Huma Finance (HUMA) is the first PayFi network, enabling global payment institutions to process payments 24/7 using stablecoins and on-chain liquidity. It addresses the slowness, high fees, and unfair structure of traditional financial systems. Let’s dive into the details of Huma Finance (HUMA) and its purpose.

What is Huma Finance?

Huma Finance is the pioneering PayFi network that facilitates 24/7 payment processing for global institutions through stablecoins and on-chain liquidity. Supported by prominent partners like Solana, Circle, Stellar Development Foundation (SDF), and Galaxy Digital, Huma has processed over $3.8 billion in transaction volume, delivering double-digit real-world yields to its liquidity providers (LPs).

Huma’s Two Versions

- Huma (Permissionless): Launched in April 2025, this version is open to all, allowing retail investors to participate in Huma pools.

- Huma Institutional: A permissioned service tailored for institutional investors, offering curated, receivables-backed credit opportunities within a regulated framework.

Why Huma?

Traditional financial systems are plagued by slowness, high costs, and inequitable profit distribution. Banks channel deposit yields to shareholders and bureaucracy, leaving depositors with minimal returns. Huma offers solutions:

- Instant Payments: Merchants and suppliers receive payments instantly.

- Low Fees: Migrant workers can send money home without excessive remittance fees.

- Transparent Yields: Everyone can earn returns on equal terms, free from bank deductions.

Huma builds the future of finance with PayFi, synchronizing money movement with modern commerce.

Huma 2.0 Features

Huma 2.0, launched on Solana in 2024, provides sustainable yields to LPs. Key features include:

- Permissionless Access: No KYC/KYB or professional investor status required.

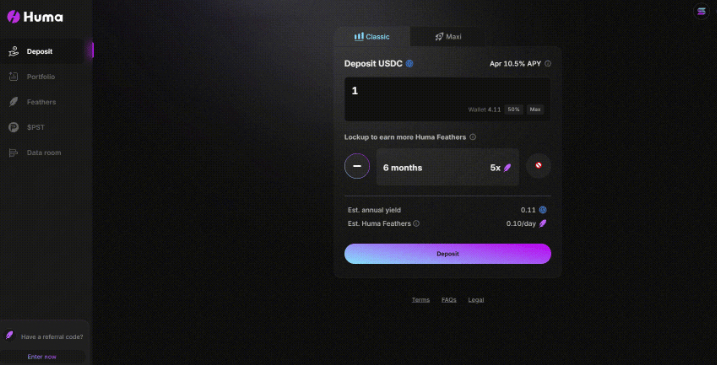

- Classic and Maxi Modes:

- Classic Mode: Offers 10.5% APY with balanced Huma Feathers rewards.

- Maxi Mode: Forgoes stable yield for maximum Huma Feathers rewards.

- Flexible Lockups: LPs can choose no lockup or 3/6-month lockups to boost rewards.

- DeFi Integrations: Compatible with Solana DeFi protocols like Jupiter, Meteora, Kamino, and RateX.

- Huma Feathers Rewards: A loyalty program to incentivize participation.

What are Huma Feathers?

Huma Feathers is a loyalty system rewarding engagement with the Huma Protocol. Inspired by the mythical Huma bird, symbolizing prosperity and renewal, it reflects the platform’s agility and long-term vision. Existing Huma Points were converted to Feathers at a 1:1 ratio.

Ways to Earn Feathers:

- Mode Multiplier: Maxi Mode offers higher rewards than Classic Mode.

- Lockup Multiplier: 3-month (2x) or 6-month (3x) lockups, with promotional boosts to 3x and 5x.

- OG LP Multiplier: Lifetime bonus for pre-Huma 2.0 active LPs.

- Community Multiplier: Temporary boost for users referred by partner communities.

Investment and Withdrawal in Huma

Investment

Investing in Huma is straightforward:

- Choose Classic or Maxi Mode.

- Specify the deposit amount (minimum 1 USDC).

- Select a lockup period (none, 3 months, or 6 months).

- Sign the transaction with your wallet.

Withdrawal

- Unlocked Positions: Redeemable anytime, processed within 1 business day (up to 7 days).

