DeepBook Protocol (DEEP) is a decentralized finance (DeFi) platform operating on the Sui Network, distinguished as a central limit order book (CLOB) protocol. Unlike traditional automated market maker (AMM)-based exchanges, DeepBook offers tighter spreads and familiar trading mechanics for professional traders. Leveraging the high-performance infrastructure of the Sui blockchain, it provides low latency and cost-effective transactions. The DEEP token powers the protocol’s economic layer, used for liquidity provision, governance, and transaction fees. Let’s explore DeepBook Protocol (DEEP) and its functionalities in detail.

What is DeepBook Protocol (DEEP)?

DeepBook is a fully on-chain central limit order book (CLOB) protocol designed as the native liquidity layer of the Sui Network. Thanks to Sui’s parallel transaction execution model, orders are processed with low latency (averaging 390 milliseconds), enabling microsecond-level matching. This makes it ideal for high-frequency and high-volume transactions. DeepBook allows all DeFi protocols and wallets to access a shared liquidity pool, consolidating liquidity rather than fragmenting it. Similar to Uniswap’s role in Ethereum, it provides a foundational infrastructure within the Sui ecosystem.

Key Features

-

Deep and Shared Liquidity: All Sui dApps access the same order book, concentrating liquidity.

-

Better Price Execution: The CLOB model supports limit orders and advanced market-making with minimal slippage.

-

High Throughput, Low Fees: Sui’s object-based design delivers high-speed matching with low transaction fees.

-

Composability: Developers can integrate DeepBook via simple APIs to build lending, leveraged trading, or derivative products.

-

Transparent On-Chain Data: Every order, cancellation, and match is recorded on the Sui blockchain, ensuring full transparency.

How Does DeepBook Protocol (DEEP) Work?

DeepBook operates as an on-chain CLOB, matching buyer and seller orders like traditional exchanges. Unlike AMMs’ constant product curve, it offers price-time priority with deterministic execution. The DEEP token strengthens the ecosystem by providing incentives for liquidity providers (makers) and discounted transaction fees for takers. Two key mechanisms keep liquidity deep and spreads tight:

-

Dynamic Fee Structure: Everyone starts with a standard fee, but takers who stake a certain amount of DEEP tokens and exceed a trading volume threshold receive a 50% fee discount, reducing costs for active traders.

-

Market Maker Incentives: Makers staking DEEP earn higher token rebates during low-liquidity periods, providing counter-cyclical incentives to balance liquidity.

Wallets without staked DEEP pay full fees and receive no rewards, aligning incentives between serious liquidity providers and the protocol. At the end of each epoch, fees not redistributed as maker incentives are permanently burned, making the DEEP token deflationary. Additionally, DEEP stakers govern pool-specific fee bands and staking requirements. A concave voting system ensures smaller investors have a meaningful voice.

Why is DeepBook (DEEP) Important?

DeepBook positions itself as a core liquidity hub in the Sui Network’s DeFi ecosystem. Its on-chain structure maximizes programmability, interoperability, and composability advantages. DeepBook v3 enhances performance with features like flash loans, advanced matching algorithms, and governance. Liquidity providers gain greater price control compared to AMM models, making it appealing to sophisticated market makers. Combined with Sui’s low fees and high transaction speeds, DeepBook is an ideal DeFi platform for both individual and institutional investors.

Why It Matters

-

Deep Liquidity: Shared pools reduce slippage for large orders.

-

High Speed and Low Cost: 390 ms transaction times and low fees.

-

Security: Comprehensive audits, bug bounty programs, and expert reviews.

-

Community Governance: DEEP token holders shape the protocol’s future.

-

Ecosystem Integration: Compatibility with platforms like Aftermath Finance, KriyaDEX, Cetus, and FlowX.

How to Use DeepBook (DEEP)?

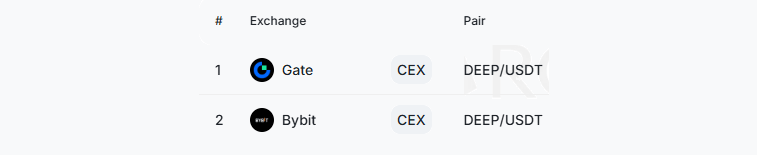

To use DeepBook, you first need to acquire DEEP tokens by bridging assets like USDC to a Sui wallet. DEEP can be purchased on exchanges like Gate.io, Bybit, or through DeepBook’s DEEP/USDC pair. Users can stake DEEP tokens to participate in governance, earn fee discounts, or provide liquidity for rewards. Developers can use DeepBook’s APIs to build their own DeFi applications.

Getting Started

-

Bridge USDC to a Sui wallet.

-

Purchase DEEP from supported exchanges or DeepBook’s interface (e.g., Turbos, Navitrade).

-

Stake DEEP tokens to participate in governance or earn rewards.

-

Trade in DeepBook’s liquidity pools or integrate with dApps.

DeepBook Ecosystem

DeepBook is integrated with numerous DeFi protocols in the Sui ecosystem. Platforms like Aftermath Finance, KriyaDEX, Cetus, FlowX, Turbos Finance, and 7K Aggregator connect to DeepBook’s shared order book, providing deep liquidity. This enables Sui dApps to share liquidity and enhance user experience.

