Derive (formerly Lyra Finance) is a high-performance decentralized protocol designed for options and perpetual futures trading in the DeFi ecosystem. Based on the latest available sources and updated project data, here is a complete and detailed analysis of the Derive (DRV) project.

Derive is a decentralized crypto trading platform that offers programmable derivatives such as options and perpetual futures. Formerly known as Lyra Finance, the project rebranded to Derive in 2024 to reflect its broader vision and expanding ecosystem.

Its core mission is to combine the performance and user experience of centralized exchanges (CEXs) with the transparency and self-custody of decentralized exchanges (DEXs). To achieve this, Derive built its own Layer-2 blockchain known as Derive Chain.

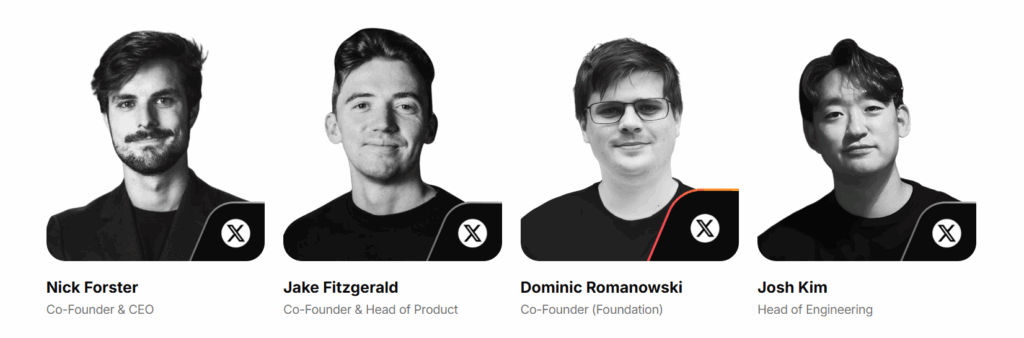

Core Team

The project is built by one of the most experienced derivatives teams in DeFi, originally from Lyra.

- Nick Forster (Co-Founder): Former professional options trader at Susquehanna (SIG). Highly experienced in quantitative derivatives infrastructure.

- Jake Fitzgerald (Co-Founder & Product Lead): Oversees product development and protocol architecture.

- Dominic Romanowski: Senior contributor, protocol development.

Investors and Partnerships

Derive is backed by leading venture capital firms and angel investors known across the crypto industry.

Major Investors

• Framework Ventures

• ParaFi Capital

• Robot Ventures

• GSR

Angel Investors

• Stani Kulechov (Aave)

• Robert Leshner (Compound)

• Bankless Founders

Ecosystem Partners

- Optimism: Derive Chain is built on OP Stack and part of the Superchain.

- Celestia: Used for data availability and cost reductions.

- Synthetix: Historical liquidity and technology collaborations.

Project Vision and Core Idea

The key vision behind Derive is Programmable Derivatives. Most DeFi options platforms suffer from slow execution, liquidity fragmentation, and poor UX. Derive solves this through:

-

High-Speed Execution: Its custom L2 chain ensures fast and low-cost transactions

-

Hybrid Matching Model: Off-chain matching combined with on-chain settlement enables high-frequency trading

-

Capital Efficiency: Portfolio margining allows traders to use a single collateral source for multiple hedged positions