- Locked Positions: Redeemable after the lockup period ends.

- Daily Redemption Cap: A limit ensures protocol stability; requests exceeding it are rejected.

DeFi Integrations

Huma integrates with the Solana ecosystem:

- Jupiter/Meteora: PST-USDC pool for instant liquidity.

- Kamino/RateX: Upcoming support for borrowing USDC and additional yield opportunities.

Huma Institutional

Huma Institutional is a permissioned protocol for institutional investors, offering receivables-backed credit lines, invoice factoring, and revolving credit facilities. Key features:

- Structured Finance: Includes tranches, first-loss coverage, and 30/360 calendar.

- Tokenization: Real-world assets tokenized via SPV structures.

- Transparency: Receivables lifecycle tracked on-chain.

Pool Types

- Revolving Credit Line: Borrowers can repeatedly borrow within a credit limit.

- Receivables-Backed Credit Line: Requires approved receivables for borrowing.

- Invoice Factoring Credit: Advances a percentage of invoice amounts.

Huma’s Security

Huma prioritizes security:

- Minimized Admin Rights: All actions require multi-signature approval.

- Audits: Conducted by Spearbit, Halborn, and Certora.

- Infrastructure Security: Penetration testing and real-time malware monitoring.

Huma 2.0 Technical Infrastructure

Huma 2.0 operates on Solana with the following components:

- Solana Program: Manages liquidity pools.

- dApp Interface: User interaction hub.

- Price Oracle: Tracks PST prices in real-time.

- Autotasks: Handle redemption requests and price updates.

$HUMA Token Overview

$HUMA is the native utility and governance token of the Huma Protocol, supporting governance, rewards, and ecosystem features to drive the PayFi movement.

Token Utilities

- Governance: Staked $HUMA enables voting on protocol decisions.

- Rewards: LPs and ecosystem partners earn $HUMA based on contributions.

- Value Accrual: Protocol revenue is distributed via community-designed mechanisms.

- Ecosystem Currency: Enables advanced features like real-time redemption.

