KGST (KGST) is a fully collateralized stablecoin pegged 1:1 to the Kyrgyz Som (KGS), the official currency of Kyrgyzstan. The project aims to create a secure, transparent, and regulation-compliant digital currency infrastructure for Kyrgyzstan and the Central Asia region in general. KGST combines the speed and cost advantages offered by blockchain technology with the stability of the national currency, providing a practical solution for both individual users and institutional structures.

Aiming to eliminate the volatility problem frequently encountered in cryptocurrency markets, KGST positions itself in digital payments, cross-border transfers, and financial inclusion with its state-backed structure and reserve-based model. In line with Kyrgyzstan’s digital economy vision, the project seeks to become a blockchain-based representative of the national currency.

How Does KGST Work?

KGST is backed by a 1:1 reserve of KGS for every token in circulation. These reserves are held in licensed Kyrgyz banks and authorized custody institutions. Thus, the price remains pegged to the Kyrgyz Som both theoretically and practically.

The supply and circulation of KGST are managed in constant alignment with the reserve assets. Token minting and burning processes are carried out in compliance with the regulatory framework. This structure supports both price stability and user trust.

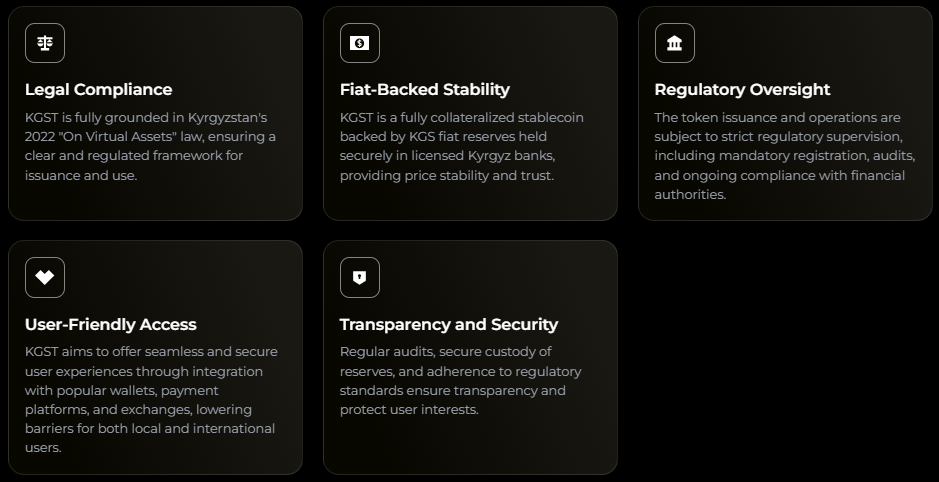

Legal Infrastructure and Regulatory Compliance

One of the most notable aspects of KGST is its strong legal foundation. The project operates within the framework of the “Law on Virtual Assets” that entered into force in Kyrgyzstan in 2022. This law defines clear rules for the issuance, circulation, and supervision of virtual assets.

The issuance and operational processes of KGST are under the supervision of the following institutions:

- State Service for Regulation and Supervision of Financial Market: The main regulatory authority for crypto asset circulation.

- National Bank of the Kyrgyz Republic: Has supervisory authority over monetary transactions and banking integrations.

- Ministry of Digital Development and Innovative Technologies: Monitors compliance with crypto legislation.

The project team commits to regular reporting to relevant institutions and undergoing necessary audit processes.

Fully Collateralized Stablecoin Structure

Project is designed as a fully fiat-collateralized stablecoin. All KGST tokens in circulation are backed by an equivalent amount of KGS cash or cash-equivalent assets. The existence and adequacy of these reserves are checked through regularly conducted audits and verification processes.

Thanks to this structure:

- KGST price is not affected by speculative fluctuations

- Users know that there is a real national currency reserve behind the token

- A reliable infrastructure is created for institutional use cases

Reserve Verification (Attestation) Process

The reserve verification process plays a critical role in the ecosystem. The attestation mechanism aims to continuously confirm that the total token supply in circulation is backed 1:1 by KGS reserves.

Reserves:

- Are held in licensed banks

- Are protected by authorized custody institutions

- Are reported in compliance with regulations

This process supports both transparency and the long-term reliability of the system.

