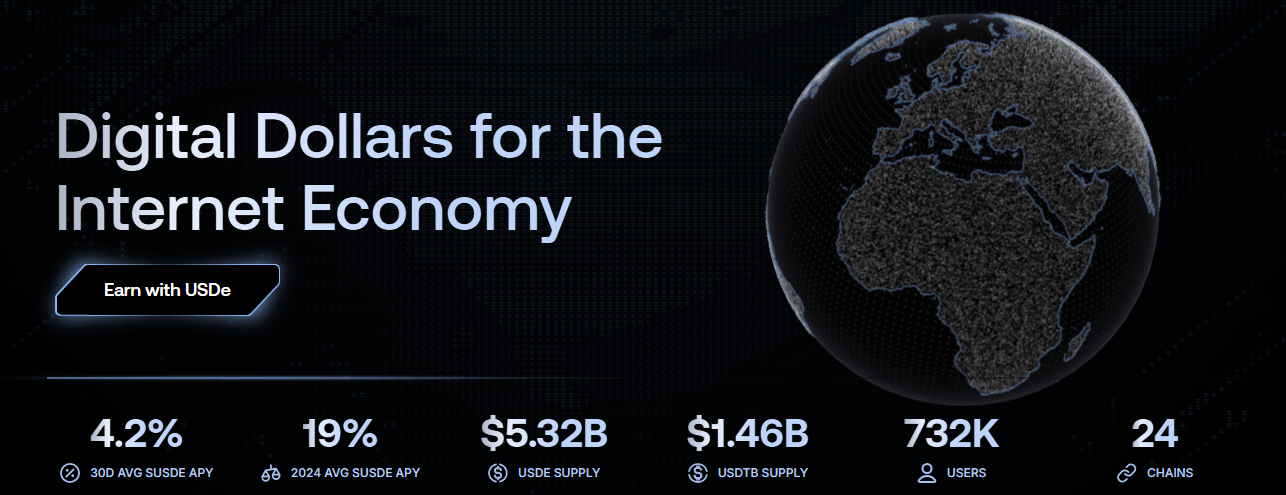

Ethena is a synthetic dollar protocol built on the Ethereum blockchain, offering a scalable, censorship-resistant cryptocurrency solution called USDe. Additionally, it provides a globally accessible dollar savings asset, sUSDe, which allows users to earn rewards. This article will explore what Ethena’s USDe is, how it works, its advantages, and its role within the ecosystem in detail.

What is Ethena and USDe?

Ethena is a protocol designed to bridge decentralized finance (DeFi) and centralized finance (CeFi) in the crypto ecosystem. USDe is a synthetic dollar backed by spot assets like Bitcoin, Ethereum, and Solana, as well as liquid stablecoins such as USDC and USDT, utilizing a delta-neutral strategy. This ensures that USDe’s value remains relatively stable by balancing protocol-held assets with futures contracts.

USDe is a fully backed asset (subject to potential loss scenarios outlined in the risks section) and can be freely used across CeFi and DeFi platforms. The protocol enables users to acquire USDe permissionlessly, stake it, and earn rewards.

How Does USDe Work?

USDe is a cryptocurrency solution supported by on-chain custody of spot assets and centralized liquidity venues. Here are the key aspects of USDe’s mechanism:

Delta-Neutral Strategy

USDe’s peg stability is maintained through a delta-neutral hedging strategy against price fluctuations of the protocol’s spot assets. For example, when a user deposits 100 USDT, approximately 100 USDe is minted, and the protocol opens a short futures position of equivalent value to offset asset price volatility. This keeps USDe’s value stable.

Off-Exchange Custody

Assets backing USDe are stored in off-exchange settlement solutions, ensuring they remain on-chain while minimizing counterparty risk from centralized exchanges. Ethena delegates but retains control over these assets.

Protocol Rewards

sUSDe is the reward-bearing version of USDe. Users can stake their USDe to receive sUSDe and earn a share of protocol revenue. Rewards come from three main sources:

-

Funding rates and basis spreads from delta-hedging positions.

-

Yields from liquid stablecoins (e.g., USDC).

-

Consensus and execution layer rewards from staked ETH assets.

In 2024, sUSDe’s annual percentage yield (APY) averaged 18%. Bitcoin and Ethereum perpetual futures positions yielded 11% and 12.6%, respectively.

USDe Use Cases

Ethena offers users multiple ways to interact with USDe:

-

Permissionless USDe Acquisition: Users can buy or sell USDe using assets like USDT or USDC through AMM pools.

-

Direct Mint and Redeem: Approved market makers who pass KYC/KYB checks can mint USDe or redeem backing assets.

-

Stake and Unstake: Users in permitted jurisdictions can stake USDe to receive sUSDe and earn protocol rewards.

