their own curated feed.

Future “Curator” Economy

Vertical players can curate their own feeds. For example, ESPN runs a node for sports content, Politico for political content. Since DeSo is open source, the user interface is customizable, algorithms adapt to the target audience.

This enables a transition from a world where a few giants control dominant feeds to thousands of focused feeds. Storing data on a public blockchain makes it possible for an engineer to build a competitive social media experience with existing incumbents; it lowers entry barriers.

Existing publishers can easily spin up social apps as adjacency to their core business; upstarts innovate on equal footing with megacorps. Today, a competitive social app requires a billion-user data moat.

How Do Nodes Work?

Anyone running a node contributes data to the global profile, post, follow pool. A post or like on the ESPN node can surface in the Politico feed. A post from China appears on an American node.

With each node, more content is added to the global pool, every node on the network becomes stronger and more engaging. DeSo solves the collective action problem among independent publishers: Instead of contributing to a private pool not aligned with megacorp interests, they contribute to a public pool no one controls, cannot be disintermediated.

Data transforms from heavily guarded private source to globally accessible utility. Publishers have strong incentives to contribute data to the blockchain; top creators do not want to publish on closed platforms, because by publishing posts to the blockchain, they instantly reach every node/feed on the internet.

Creators gain unprecedented reach and direct relationships with followers. Reach is one side; monetization is the other.

Future “Creator” Economy

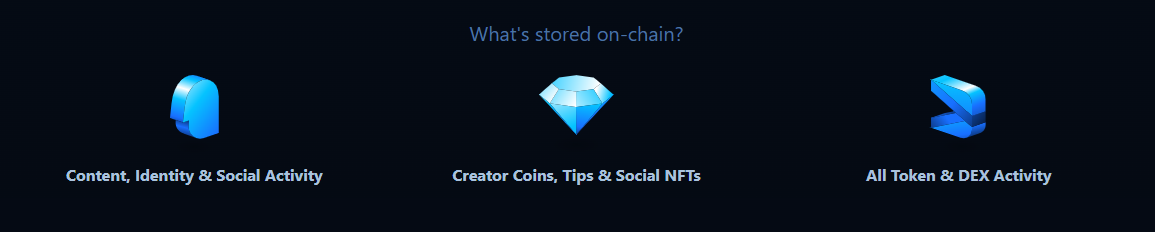

Social tokens, social NFTs, and social tipping are categories pioneered by DeSo that change creator monetization; but it’s just the beginning. Since DeSo is money-native and open source, anyone can build apps on DeSo to experiment with new monetization paths.

For example, a major creator wants to offer monthly subscriptions for premium content. One person building the feature on the internet is enough; the entire DeSo app ecosystem instantly accesses it. Like paying for reposts or message replies in the same inbox.

The best machine learning researchers for spam or harmful content detection build solutions on the full data firehose without permission.

Future of Open Standards

The DeSo blockchain is an open protocol the world can collaboratively build; it unlocks creator potential, brings competition and innovation to social media. Since it’s money-native, new signals emerge for effective content ranking. Bitclout.com’s first experiment was ranking comments by the commenter’s social token price.

This simple mechanism produces competitive results with centralized platforms. Ranking messages by coin price reduces influencer spam; unique to DeSo apps. When the world builds on DeSo, what can be done with the “$DESO Signal” is just the beginning.

DeSo was designed from scratch to keep system incentives decentralized in the long term. Creators have strong incentives to post content directly to the blockchain. Developers cannot lose data or API access; when they run a node, all data is already in their hands.

Traditional social media companies start open for network effects, close access once they gain a data moat. DeSo becomes an enduring positive force for humanity; it brings competition and innovation to the internet. The internet started decentralized; now it’s concentrated and innovation is hard. The pendulum will permanently swing back to decentralization; we can all be part of it.

Next-generation applications the world can collaboratively build unlock the full potential of human ingenuity.

DESO Tokenomics

- Total Supply: 10.8 M (excluding stake rewards)

- Burn: 100% of transaction fees burned, DESO becomes scarcer as transactions increase

- Stake: Secures nodes with Revolution PoS, 20% APY (variable)

- Inflation: Short-term, decreases over time, deflationary

Initial Distribution

- 77%: Bonding Curve (2021, $0.50 → $180, 5k BTC)

- 20%: Core Team

- 3%: Proof of Work mining

DESO Sinks

Openfund & Focus: their tokens purchased only with DESO

No Equity

- No equity ever sold

- No locked tokens

- Team = bought at same price as everyone

BMF: Burn-Maximizing Fee Mechanism

Unlike other blockchains, fees are maximally burned; network value accrues to DESO, transaction ordering and validator incentives are not disrupted.

High level: Validators paid fee log, remainder burned. 2x fee linearly increases validator reward. High fee incentivizes block placement, validators do not take lion’s share. Validators operate with commission on delegated stake.

Full system in open source code. Ethereum MEV not optimized; Solana 50% blind burn. DeSo fee burning and validator reward designed from ground up; minimize long-term operating cost, max fee burn.

DeSo Governance

Changes occur with Revolution Proof of Stake upgrades. Anyone submits upgrades to open source code; 2/3 stake-weighted validators upgrade before block height for it to pass. Like Ethereum; major economic player oversight.

Impossible without upgrade; 100% open source, no one owns more than 20% DESO.

Decentralized Social Investors

Total $200 million raised. DeSo is building the future of social media with support from the world’s most prestigious crypto funds.

Level: Coinbase Ventures, a16z crypto, Polychain, Pantera, Sequoia Level: Arrington Capital, Hack VC, Distributed Global, Blockchain.com Level: Blockchange Ventures, Winklevoss Capital, Social Capital Level: TQ Ventures

Decentralized Social Team

Founded by Nader Al-Naji in 2019, DeSo was bootstrapped entirely with own resources. The core team grows the project with open source and decentralized vision.

- Nader Al-Naji – Founder & Visionary

- Ed Moss – Head of Growth

- Piotr Nojszewski – Head of Research

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.