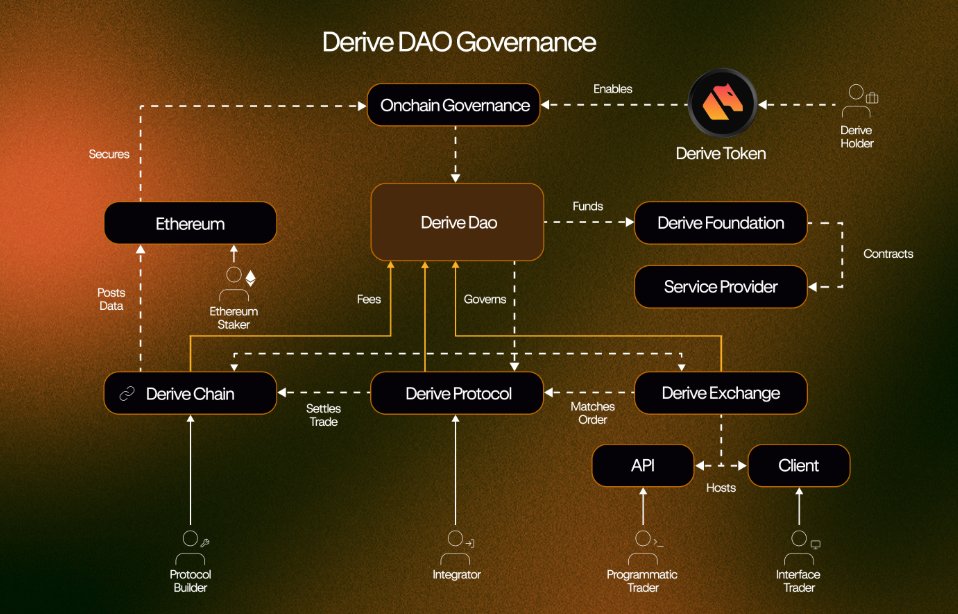

How Derive Works (Architecture)

Derive consists of three core components:

Chain (L2)

• Ethereum-secured optimistic rollup built on OP Stack

• Chain ID: 957

• Uses a deployer allowlist governed by Derive DAO

Protocol

• Smart contract layer responsible for derivatives logic, collateralization, liquidation rules, and settlement

Exchange

• A CLOB (central limit order book) self-custodial trading interface

• Funds always remain in user-controlled smart contracts

Key Features

- Portfolio Margining: Enables reduced collateral by offsetting risks across positions.

- Block Trading: Large-size institutional trades with zero slippage.

- Session Keys: High-speed trading without constant wallet confirmations.

- RFQs (Request for Quote): Market makers provide custom pricing for block orders.

Roadmap

Completed Milestones

• Lyra V1 and V2

• Migration to OP Stack

• Launch of Derive Chain

• DRV token launch

• Rebrand from Lyra to Derive

Upcoming Milestones

• More asset classes (including RWAs)

• Institutional integrations and liquidity expansion

• New yield strategies via vault products

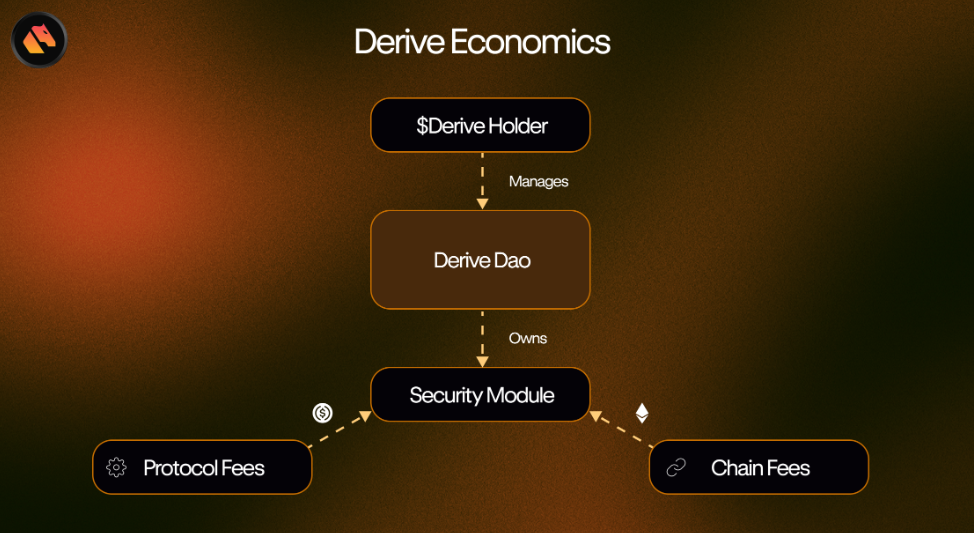

Governance Model

Derive is governed by Derive DAO. DRV holders can stake to receive stDRV, granting governance utilities such as:

