Magma Finance is a next-generation Decentralized Exchange (DEX) and Adaptive Liquidity Engine project operating specifically on the Sui Network. Its primary goal is to address capital inefficiency and liquidity fragmentation within the Sui ecosystem, delivering the best user experience and capital efficiency.

The project employs the ve(3,3) tokenomics model to align the interests of both liquidity providers (LPs) and investors.

Magma Finance is a protocol where users can:

-

Perform decentralized token swaps.

-

Provide liquidity.

-

Implement advanced trading strategies.

The platform operates on MOVE-based blockchains and offers high efficiency and low slippage advantages for both traders and liquidity providers.

Team and Founders

Magma Finance is backed by developers experienced in the blockchain and DeFi space. The team possesses deep technical knowledge in both AMM design and the MOVE ecosystem. While detailed information about the founding team is currently limited, they are known to be in close cooperation with the Sui ecosystem.

Investors and Partnerships

The project is supported by experienced investors in the crypto and DeFi space. Prominent partners and liquidity providers enable Magma to grow rapidly within the Sui ecosystem.

-

Investors:

-

HashKey Capital

-

SNZ Holding

-

SevenX Ventures

-

Puzzle Ventures

-

Topspin Ventures

-

-

Key Partners/Ecosystem Support:

-

It has received support from key DeFi ecosystem players like NAVI Protocol.

-

Project Concept

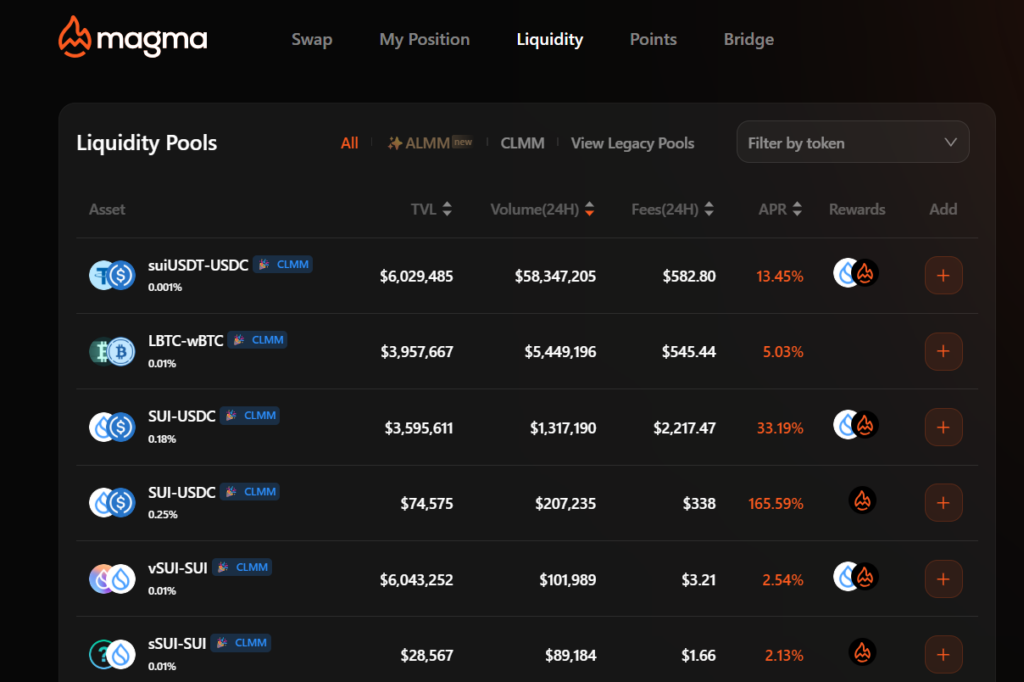

Magma’s core purpose is to optimize decentralized trading and liquidity management. The platform utilizes Concentrated Liquidity Market Maker (CLMM) technology, which allows users to provide liquidity within specific price ranges. This enhances both capital efficiency and enables liquidity providers to earn higher fees.

