Lighter is a decentralized, high-performance, and verifiable exchange (DEX) built on a Zero-Knowledge Rollup (ZK-Rollup). It leverages Ethereum’s security and composability while aiming to deliver speed and scalability comparable to traditional high-frequency finance (HFF) platforms.

Project Concept

Lighter is a fully verifiable decentralized perpetual futures and spot trading platform built on Ethereum using a custom ZK infrastructure.

The project addresses a key problem in DeFi: combining the speed and efficiency of centralized exchanges with the security and transparency of on-chain decentralized trading. All trades, including order matching and liquidations, are cryptographically verified using zero-knowledge (ZK) proofs on Ethereum.

How the Platform Works

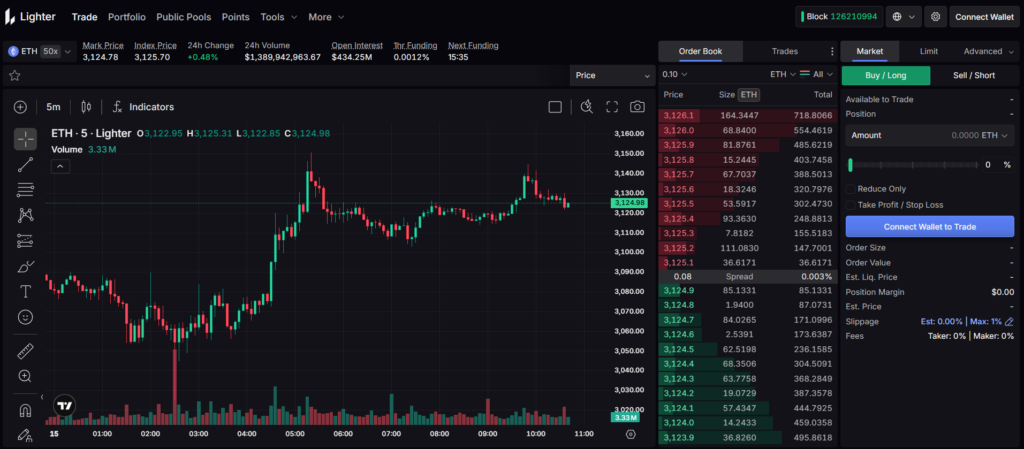

Lighter operates as a ZK-rollup perpetual DEX with the following flow:

- Users place orders on ETH, USDC, or other supported assets.

- Custom ZK circuits match orders and evaluate risks.

- Trades are batched and verified with SNARK proofs, then submitted to Ethereum.

- Liquidations and funding are managed via Chainlink oracles; isolated and cross margin supported, with leverage from 3x–25x.

The platform is compatible with the Arbitrum network and operates in a non-custodial and permissionless manner. On Lighter, market makers earn revenue from the spread by providing liquidity, while takers pay a taker fee for executing trades.

Team and Founders

- Founder & CEO – Vladimir Novakovski: Graduated from Harvard at 18 and became CEO at 22. Previously co-founded the AI social network Lunchclub, which pivoted to focus on Lighter. Extensive experience in engineering and trading.

- Engineering Lead – Emin Ayar: Core team member responsible for developing the platform’s technical infrastructure.

The team brings DeFi and blockchain expertise to build a high-performance perpetual trading platform.

