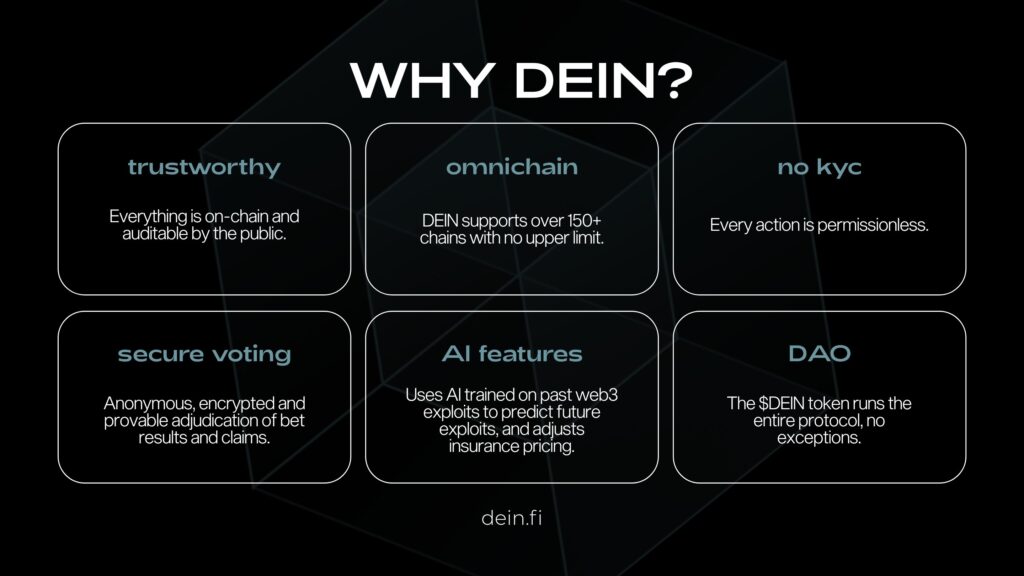

DEIN is a decentralized insurance network operating as a permissionless, DAO-governed marketplace. It allows users to purchase, underwrite, and resolve insurance policies for both crypto and traditional risks, all fully executed on-chain. Users can create customized policies covering smart contract exploits, stablecoin de-pegs, centralized exchange failures, or fraud.

The native token, DEIN, powers governance, staking, underwriting, and liquidity support within the ecosystem.

Team Overview

The DEIN founding team comprises professionals experienced in blockchain, DeFi, and fintech. Their focus is building a modular and secure infrastructure that merges decentralized insurance with traditional risk management expertise.

Founder: Mike Miglio — a lawyer active in crypto and DeFi since 2016. DEIN collaborates with Resonance Security to enhance on-chain protection. Official sources have not yet published a full team list.

Investors and Partners

DEIN is supported by leading investors and strategic partners that contribute capital and ecosystem growth. The project also collaborates with major DeFi protocols and on-chain infrastructure providers to expand its insurance network.

Vision and Mission

DEIN aims to reduce uncertainty in DeFi and safeguard user assets. The platform addresses three core challenges:

- Scalability: Enables anyone to create new insurance products with auto-adjusting pricing based on demand.

- Customizability: Users define their own risks, policy terms, and premiums.

- Flexibility: Modular on-chain architecture adapts to evolving market needs.

