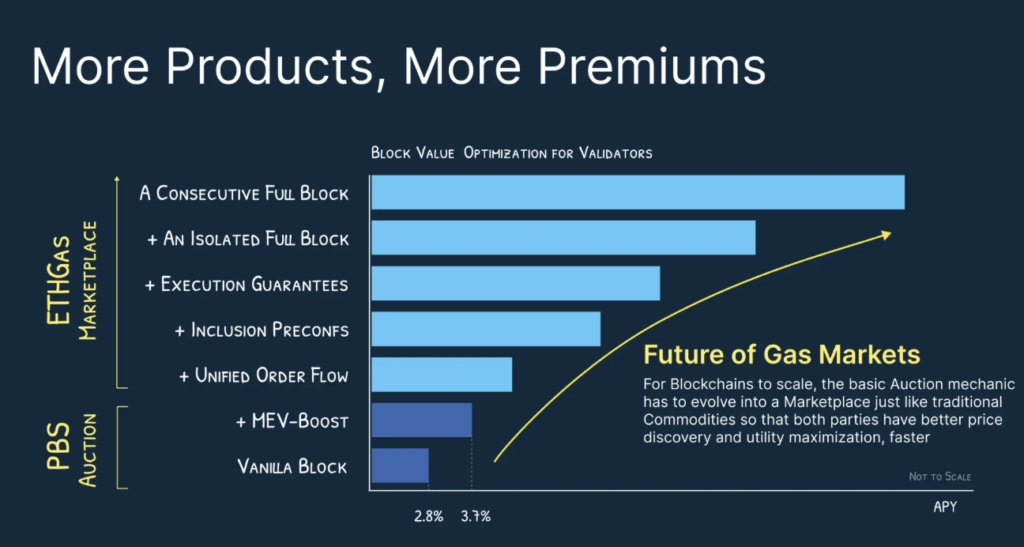

ETHGAS is an infrastructure and market protocol designed to redefine Ethereum gas fee mechanism. At its core, the project aims to make transaction fees invisible to end users while simultaneously transforming blockspace into a tradable and manageable asset class.

By doing so, ETHGAS abstracts gas fees away from users and, as a result, provides developers and protocols with a more predictable, real-time, and efficient execution environment. In turn, this structure allows transaction costs on Ethereum to be fixed, hedged, or pre-guaranteed for specific operations.

Team and Founders

ETHGAS is built by an experienced team from both traditional finance and advanced technology sectors.

Kevin Lepsoe (Founder): A former financial engineer, Lepsoe previously led the Asia structured derivatives division at Morgan Stanley. He is also the founder of the DeFi protocol Infinity Exchange.

Team Structure: The core team consists of approximately 18 professionals with backgrounds at Morgan Stanley, Deutsche Bank, HKEx (Hong Kong Exchange), and Lockheed Martin. While the team is primarily based in Hong Kong, members also operate across the United States and Europe.

Project Concept

ETHGAS aims to transform Ethereum into a real-time network by abstracting gas fees from the user experience to accelerate institutional adoption.

-

The Core Idea: Unlike Ethereum’s current chaotic auction model for gas, ETHGAS creates an institutional market where validators sell future blockspace in advance. Users can then purchase this space as “pre-confirmations”.

How It Works

-

Hybrid Infrastructure: ETHGAS uses an off-chain coordination layer to organize blockspace demand, while commitments and payments are handled via non-custodial smart contracts.

-

Real-Time Execution: Through blockspace pre-commitments, the protocol reduces timing uncertainty, aiming for a near real-time execution experience on Ethereum.

-

MEV Mitigation: Pre-reserving blockspace bypasses traditional mempool competition, limiting frontrunning and sandwich attacks.

-

The Gasless Flywheel: Protocols use zero-code incentives to attract users hesitant about gas fees. Using ETHGAS data, users are guided toward behaviors that increase TVL, while protocol-funded pools enable gasless transactions, turning a cost into a reward.

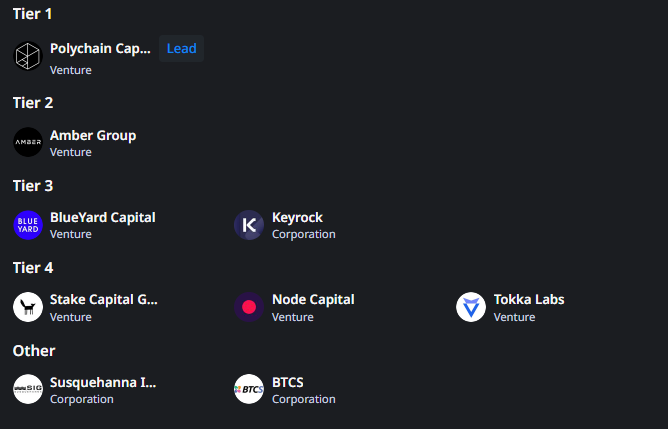

Investors and Partnerships

The project has secured significant interest from prestigious crypto funds:

-

Funding Round: A $12 million seed round led by Polychain Capital was completed in December 2025.

-

Notable Investors: Amber Group, Stake Capital, BlueYard Capital, Keyrock, SIG DT, and BTCS Inc.

-

Strategic Partners: Major Ethereum validators and block builders including Chorus One, P2P, Pier Two, A41, and Tokka Labs. The project launched with approximately $800 million in blockspace liquidity commitments.

Governance and Token Utility (GASS)

The GASS token serves as the backbone of the ecosystem:

-

Governance: Holders can stake GASS to receive veGASS, which grants voting power over protocol parameters, fee structures, and treasury distributions.

-

Incentives: Encourages participation from validators and liquidity providers.

-

Utility: Planned use as a unit of account for blockspace futures and the “Open Gas” initiative.

-

Slashing Protection: Validators provide GASS or restaked ETH as collateral to guarantee their blockspace commitments.

Roadmap

The project follows the “Open Gas Initiative” across three stages:

-

Curation: Manual subsidization of gas fees by protocols.

-

Programmatic: Automated rebate systems based on user behavior.

-

Full Automation: Complete “Gas Abstraction” where the user experience is entirely managed in the background.

-

Expansion: Plans to expand to Layer-2 solutions like Base, BNB Chain, and Arbitrum in 2026.

Tokenomics

-

Name/Symbol: ETHGas (GASS).

-

Sales Model: Primarily via SAFT (Simple Agreement for Future Tokens).

-

Vesting: Investors are subject to 6–12 month lock-up periods. The token is not yet available on public exchanges.

Ecosystem Features

-

Open Gas Initiative: A program to alleviate the $30 billion annual gas burden on Ethereum.

-

Low Latency: Aims for confirmation times up to 100x faster than standard Ethereum.

-

Institutional Focus: Provides cost predictability for high-volume DeFi protocols and institutions.

Official Links

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.