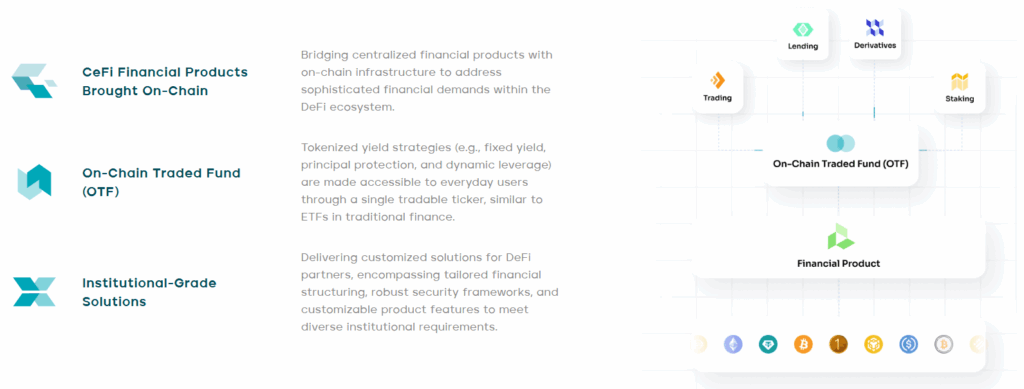

Lorenzo is an on-chain asset management protocol built on a Financial Abstraction Layer (FAL) that enables tokenized institutional-level asset management and yield strategies. The protocol aims to bring traditional financial instruments like ETFs and structured yield strategies—such as covered calls, volatility harvesting, and risk parity—into the Web3 ecosystem.

Thanks to Lorenzo’s innovative infrastructure, users can access complex financial products on-chain in a transparent and programmable manner. This framework allows the creation of tokenized investment funds called On-Chain Traded Funds (OTF).

Initially one of the oldest BTCFi staking platforms, Lorenzo has evolved into an institutional-grade asset management platform.

-

Integrated with 20+ blockchains

-

Connected to 30+ DeFi protocols

-

Yield strategies executed on $600M BTC via stBTC and enzoBTC

Project Concept

Lorenzo aims to bridge DeFi and CeFi, making sustainable, high-yield strategies accessible for both retail and institutional investors. The FAL layer allows different strategies (e.g., delta-neutral arbitrage, covered calls, volatility harvesting, RWA yields) to operate under a single modular framework. This modularity ensures flexibility, security, and scalability in financial products.

How Lorenzo Works

-

On-Chain Fund Collection:

Users deposit assets into smart contracts and receive tokens representing their investment shares (e.g., LP tokens). -

Off-Chain Strategy Execution:

Funds are managed off-chain by allowlisted managers or automated systems using CeFi arbitrage, delta-neutral trading, or volatility harvesting. -

On-Chain Settlement and Distribution:

Profits and losses are reported on-chain, NAV is updated, and yields are distributed via smart contracts.

Combined with OTFs, this setup enables real-time tracking, transparent reporting, and on-chain payments.