Ethena Ecosystem and Opportunities

Ethena aims to go beyond being a synthetic dollar provider, positioning itself as a platform for the DeFi ecosystem. USDe can be used as margin collateral in both DeFi and CeFi, with a potential $20 billion market opportunity through TradFi integration.

USDtb: A New Stablecoin

USDtb is Ethena’s blockchain-based digital dollar, offering faster and cheaper transactions compared to traditional fiat banking. USDtb is backed by institutional-grade tokenized U.S. treasury fund products, such as BlackRock’s BUIDL fund, and includes a stablecoin reserve for rapid redemptions.

Ethena Network

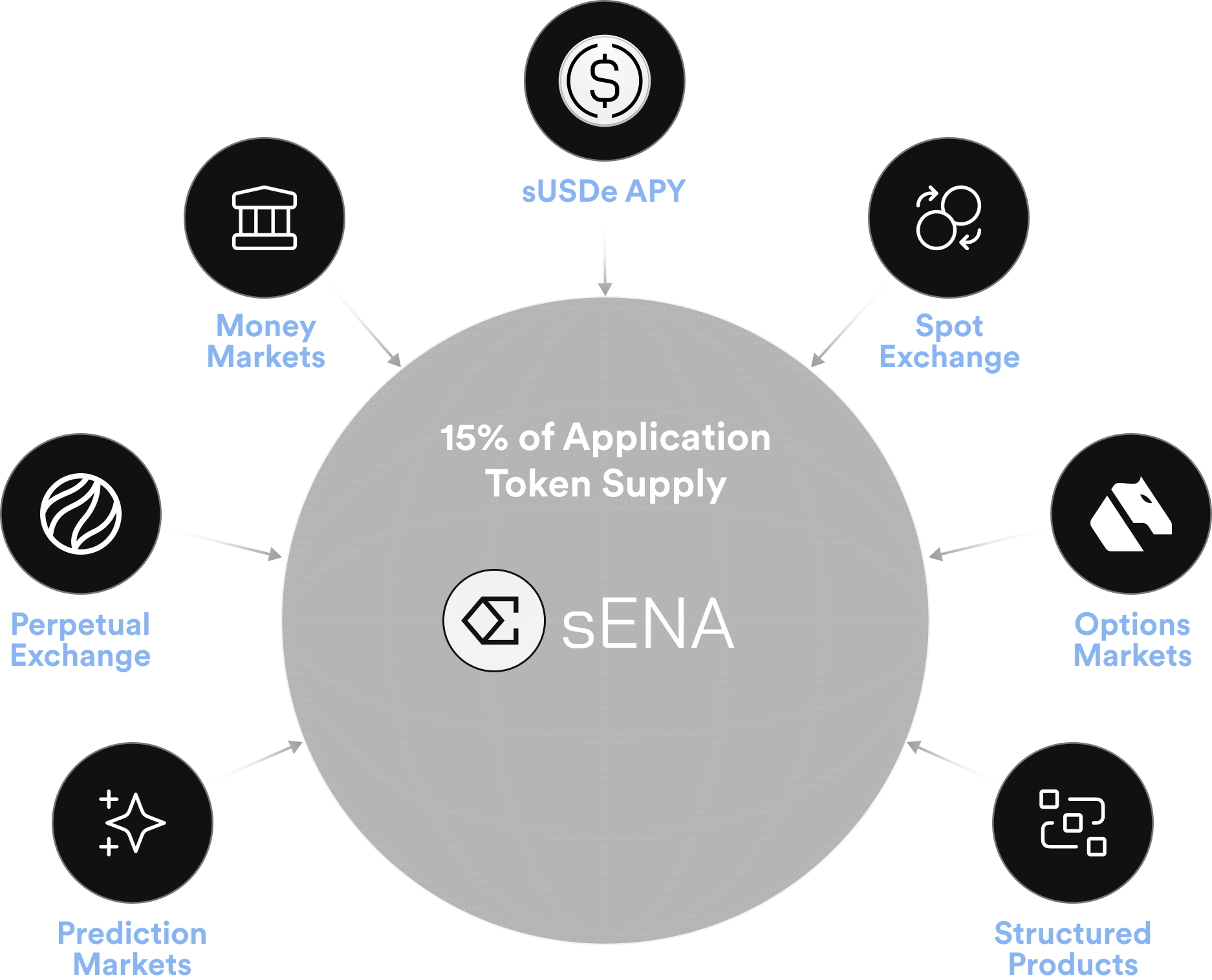

Ethena is transitioning from a single asset issuer to a platform for innovative financial applications. The Ethena Network supports new protocols built on sUSDe. Example applications include:

-

Ethereal: A perpetual and spot exchange integrated with sUSDe, with its testnet launching in February 2025.

