Global Commercial Business (GCB) is a multi-chain utility token and a comprehensive financial technology (fintech) ecosystem built on Binance Smart Chain (BSC) and TRON networks. The project aims to increase financial inclusion in the Middle East, Africa, and emerging markets by providing digital financial solutions to individuals and businesses with limited access to traditional banking systems.

GCB is not just a cryptocurrency. It is a multi-layered ecosystem that includes a crypto exchange, payment systems, DeFi solutions, an education platform, and financial–logistics integrations.

Project Vision and Concept

The core idea behind GCB is to bridge the gap between fiat currencies and the crypto economy, creating an integrated digital ecosystem capable of meeting daily financial needs.

GCB aims to:

-

Simplify cross-border payments

-

Empower local businesses with digital financial infrastructure

-

Onboard users into DeFi and Web3 with low entry barriers

-

Improve financial literacy globally

How Does GCB Work?

The GCB ecosystem operates around GCB Exchange (GCBex) and the GCB Token.

-

Centralized Exchange (CEX): Users can trade over 500 cryptocurrencies

-

Hybrid Blockchain Infrastructure: Utilizes both BSC and TRON for high speed and low transaction fees

-

Payment Gateways: Enables fiat-to-crypto conversions via P2P and OTC services

GCB Ecosystem Overview

The GCB ecosystem combines centralized and decentralized components:

1. GCB Exchange (GCBex)

-

Spot and derivatives trading

-

P2P trading

-

Perpetual futures

-

ETF and leveraged products

-

Advanced matching engine (low latency, high throughput)

-

Web, Android, iOS, H5, and REST API support

2. GCB Token

The core asset of the ecosystem.

Use cases include:

-

Trading and exchange fees

-

Staking and reward mechanisms

-

Governance participation

-

Internal platform conversions

-

Exclusive campaigns and benefits

3. GCB Academy

-

Crypto and blockchain education

-

Investment guides

-

Digital finance literacy programs

4. GCB Financial & Logistics Ecosystem

-

Digital wallets

-

Virtual cards

-

Payment solutions

-

Logistics and e-commerce integrations

-

GTaxi, travel, and tourism services (roadmap-based)