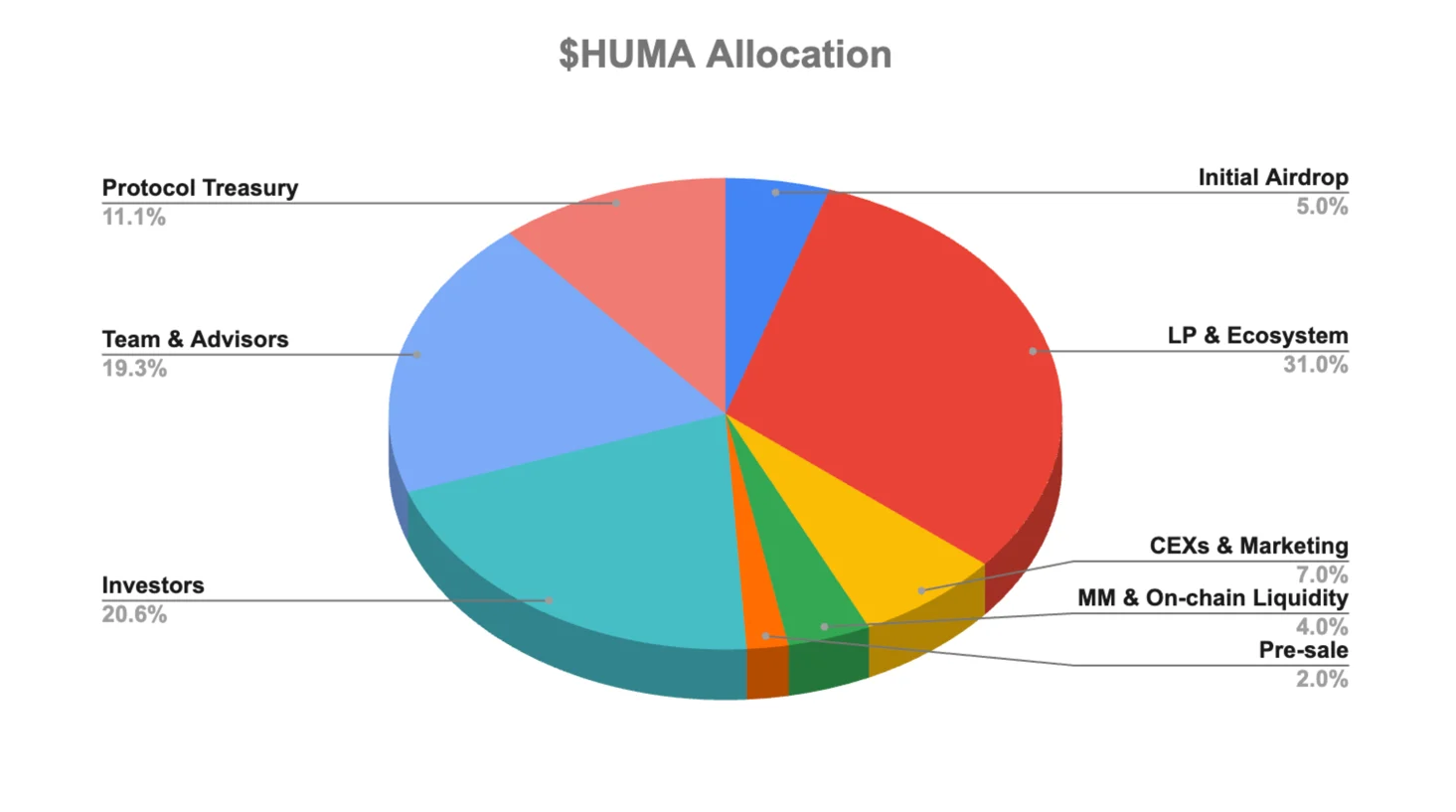

Tokenomics Breakdown

- Total Supply: 10,000,000,000 $HUMA (fixed).

- Initial Circulating Supply: 17.33%.

Allocation Plan

- Initial Airdrop (5%): Rewards loyal users, LPs, and community contributors.

- LP and Ecosystem Incentives (31%): For LPs and PayFi asset originators, with deflationary quarterly releases.

- CEX Listings and Marketing (7%): For top-tier exchange listings and global campaigns.

- Market Maker and On-Chain Liquidity (4%): Ensures stable token dynamics.

- Pre-Sales (2%): Allocated to early supporters.

- Investors (20.6%): For Seed and Series A investors, with multi-year vesting.

- Team and Advisors (19.3%): For core contributors, with multi-year vesting.

- Protocol Treasury (11.1%): For future development, with 1% unlocked at TGE and the rest over 8 quarters.