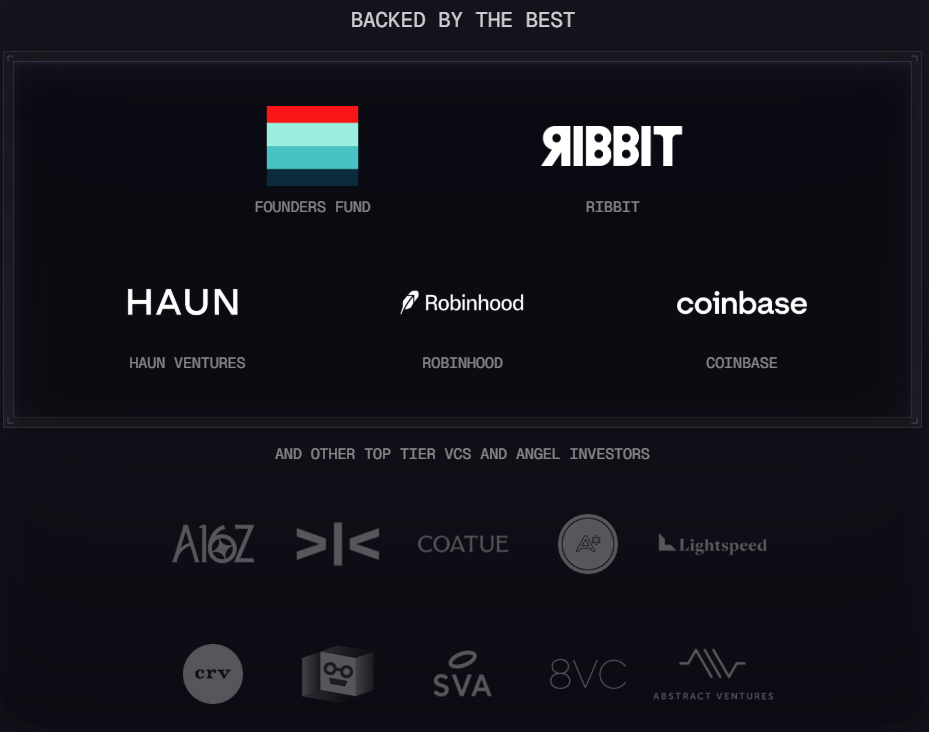

Investors and Key Partners

Lighter is backed by prominent crypto and tech investors:

- Founders Fund

- Haun Ventures

- Ribbit Capital

- Andreessen Horowitz (a16z)

- Lightspeed Ventures

- Dragonfly Capital

- Robinhood Markets (partner)

These partnerships enhance the project’s credibility and long-term potential.

Governance

Currently, Lighter is centrally governed by the team and investors. The token (LIT) has not yet been launched, so DAO or token-based governance is inactive. Future token release may enable community-led decision-making.

Roadmap

While a public roadmap is limited, recent developments and funding milestones include:

- 2022–2024: Setup, seed funding, and testnet launch.

- 2025 Q1–Q3: Public mainnet launched, perpetual products expanded (ICP, FIL, STRK) with FX and equity perps added (GBP/USD, AAPL, NVDA).

- 2025 Q4: Spot trading mainnet live (ETH/USDC), mobile integration, and RWA expansion (commodities, equities).

- Future: Institutional APIs, multi-chain derivatives, token generation event (TGE), and monetization tools.

The platform has 500,000+ users and cumulative trading volume exceeding $279 billion.

Token Information

- Total Supply: 1,000,000,000 LIT

- Max Supply: 1,000,000,000 LIT

Token Use Cases

Although the token is not yet released, potential use cases include:

- Platform governance

- Liquidity incentives

- Community and trading rewards

- Converting the points program into a token economy

Currently, rewards are distributed through the points system.

Ecosystem

Lighter’s ecosystem includes:

- Perpetual futures infrastructure

- Points reward program

- Layer 2 zk-rollup protocol

- Cryptographically verifiable order matching and liquidations

- Developer tools and API support

- Community channels (X/Twitter, Discord)

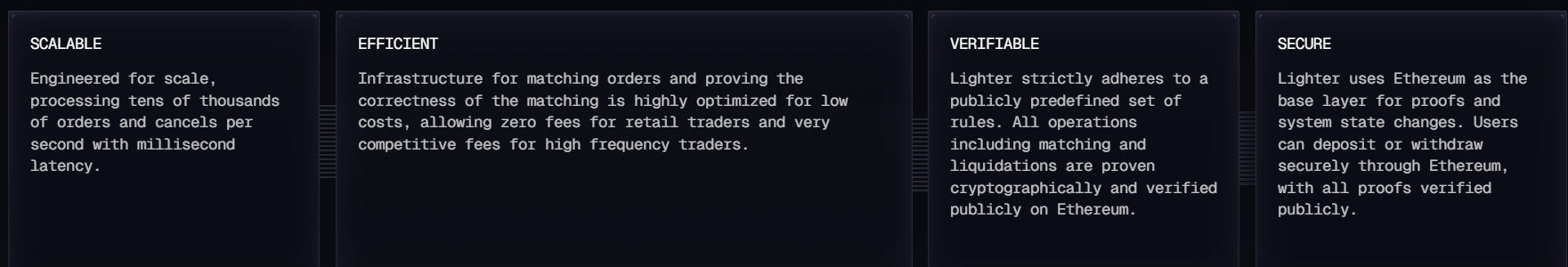

Performance and Features

- Scalability: Tens of thousands of orders per second with millisecond latency.

- Efficiency: Zero fees for retail, HFT-optimized infrastructure, custom ZK circuits.

- Verifiability: All trades are publicly verified via SNARK proofs.

- Security: Ethereum-based, non-custodial, MEV-protected.

- Multi-Market Support: Perps, spot, FX, equity, and RWA; leverage 3x–25x, isolated margin, funding.

- Institutional Tools: Low-latency APIs, liquidity pools, Chainlink integration.

- Mobile & Integrations: Liquid mobile access, automated liquidation via XLP.

Official Links

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.