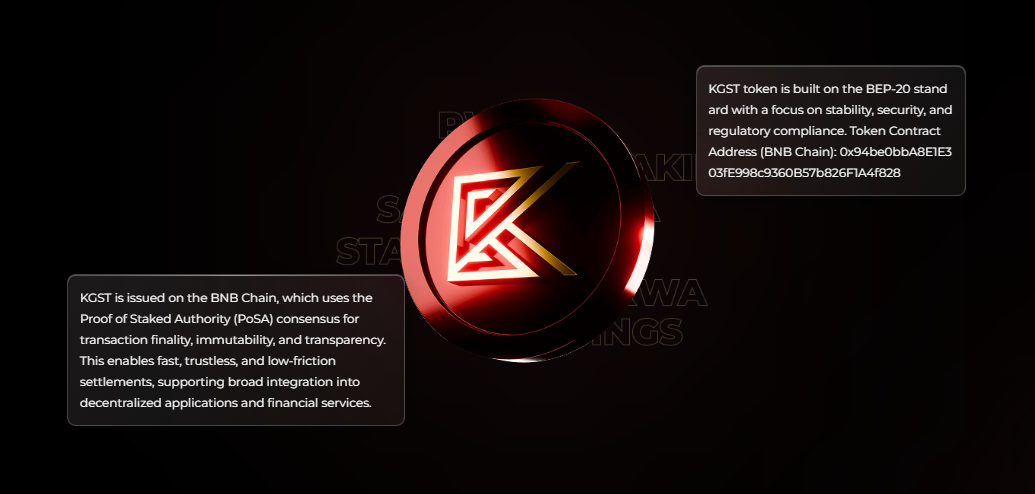

Technical Infrastructure

KGST operates on the BNB Chain and uses the BEP-20 token standard. BNB Chain offers fast transaction confirmation, low costs, and high efficiency with its Proof of Staked Authority (PoSA) consensus mechanism.

Thanks to this technical infrastructure, KGST:

- Enables fast and low-cost transfers

- Can be easily integrated with decentralized applications (dApps)

- Can work compatibly with DeFi protocols

Use Cases of KGST

Digital Payments and Daily Use

Project facilitates individuals and businesses to transact in Kyrgyz Som in the digital environment. Thanks to its blockchain-based structure, payments are fast and low-cost.

Cross-Border Money Transfers

International transfers that require high costs and long durations in traditional banking systems become nearly instant and low-cost with KGST. This provides a significant advantage, especially for the Central Asia region.

Financial Inclusion

Individuals with no or limited access to banking services can participate in the digital economy using KGST through mobile wallets. This structure aims to increase financial inclusion.

DeFi and Digital Service Integration

Thanks to the BEP-20 standard, KGST can be integrated into decentralized finance (DeFi) protocols. Users can access KGST-based lending, borrowing, and yield strategies.

Integration with Existing Financial Infrastructure

KGST is designed to be compatible with existing payment systems and financial infrastructure in Kyrgyzstan. Integration with banks, payment providers, and digital platforms is targeted. This approach facilitates access for both local and international users.

Licensing and Issuance Process

The initial public offering and issuance process of KGST stablecoins is carried out by KGSToken LLC. Issuance and circulation processes are conducted through a structure registered with and open to supervision by relevant regulators.

This makes KGST a strong stablecoin example not only technically but also legally.

KGST’s Role in Central Asia

KGST positions itself as an important example for digital payments and stablecoin adoption not only in Kyrgyzstan but across Central Asia. Offering a national currency-based, regulation-compliant, and blockchain-supported structure could create a potential model for other countries in the region.

KGST and the Support Behind It

KGST has attracted attention from prominent names in the crypto ecosystem. Changpeng Zhao (CZ), founder of Binance, announced KGST as the first nation-backed stablecoin launched on the BNB Chain. This announcement significantly increased the project’s global visibility.

Additionally, the President of the Kyrgyz Republic, Sadyr Japarov, evaluated the listing of KGST on a global crypto platform as an important milestone for the country. In the statements, it was emphasized that KGST will increase the use of the national currency in the digital environment, facilitate cross-border payments, and contribute to Kyrgyzstan’s integration into the global virtual asset ecosystem.

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.