Helios Blockchain is a Layer-1 network designed for creating, managing, and automating on-chain portfolio products such as index funds, ETFs, and multi-asset strategies. Its goal is to unify assets across multiple blockchain ecosystems under a single logic and accounting framework.

What is Helios?

Helios is an EVM-compatible Layer-1 blockchain with a Proof-of-Stake (PoS) consensus mechanism, enabling developers to build decentralized, programmable, and automated portfolio products.

Key Objectives:

-

Scalability: Support high transaction throughput (TPS)

-

Security: Ensure network safety through cryptographic methods

-

Decentralization: Maintain a distributed network without central authority

-

Eco-Friendly: Low energy consumption via PoS

How Helios Works

-

Execution Layer: Runs smart contracts and portfolio operations.

-

Automation Layer: Handles rebalancing, periodic buys, and conditional operations automatically.

-

Cross-Chain Layer: Enables direct interaction with assets and protocols on other blockchains.

Developers create tokenized portfolios with predefined rules. Users can enter or exit portfolios, while asset allocations update automatically.

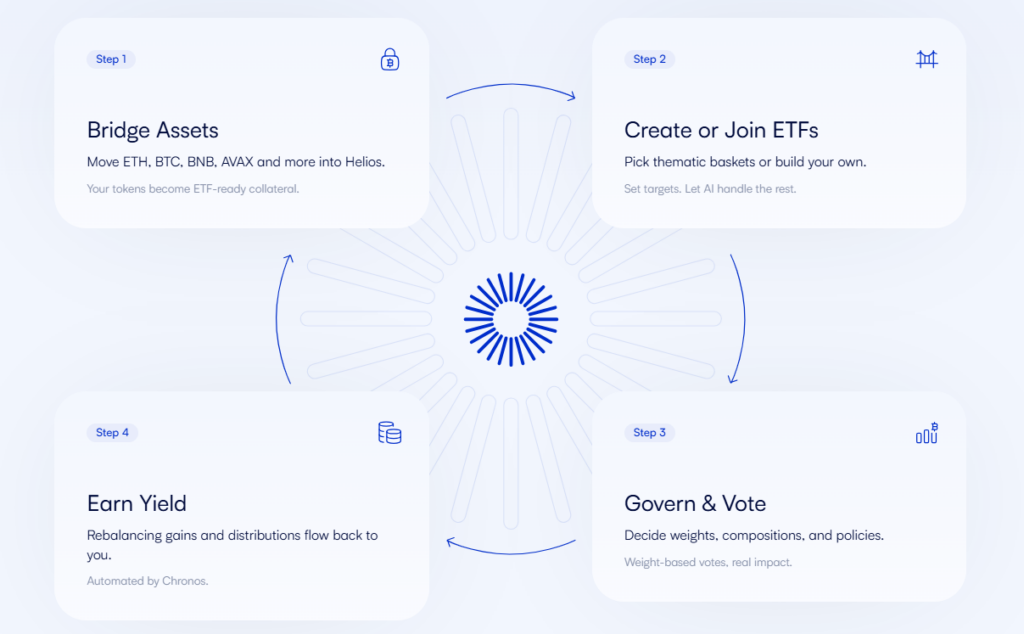

HLS Ecosystem User Journey

-

Bridge Assets: Transfer ETH, BTC, BNB, AVAX, and others to Helios as ETF collateral.

-

Create or Join ETFs: Select thematic baskets or build your own; AI manages strategy.

-

Govern & Vote: Voting on asset weights, composition, and policies.

-

Earn Yield: Rebalancing and distributions automatically return to users via Chronos.

