Ika (IKA) is a decentralized, secure, and high-performance cross-chain interoperability solution built on the Sui blockchain infrastructure. The project aims to address the security, performance, and centralization issues faced by traditional cross-chain bridges and federated systems. It does this through a Zero Trust cryptographic framework, removing the need for trusted intermediaries. As a result, users can manage their native assets across major networks like Bitcoin, Ethereum, and Solana without relying on centralized intermediaries.

Team and Founders

The IKA team is led by founders Omer Sadika, David Lachmish, Yehonatan Cohen Scaly, and Sheran Hussain. The project evolved from the DWLT token model previously developed by dWallet Labs. Strategic governance support is provided through a partnership with Odsy Foundation (now IKA Foundation).

Project Concept and How It Works

Ika’s primary goal is to resolve fragmentation in the blockchain ecosystem and enable secure, efficient asset transfers across chains. It achieves this through two main technologies:

- 2PC-MPC Protocol: The backbone of Ika’s cryptographic framework, requiring participation from both the user and a decentralized network for each signature operation. This ensures that the private key is never reconstructed on a single side, and even network participants cannot independently control user assets.

- dWallet Technology: Digital wallets that control accounts across chains like Bitcoin, Ethereum, and Solana. Unlike traditional wallets, dWallets can execute complex conditional spending or multi-party approvals via smart contracts, allowing programmable logic across different blockchains.

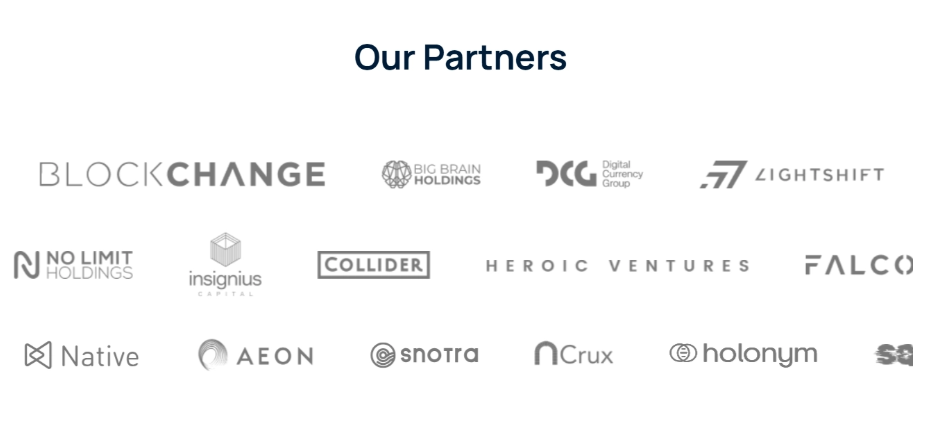

Investors and Partners

Ika has raised over $21 million from leading investors such as the Sui Foundation and DCG, securing strong support within the industry.

Governance

IKA token holders participate in decentralized governance, making decisions on protocol upgrades, economic parameters, and network changes.

Roadmap

- Q1 2024: Testnet launch

- Q1 2025: Mainnet launch (including MEXC listing)

- Q2 2025: 600 million IKA community airdrop

- Next Phase: Additional chain support (beyond BTC, ETH, SOL), developer tools, API integration

Token Use Cases

IKA token serves three main functions as the network’s native utility token:

- Staking for Network Security: Validators stake IKA tokens to participate in MPC operations.

- Transaction Fee Payments: Used to pay for dWallet creation, signature operations, and other network activities.

- Decentralized Governance: Token holders vote on decisions affecting the protocol’s future.

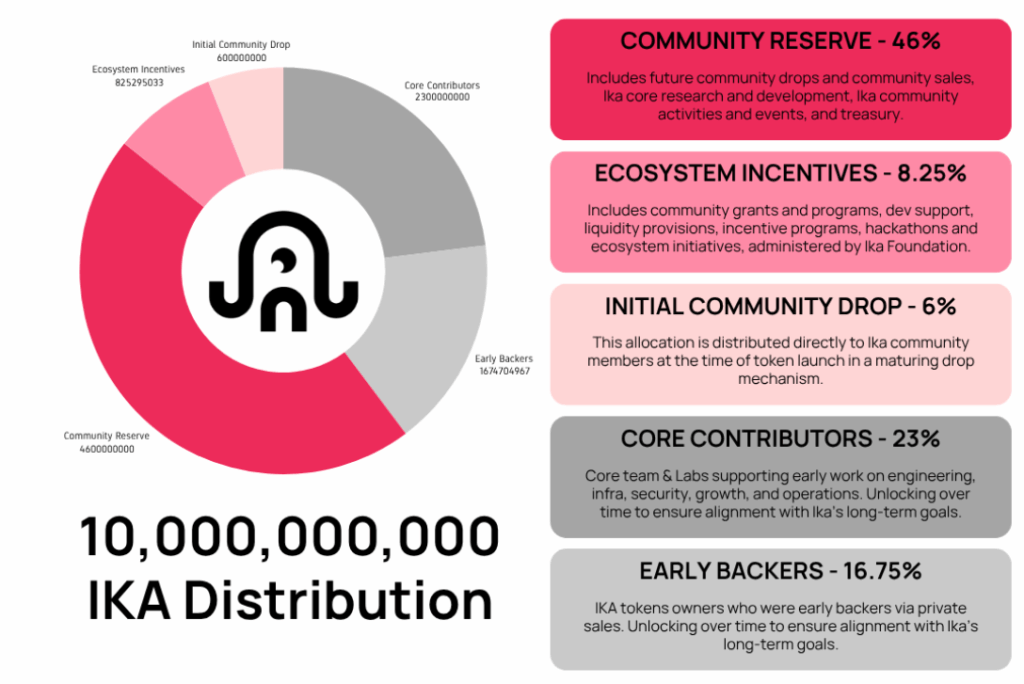

Token Information and Distribution

- Total Supply: 10 billion (10,000,000,000) IKA

- Circulating Supply: 3B IKA

- Distribution: Over 60% allocated to ecosystem participants, emphasizing community ownership.

Token Distribution Breakdown:

- Community Reserve (46%): Future distributions, sales, R&D, events, treasury

- Early Supporters (16.75%): Private sale, vesting schedule

- Core Contributors (23%): Team, engineering, infrastructure, operations

- Ecosystem Incentives (8.25%): Grants, liquidity, incentives, hackathons, foundation initiatives

- Airdrop (6%): Community distribution at launch

Ecosystem and Use Cases

Ika’s technology has potential applications across multiple sectors:

- DeFi: Liquidity management and automated trading strategies

- Enterprise Custody Solutions: Programmable custody for companies

- Gaming & NFT Ecosystems: Cross-platform asset management and programmable ownership

- DAO Treasury Management: Transparent, programmable governance over multi-chain treasuries

- dWallets: Multi-chain digital wallet infrastructure

Features

- Zero Trust Architecture: Eliminates the need to trust network participants for asset control

- High Performance: DAG-based Mystique consensus handles over 10,000 signature operations per second

- Native Cross-Chain Interoperability: Direct control of assets across chains without bridges or wrapped tokens

- Programmability: dWallets allow complex logic across multiple blockchain networks while preserving cryptographic security

Official Links

You can freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram ,YouTube and Twitter channels for the latest news and updates