Token Information

- Total Supply: 1,500,000,000 DRV

- Max Supply: 1,500,000,000 DRV

- Circulating Supply: 737,520,000 DRV

Token Utilities (DRV Utility)

-

Governance rights through stDRV

-

Staking rewards (transitioning to a buyback-based model after 6 months)

-

Protocol incentives: 2,500,000 DRV weekly for trading and liquidity

-

Revenue Buybacks: 25% of protocol revenue allocated to buy back DRV

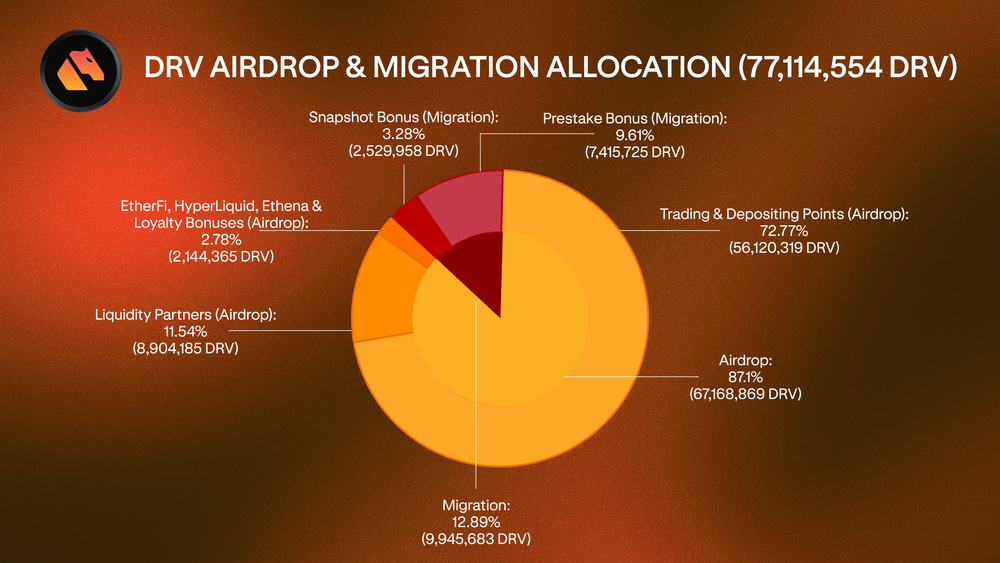

Token Distribution

-

General Airdrop: 87.1% – 67,168,869 DRV

-

Trading & Depositing Points: 72.77% – 56,120,319 DRV

-

Liquidity Partners Airdrop: 11.54% – 8,904,185 DRV

-

EtherFi, HyperLiquid, Ethena & Loyalty: 2.78% – 2,144,365 DRV

-

Snapshot Bonus: 3.28% – 2,529,958 DRV

-

Pre-Stake Bonus: 9.61% – 7,415,725 DRV

-

Migration Base Allocation: 12.89% – 9,945,683 DRV

Ecosystem & Integrations

Derive is not only a derivatives exchange — it is a modular L2 allowing third-party integrations.

- Automated trading via Hummingbot

- Open-source SDKs for developers building their own trading strategies

- API integrations for institutional traders

Summary

Derive is one of the most advanced decentralized derivatives protocols in the DeFi landscape, combining high-speed execution, portfolio margining, and a dedicated L2 chain built on OP Stack. With strong investors, an experienced team, and deep derivatives expertise, Derive aims to become the leading derivatives infrastructure in Web3.

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.