Team & Founders

-

Frederick Marinho – Co-Founder & CEO

-

Jeremy Guyet – Co-Founder & CTO

-

Jordan Karuk – Head of Business Development

-

Cristian Alexandrescu – CMO

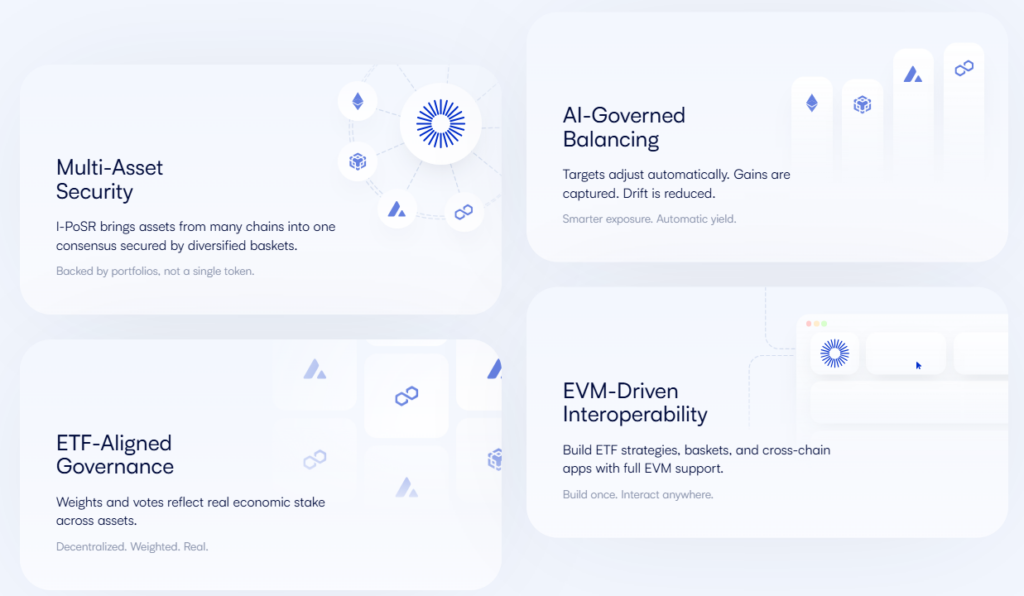

Governance

Helios targets on-chain governance with HLS token holders voting on network proposals. Voting power is proportional to token holdings or staking. Decisions cover fees, consensus changes, new features, and treasury usage.

Roadmap (Summary)

-

Q4 2025 – TGE & Beta Mainnet: $HLS TGE, early staking, CEX listings, beta mainnet

-

Q1 2026 – Full Mainnet: Permissionless validators, ETF mint/redeem, automation, first dApps

-

Q2 2026 – Asset Layer: Real-world assets, multi-chain integration, institutional custody

-

Q3 2026 – Automation: AI-powered ETF rebalancing, LP incentives, SDK for custom strategies

-

Q4 2026 – Institutional Maturity: Infrastructure for funds, cross-chain ETF routing, stablecoin ETFs

-

Q1 2027 – Global ETF Infrastructure: Multi-asset security, AI portfolios, global liquidity, major ecosystem support

Token not live yet; official TGE date will be announced soon.

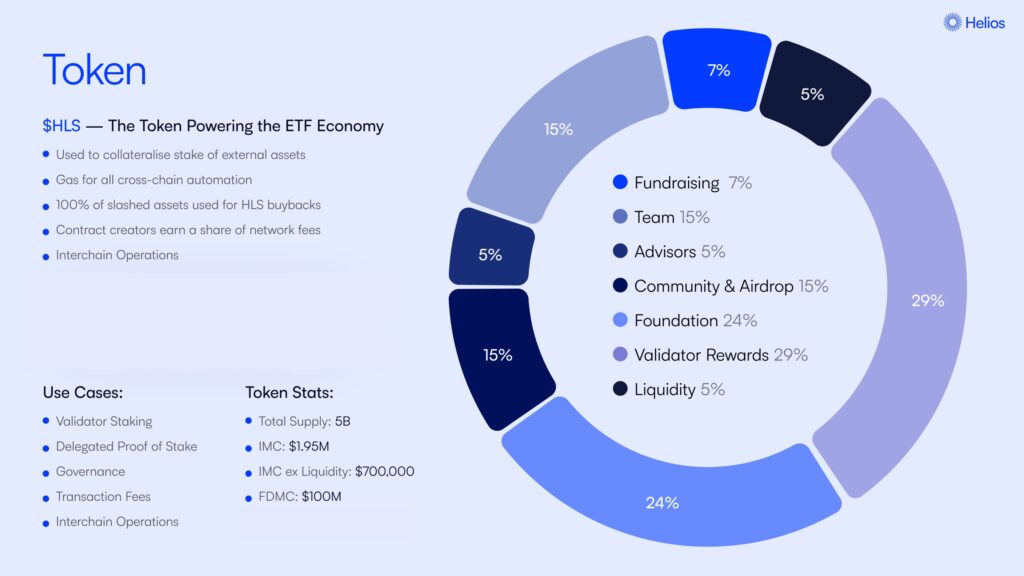

Token Information

-

Name: Helios

-

Ticker: HLS

-

Total Supply: 3.55B HLS

-

Max Supply: 5B HLS

-

Self-Reported Circulating Supply: 97.5M HLS

Token Allocation

-

Validator Rewards: 29%

-

Foundation: 24%

-

Community & Airdrop: 15%

-

Team: 15%

-

Fundraising: 7%

-

Advisors: 5%

-

Liquidity: 5%

HLS Token Use Cases

-

Network Security (Staking) and delegated staking

-

Gas for transactions and cross-chain automation

-

Governance voting

-

Payment within dApps

-

Slashed token buybacks

-

Developer revenue sharing

Features

-

Layer-1 cross-chain execution

-

Programmable, tokenized portfolios

-

Automated rebalancing and strategy execution

-

Modular architecture for scalability

-

Developer revenue-sharing model

-

Reputation and staking-based consensus

Official Links

Also, in the comment section, you can freely share your comments and opinions about the topic. Additionally, don’t forget to follow us on Telegram, YouTube and Twitter for the latest news and updates.