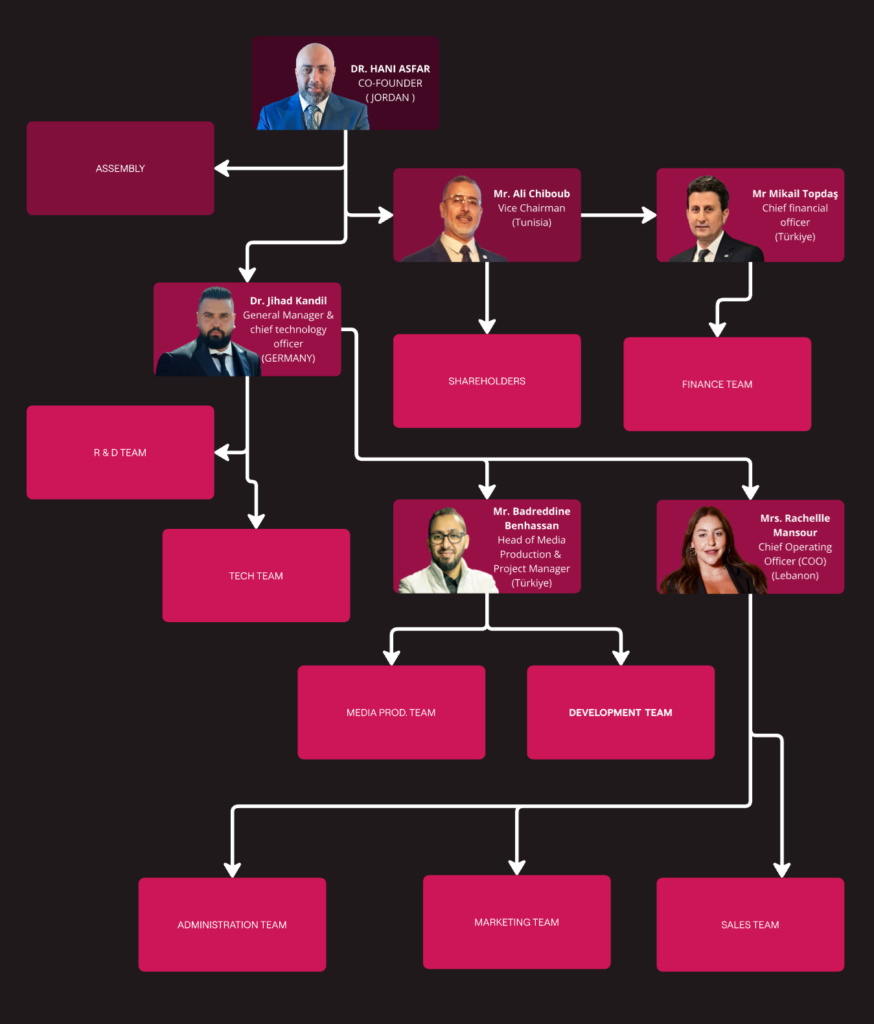

Team and Management Structure

Executive Leadership

-

Dr. Hani Asfar – Chairman

-

Ali Chiboub – Vice President

-

Mikail Topdaş – CFO

-

Dr. Jihad Kandil – General Manager & CTO

Governance Model

-

GCB token holders can participate in governance processes

-

Platform-level decisions are supported through GCB Token mechanisms

-

Long-term vesting structures aim to reduce sudden sell pressure

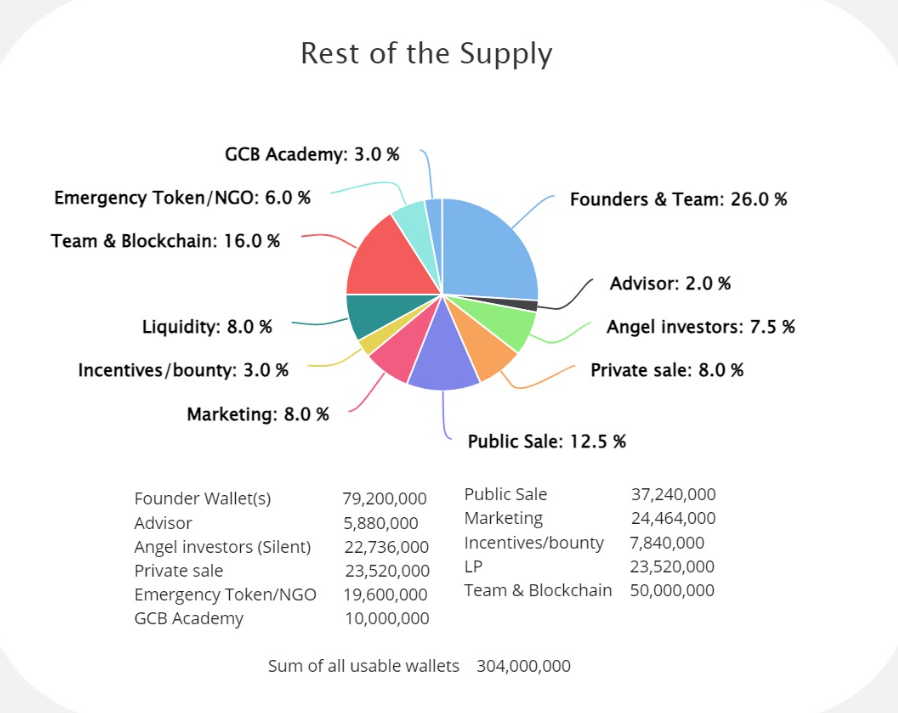

Tokenomics

GCB operates as a multi-chain token on BSC and TRON. 86.2% of the total supply has been burned, creating a deflationary token model. The remaining 13.8% is distributed across predefined categories to ensure ecosystem sustainability.

The GCB token is actively used for trading, liquidity provision, staking, and community rewards. Users can trade GCB via GCB Exchange (GCBex) and access fiat–crypto conversion services.

Supported Networks

-

Binance Smart Chain (BSC)

-

TRON

Supply Metrics (CMC)

-

Total Supply: 1.2 billion GCB

-

Maximum Supply: 2.5 billion GCB

-

Circulating Supply: 1.2 billion GCB

Token Distribution (Summary)

-

Founding companies & core team: 26%

-

Team, development & infrastructure: 16%

-

Public sale: 12%

-

Private sale: 8%

-

Angel investors: 7.5%

-

Marketing: 8%

-

Liquidity providers: 8%

-

Emergency funds & NGOs: 6%

-

Advisors: 2%

-

Academy & airdrops: 6%

This distribution is designed to support decentralization and long-term sustainability.

Vesting Schedule

Angel Investors

-

15% unlocked at TGE

-

Remaining 85% released monthly over 48 months

Private Sale

-

No lock-up at TGE

-

Fully vested monthly over 48 months

This structure aims to minimize dump risk and maintain market stability.

Roadmap

Q4 2023

-

Token launch

-

Smart contract audit

-

Private sale

-

DEX & CEX listings

2024

-

GCB Exchange launch

-

P2P and fiat gateway integration

-

500+ token listings

-

GCB+ and Social ID Wallet

-

GTaxi and product integrations

2025

-

GCB ecosystem expansion

-

Staking and liquidity pools

-

Virtual card launch

-

Native GCB Blockchain (TBA)

Key Features of GCB

-

Multi-chain architecture (BSC + TRON)

-

Utility token with broad use cases

-

Integrated finance, education, and trading ecosystem

-

Strong focus on emerging markets

-

Social impact and financial inclusion vision

Partners

-

Visa: Global payment network and crypto card solutions

-

Mastercard: Worldwide payment integration and financial accessibility

-

Royal Chartered Bankers: Trusted & regulated banking partner

-

Gulf Software & Technology: Software development and infrastructure support

-

GulfCoin: Strategic crypto partner integrated into the GCB ecosystem

-

Al Masar Internet Services: Regional internet and network infrastructure provider

Ecosystem Highlights

-

GCBEX Exchange: 24/7 live support and advanced security systems

-

AI Grid Trading Bot: Automated trading for volatile markets

-

Multiple Payment Options: Credit cards, P2P, and OTC

-

Burn Mechanism: Periodic token burns to support long-term value

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.