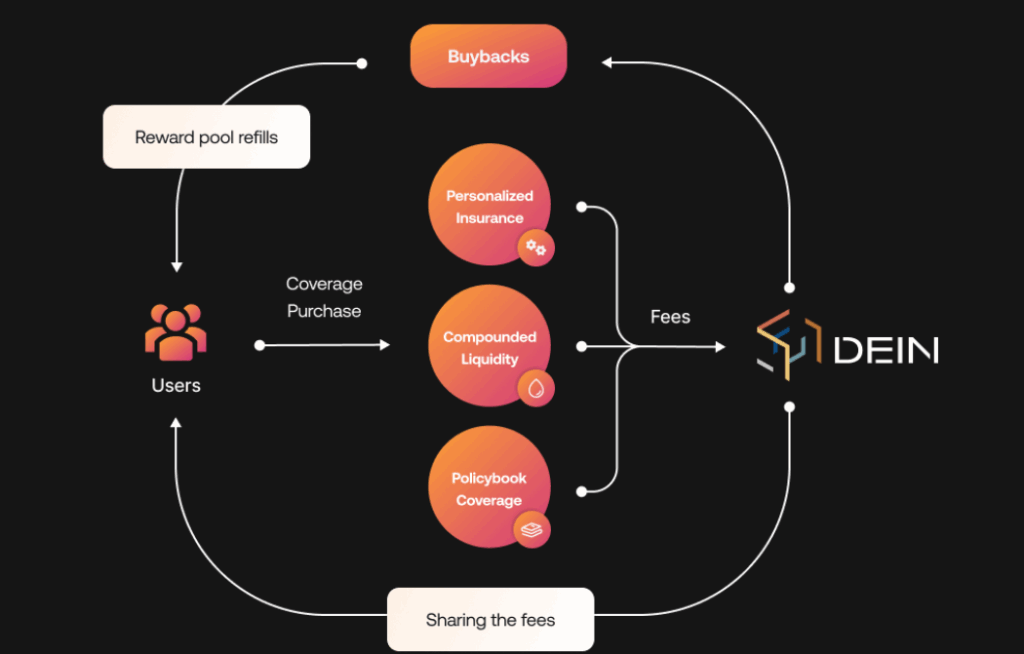

Economic Flywheel

DEIN redistributes protocol fees through buybacks and rewards, creating a sustainable value cycle.

As users interact with insurance products, fees flow to the protocol. Part of these fees funds DEIN token buybacks, while another portion replenishes the reward pool to incentivize participants.

This cyclical system strengthens token value and promotes continuous ecosystem engagement.

How DEIN Works

-

Insurance Marketplace: Users buy coverage or underwrite insurance pools for rewards and premiums.

-

Custom Insurance: Tailored policies for specific on-chain or off-chain risks.

-

Coverage Auctions: Dynamic price discovery through underwriter bidding.

-

Bundled Insurance: Thematic grouping (e.g., stablecoins, perpetuals, yield strategies) for diversified exposure.

-

Omnichain Coverage: Unified on-chain management for both EVM and non-EVM protocols.

-

DAO-Based Claims Resolution: Stake-weighted voting determines valid claims, automatically settled on-chain.

Governance

DEIN operates with full DAO-based governance. Staked $DEIN holders gain vote-escrow power, increasing with lock duration.

Claims voting is weighted by reputation scores (0.1x–3.0x), with the top 15% “Trusted Voters” participating in appeals. All decisions follow quorum and supermajority rules.

Native stakers earn voting rights, while ERC-1155 NFTs serve as proof-of-stake certificates.

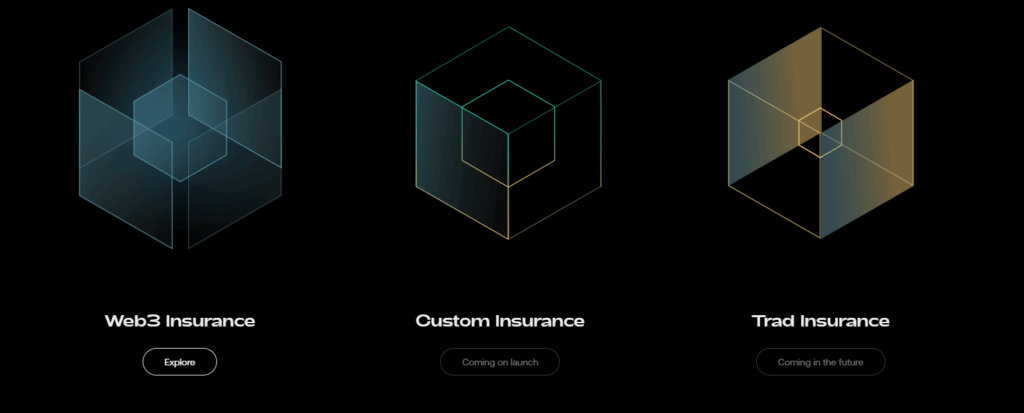

Roadmap

- Web3 Insurance Launch: Multichain on-chain insurance marketplace.

- Custom Insurance Phase: User-defined policy requests go live.

- Traditional Insurance Integration: Future expansion to real-world assets and RWA coverage.

Token Utility

-

Governance: Participate in DAO proposals and decisions.

-

Claims Voting: Ensure fair claims through staking-based governance.

-

Staking & Rewards: Earn premium discounts and boosted rewards.

-

Underwriting: Provide liquidity to policy pools for yield.

-

Liquidity Support: Enhance sustainability via staking participation.

Tokenomics

DEIN: Native token used for governance, staking, and underwriting.

DEINxCover: Represents USDT collateral within each policy pool.

Staking NFT / NFT Bond: Reflects user staking positions and reward entitlements.

Ecosystem and Features

-

Omnichain Reach: 150+ chain support for seamless insurance coverage.

-

User-Controlled: Peer-to-peer structure, no intermediaries.

-

Comprehensive Risk Protection: Smart contracts, CEXs, stablecoins, and yield protocols covered.

-

Full DAO Transparency: Every vote and claim processed on-chain.

DEIN delivers a scalable, customizable, and flexible insurance solution for both individuals and institutions—strengthening trust and risk management across the DeFi ecosystem.

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.