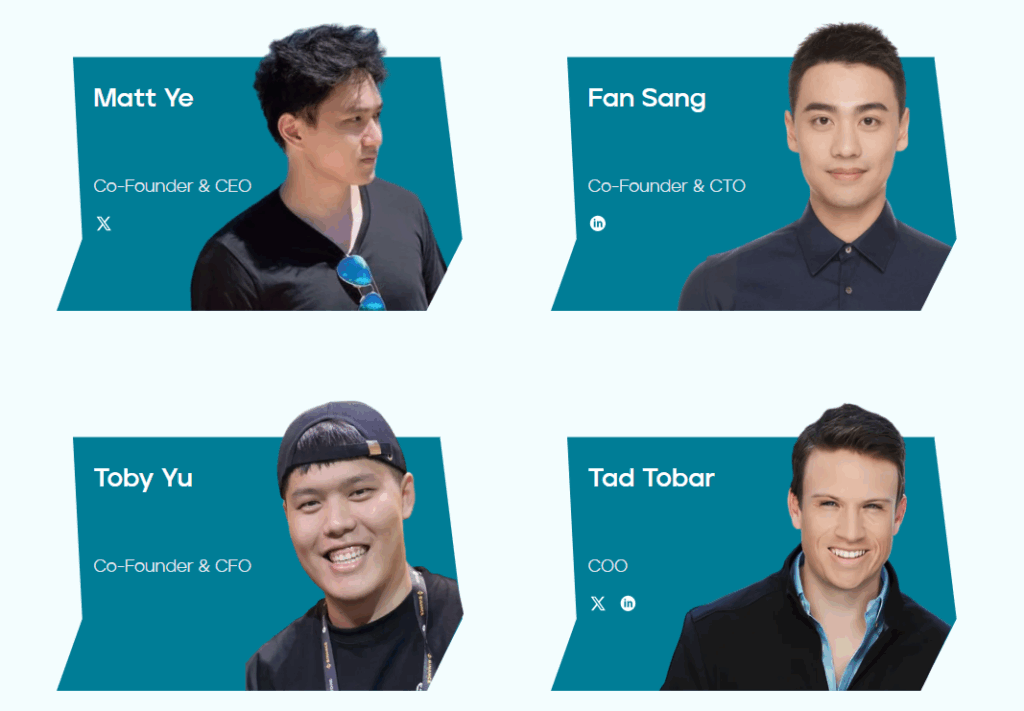

Team & Founders

-

Matt Ye – Co-Founder & CEO

-

Fan Sang – Co-Founder & CTO

-

Toby Yu – Co-Founder & CFO

-

Tad Tobar – COO

Investors & Partners

-

World Liberty Financial (WLFI) – official asset management partner

-

BNB Chain (strategic partner)

-

Animoca Brands

-

NGC Ventures

-

DHVC

-

Portal Ventures

Products

-

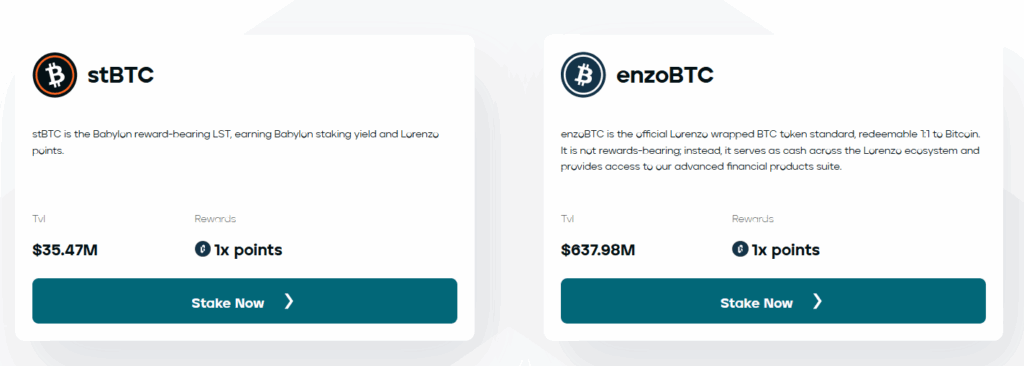

stBTC: Babylon reward-bearing LST for staking, earns Babylon yield and Lorenzo points. TVL ~$35.47M.

-

enzoBTC: Wrapped BTC 1:1 redeemable, used as collateral in the Lorenzo ecosystem. TVL ~$637.98M.

Both tokens reward active users through a 1x point mechanism, representing $600M+ BTC yield strategies.