How the Project Works

-

The ALMM engine dynamically concentrates liquidity in active price bands, increasing capital efficiency.

-

Liquidity Providers (LPs) provide range-based liquidity and earn income from transaction fees and incentives through automatic adjustments.

-

Traders minimize slippage with deep liquidity and low fees, capturing the best prices with AI-backed route optimization.

-

Governance participants gain voting rights and access to rewards by locking tokens.

This model ensures that:

-

veMAGMA Holders: Earn income from protocol fees (bribes) and support their pools by voting on where emissions should go.

What is veMAGMA?

veMAGMA is short for Vote-Escrowed MAGMA. It is a non-transferable governance power obtained when locking MAGMA tokens in the protocol for a specific period.

How to Obtain It? MAGMA holders obtain veMAGMA by locking their native MAGMA tokens in the protocol.

-

Lock-up Period: The amount of veMAGMA obtained depends on the amount of MAGMA locked and the length of the lock-up period. The longer the duration, the higher the veMAGMA power.

Governance

Governance in Magma Finance is conducted through the veMAGMA (Vote-Escrowed MAGMA) token, which is obtained by locking the native MAGMA token.

-

veMAGMA’s Role: veMAGMA is the essential tool that enables users to have a say in the protocol’s future and economic incentives.

-

Balance of Power: The amount of veMAGMA and consequently the governance power depends on the amount of MAGMA locked and the length of the lock-up period. Tokens locked for a longer period grant more voting power (veMAGMA).

MAGMA Token

The MAGMA token is the native utility and governance token of Magma Finance, the DEX and liquidity engine operating on the Sui Network. As the project’s main goal is to solve liquidity inefficiency, MAGMA is central to this mechanism.

Key Information

-

Network: Sui Network

-

Total Supply: 1 billion MAGMA

-

Max Supply: 1 billion MAGMA

-

Circulating Supply: 190 million MAGMA

-

Project Type: Decentralized Exchange (DEX) / Adaptive Liquidity Engine

-

Tokenomics Model: Uses the ve(3,3) structure (specifically for governance and incentives).

Token Utility

-

Governance: MAGMA tokens are locked to obtain veMAGMA; holders can vote on the protocol.

-

Protocol Revenue: veMAGMA holders earn extra rewards and “bribes” from the pools they govern.

-

Liquidity Incentives: MAGMA is used to reward liquidity providers, drawing liquidity into the protocol.

Roadmap

-

February 2025: Full functional launch of the CLMM DEX on Sui and comprehensive security audits.

-

ALMM MVP: Testing of the core trading engine, adaptive liquidity management, and user-friendly interface.

-

Testnet and Mainnet Launch: Multi-asset trading pairs, advanced ALMM features, and community testing.

-

2026+ period for AI-backed yield strategies: Multi-source yield including ALMM LPs, DEXes, lending, and liquid staking.

Ecosystem and Features

Magma offers a fully open and permissionless platform on MOVE-based blockchains. Users can create their own pools, optimize trading strategies, and manage liquidity positions as NFTs. ALMM ensures adaptive liquidity, low slippage, and high capital efficiency. Supported by audited smart contracts, the platform provides an ideal DeFi solution for both traders and LPs.

-

Adaptive Liquidity Provision: Maximizes capital efficiency by optimizing liquidity through dynamic ranges.

-

Capital-Efficient AMM: Minimizes slippage, optimizes transaction fees, and is designed for volatility.

-

Audited & Secure: User security is ensured with battle-tested smart contracts and comprehensive security audits.

-

AI Strategy Layer: AI automatically balances and optimizes liquidity positions, ensuring most of the TVL remains active.

-

Optimal Transaction and MEV Protection: AI optimizes the route for the lowest slippage and gas cost, and prevents potential MEV attacks.

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.