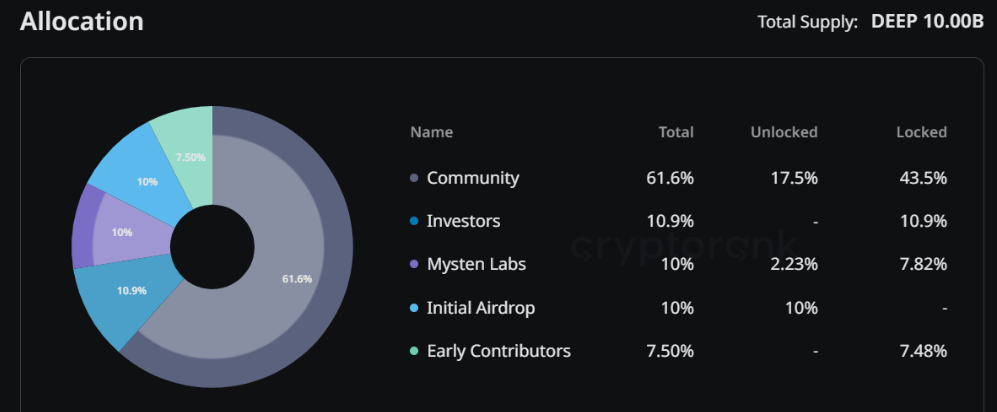

DEEP Tokenomics

The DEEP token is used for transaction fees, liquidity incentives, and governance. The total supply is 10 billion DEEP, distributed as follows:

-

61.6%: Community airdrop.

-

10%: Initial airdrop.

-

7.5%: Early contributors.

-

10%: Mysten Labs.

-

10.9%: Liquidity-backing partners.

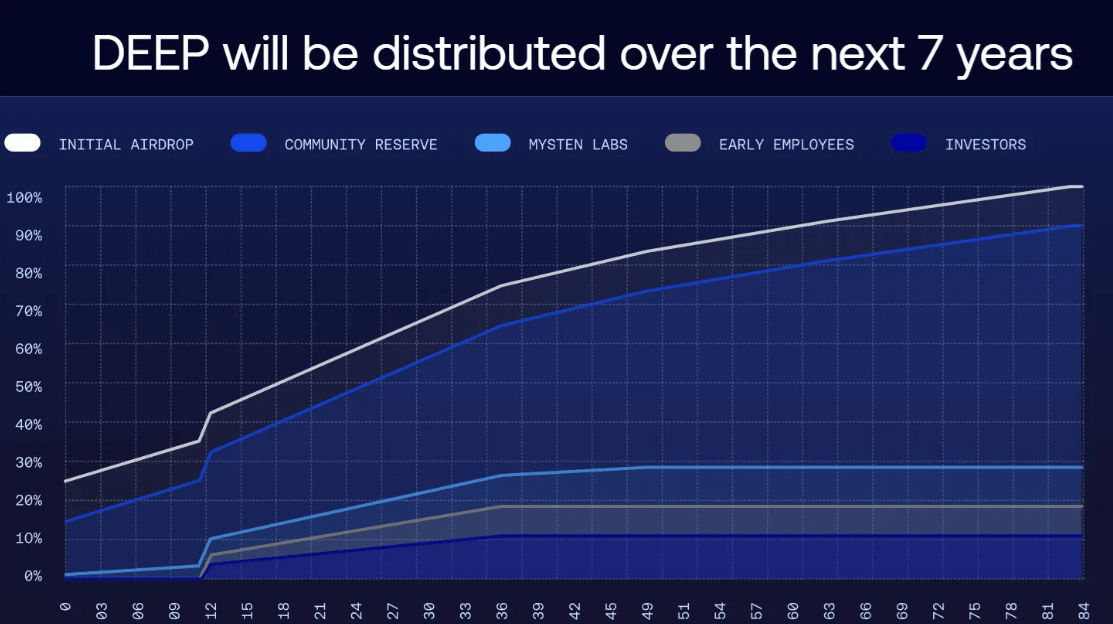

Emissions taper over four years, with monthly vesting for contributors and quarterly unlocks tied to on-chain volume milestones. DEEP was launched in 2024 via DBClaimNFTs, distributed to over 100,000 users.

DeepBook Protocol (DEEP) Ecosystem Partners

DeepBook Protocol (DEEP) collaborates with various partners to enhance its ecosystem on the Sui Network. Lotus Finance offers advanced trading strategies and high-yield strategy vaults as a DeFi platform. DeepTrade is a community-driven, open-source decentralized order book exchange built on DeepBook. Axelar provides cross-chain interoperability, enabling DeepBook to integrate seamlessly with multiple blockchain networks.

DeepBook Protocol (DEEP) Team

The DeepBook Protocol (DEEP) team includes key contributors who drive the development of its decentralized finance (DeFi) platform on the Sui Network. Aslan Tashtanov, Manolis Liolios, and Tony Lee are pivotal figures supporting the protocol’s innovative liquidity solutions. This team bolsters DeepBook’s technical and strategic advancements.

Where is DeepBook Protocol (DEEP) Listed?

DeepBook Protocol (DEEP) token is listed on leading cryptocurrency exchanges such as Gate.io and Bybit.

Official Links

- DeepBook Protocol (DEEP) Website

- DeepBook Protocol (DEEP) X (Twitter)

- DeepBook Protocol (DEEP) Whitepaper

Also, in the comment section, you can freely share your comments and opinions about the topic. Additionally, don’t forget to follow us on Telegram, YouTube and Twitter for the latest news and updates.