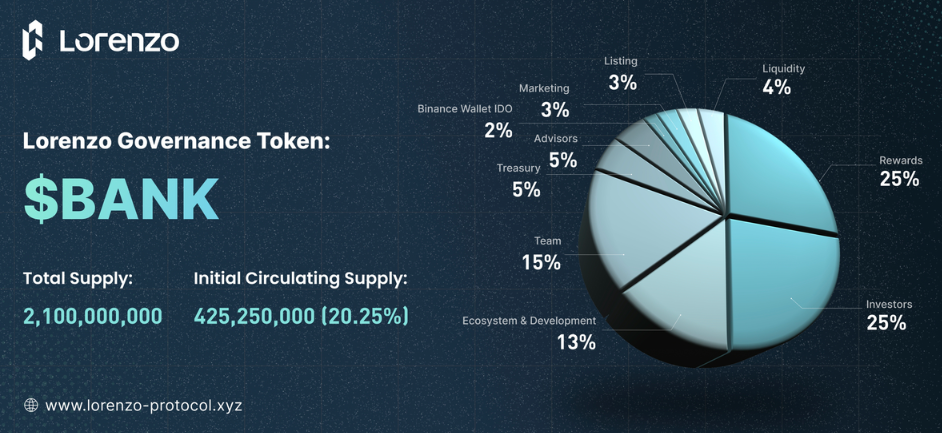

Governance ($BANK)

Governance uses the $BANK token and vote-escrowed system (veBANK). Users lock $BANK for veBANK, gaining higher voting power and boosted rewards.

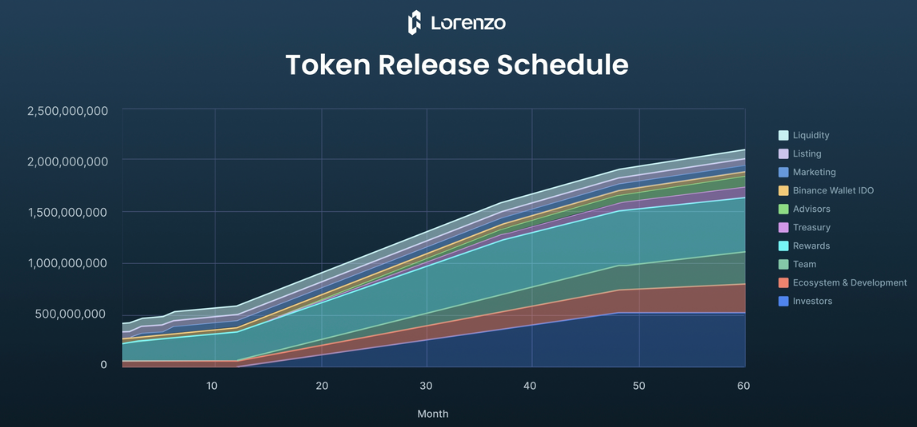

$BANK Token Details

-

Total Supply: 537.83M

-

Max Supply: 2.1B

-

Circulating Supply: 437.91M

Allocation

-

Rewards: 25%

-

Investors: 25%

-

Ecosystem & Development: 13%

-

Team: 15%

-

Treasury: 5%

-

Advisors: 5%

-

Binance Wallet IDO: 2%

-

Marketing: 3%

-

Listing: 3%

-

Liquidity: 4%

Token Use Cases

-

Staking & Platform Access

-

Governance Voting

-

Participation Rewards

Ecosystem & Integrations

-

20+ blockchains

-

30+ DeFi protocols

-

stBTC & enzoBTC yield strategies worth $600M

-

Oracle & cross-chain services: Chainlink, LayerZero, Wormhole

-

Wallets: OKX Wallet, Trust Wallet, Binance Wallet

-

USD1+ product in partnership with WLFI combining RWA and DeFi yields

Key Features

- FAL: Modular DeFi & CeFi strategy execution

- OTF: Fully on-chain, ETF-style yield funds

- veBANK: Long-term governance power & reward boosts

- Multi-chain & multi-protocol: Active integration with 20+ chains & 30+ protocols

- Institutional-grade products: RWA, CeFi loans, advanced risk management

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.