-

Derive: An on-chain options and structured products protocol using sUSDe as a core collateral asset, with its token launched in January 2025.

ENA: Ethena’s Governance Token

ENA is Ethena’s governance token with the following functions:

-

Governance: ENA holders can vote biannually to elect members of the Risk Committee and other key bodies. For instance, in 2024, ENA holders voted to add SOL as a backing asset for USDe.

-

sENA Rewards: Users staking ENA receive sENA, earning ecosystem rewards. For example, Ethereal committed to distributing 15% of its future token supply to sENA holders.

-

Restaked ENA: Through integration with LayerZero, ENA restaking pools provide economic security for cross-chain USDe transfers.

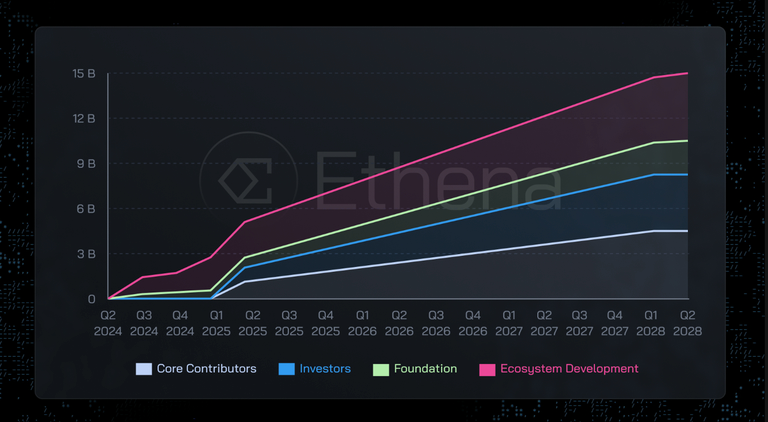

ENA Tokenomics

ENA’s total supply is allocated as follows:

-

30% Core Contributors: Locked for 1 year with a 25% cliff, followed by 3-year linear monthly vesting.

-

30% Investors: Subject to the same vesting schedule.

-

30% Ecosystem Development: Used for airdrops and incentive campaigns.

-

10% Foundation: Funds development, risk assessments, audits, and USDe expansion.

Ethena Vesting

How to Acquire and Stake USDe

Acquiring USDe

USDe can be purchased on secondary markets (e.g., Uniswap, Curve) or minted directly through the Ethena protocol. Whitelisted users can mint USDe using assets like USDT or USDC.

Staking USDe

Users can stake USDe via Ethena’s dApp interface to receive sUSDe. The staking process uses a token vault mechanism, with sUSDe’s value increasing over time due to protocol rewards. Unstaking involves a 7-day cooldown period.

Staking ENA

ENA holders can stake ENA to receive sENA and earn rewards. sENA’s value also grows with protocol distributions, and unstaking requires a 7-day cooldown period.

Peg Stability and Reserve Fund

USDe’s peg stability is achieved through a delta-neutral hedging strategy, using short futures positions to balance price fluctuations of backing assets. Additionally, Ethena’s reserve fund acts as a safety net during negative funding periods, reaching $46.6 million in Q4 2024.

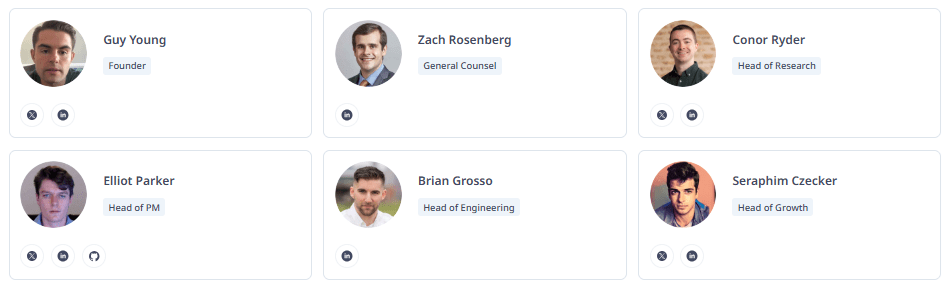

Ethena Team

Ethena was founded in 2023 by Guy Young with a vision to create a censorship-resistant, scalable, and stable internet money in the crypto world. The protocol is managed by an experienced team and advisors. Ethena Labs consists of core contributors working on USDe’s development and market launch. This team focuses on building the protocol’s technical infrastructure, enhancing risk management processes, and expanding the ecosystem. The Risk Committee, playing a key role in governance, comprises industry-recognized experts, including:

-

Gauntlet

-

Block Analitica

-

Steakhouse

-

Blockworks Research

-

LlamaRisk

-

Ethena Labs Research

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.