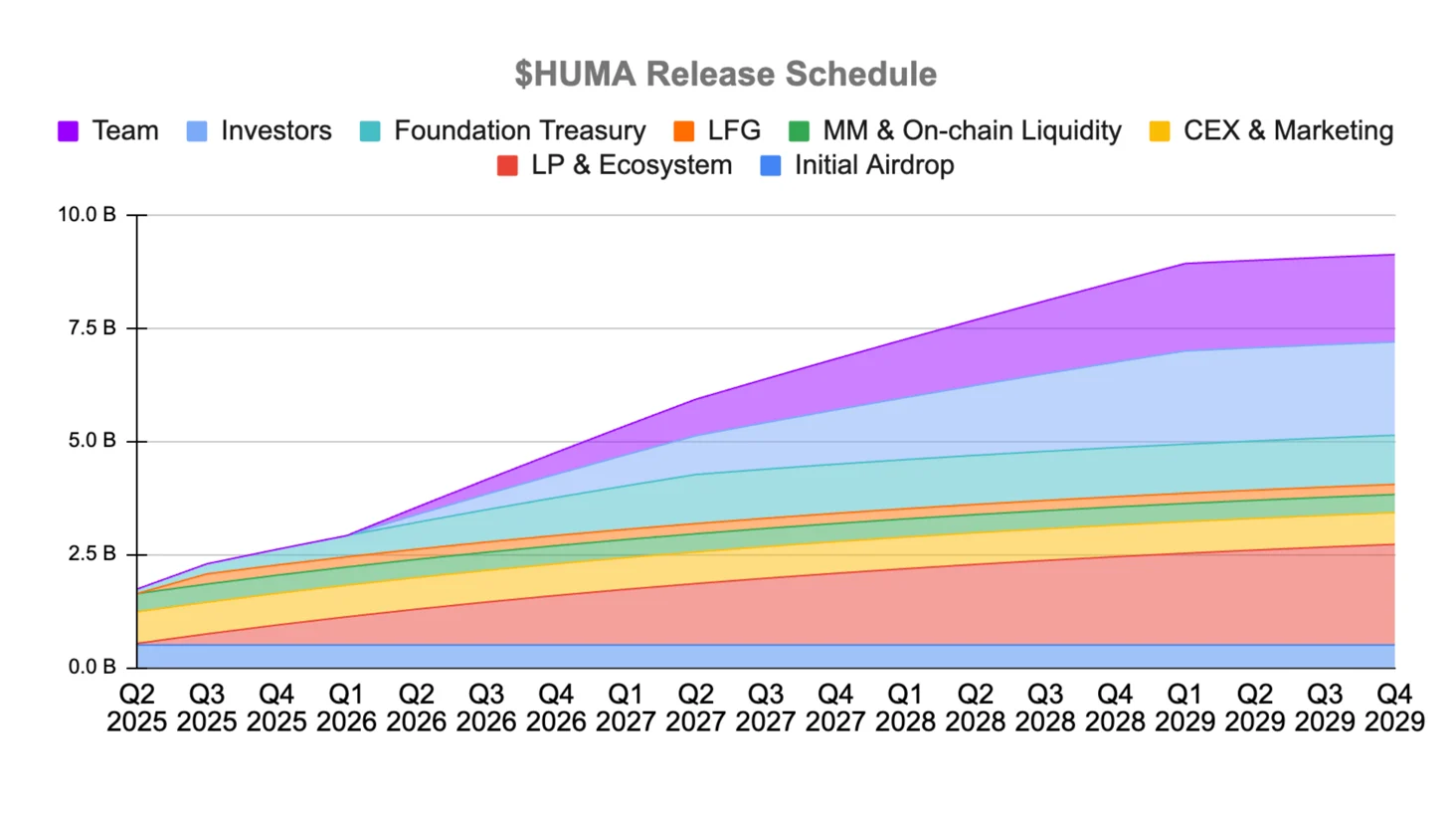

Vesting Schedule

- Team and Investors: 12-month lockup, followed by 3-year quarterly linear releases.

- LP and Ecosystem: Deflationary quarterly releases (7% decay), with a second airdrop (2.1%) 3 months post-TGE.

- Protocol Treasury: 1% unlocked at TGE, remainder distributed over 8 quarters.

Transparency and Security

- Audits: Huma 2.0 (Solana) and Huma Institutional (Solana, EVM, Stellar) audited by Halborn, Spearbit, and Certora.

- Transparency: Real-time token supply and allocation metrics are publicly accessible. Governance tools will be announced post-TGE.

Huma Finance Investors and Partnerships

Huma Finance, a San Francisco-based DeFi protocol founded in 2022, provides decentralized risk and credit solutions backed by revenue and receivables. It has raised $46.3 million from notable investors and partners, including:

- Circle

- Robot Ventures

- Türkiye İş Bankası

- Fenbushi Capital

- Folius Ventures

- Parafi Capital

- Distributed Global

This strong investment network supports Huma’s mission to scale its Web3 credit infrastructure globally.

Huma Finance Founding Team

Huma Finance was founded by experienced entrepreneurs Erbil Karaman and Richard Liu. The leadership team includes:

- Richard Liu – Co-Founder and CEO

- Erbil Karaman – Co-Founder (previously founded 7 ventures, including Campus People, Rotaractors, and Sahnebenim.com)

- Ji P. – Co-Founder

- Lei Du – Co-Founder

- Patrick F. Campos – Strategic Advisor

This team’s deep expertise in Web3 and traditional finance drives Huma Finance’s global growth.

Official Links

Also, in the comment section, you can freely share your comments and opinions about the topic. Additionally, don’t forget to follow us on Telegram, YouTube and Twitter for the latest news and updates.