Mamo is a blockchain-based personal finance assistant. It helps users grow, manage, and understand their money while avoiding complex financial jargon. The platform allows investors to increase their savings without financial expertise and automatically allocates funds across trusted platforms to maximize returns.

Combining the simplicity of traditional banking with the yield opportunities of blockchain, Mamo leverages Base network’s low fees and speed, supported by an AI bot (Mamo Bot) that enables investment even in small amounts. The project’s motto, “Learn as You Earn,” simplifies complex financial decisions and represents the future of onchain finance.

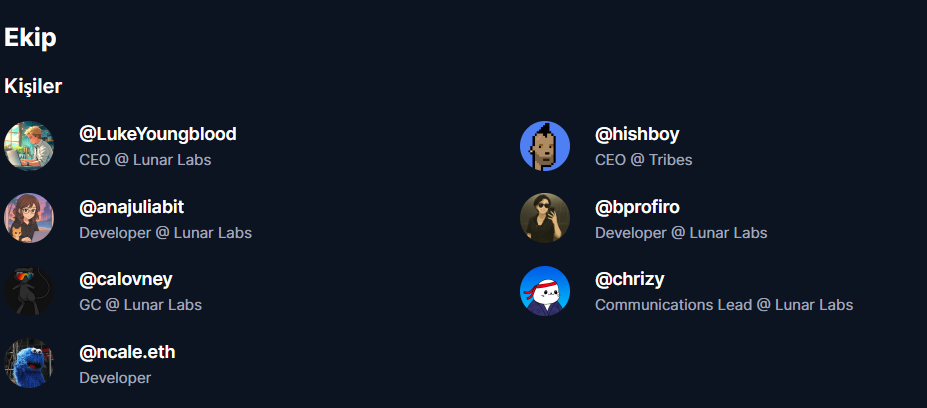

Team Information

-

Luke Youngblood (@LukeYoungblood): CEO of Lunar Labs, recognized in blockchain infrastructure.

-

Hish (@hishboy)

-

Ana Julia (@anajuliabit): Developer at Lunar Labs.

Investors and Key Partners

Mamo has received support from both traditional finance (TradFi) and Web3 sectors:

-

Key Partners: Integrated with the Base ecosystem, strategic collaborations with Moonwell, Aerodrome, and Coinbase.

-

Investors: Funded by Global Ventures, 4DX Ventures, and angel investors. UAE-compliant structure enhances institutional trust.

Project Idea

Mamo aims to grow users’ money without requiring financial knowledge. The platform offers steady growth using simple, risk-aware strategies. Users can add, pause, or withdraw funds anytime.

Luke Youngblood’s vision is to create simple and powerful financial tools to bring the world onchain.

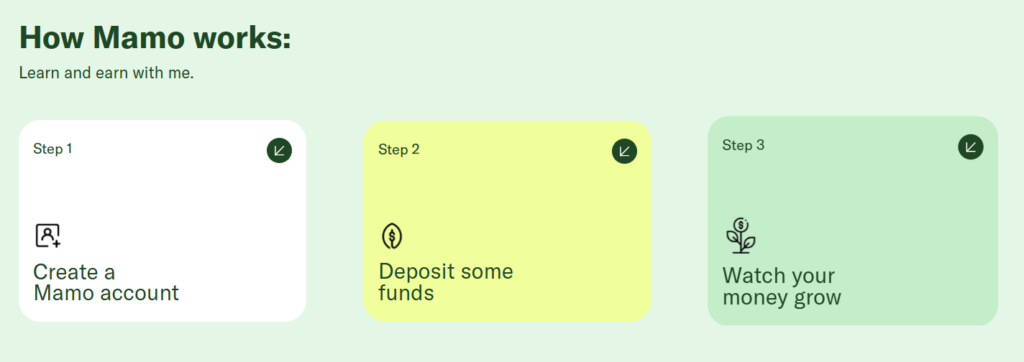

How It Works

Mamo operates on three main pillars:

-

AI Automation: Moves funds automatically across DeFi protocols (liquidity pools, staking) according to user risk preferences to optimize yield.

-

Simplified Interface: Users manage funds via a bot interface (Telegram or WebApp), avoiding complex wallet addresses or confirmations.

-

Data Analysis: Categorizes spending and helps plan budgets to understand where money goes.

Governance

Mamo follows a user-centric governance model. Platform updates and strategy changes require user approval, ensuring full control over personal funds.

Roadmap

Past (2025):

Mamo accounts went live in June 2025 with USDC and cbBTC integrations.

Present (Late 2025):

The platform offers a “Points” campaign for deposit-based rewards, a $4,000 total prize pool, and weekly distributions of $5.6K in MAMO and cbBTC rewards.

Future (2025–2026):

Coinbase system upgrades and integrations by December 2025, additional wallet support (e.g., Phemex), expanded AI strategies, and new customized modes such as directing Bitcoin rewards directly to BTC accounts. Long-term goals include more asset support and global accessibility.

MAMO Token Use Cases

-

Deposit & Yield: Earn 7.88% APY with auto-compounding.

-

Governance: Participate in DAO votes.

-

Rewards: Share weekly Aerodrome fee distributions.

-

Points & Campaigns: Earn points with deposits and compete for rewards.

-

Integrations: Convert Bitcoin rewards to MAMO or compound automatically.

Token Information

-

Network: Base

-

Total Supply: 1,000,000,000 MAMO

-

Max Supply: 1,000,000,000 MAMO

-

Circulating Supply: 513,450,000 MAMO

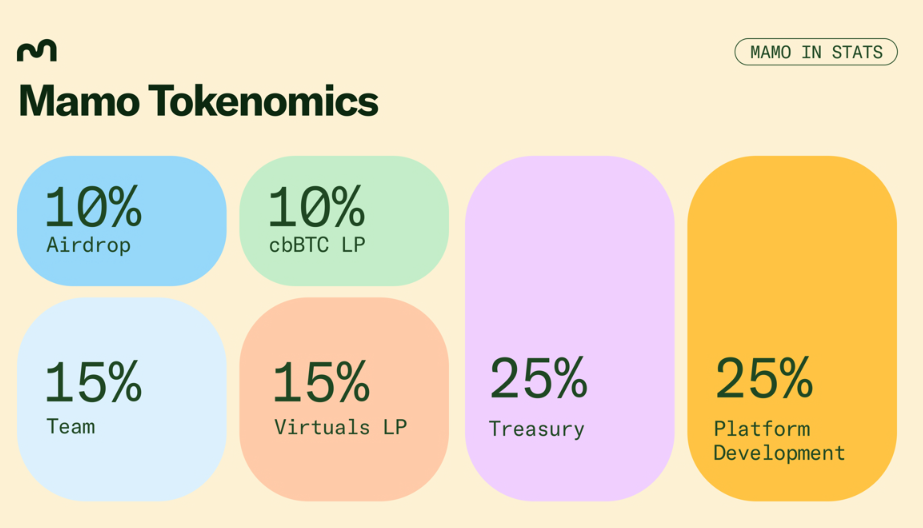

Token Distribution

-

10% Community Airdrop (stkWELL, WELL, VIRTUAL, veAERO holders)

-

25% Treasury (24-month monthly vesting)

-

25% Platform Development (24-month monthly vesting)

-

15% Team (6-month cliff + 24-month vesting)

-

15% Virtuals LP (locked)

-

10% cbBTC LP (locked)

Ecosystem

Mamo operates within the Base ecosystem with key integrations:

-

Moonwell DeFi: Lending and borrowing

-

Morpho Labs: Vaults and auto-yield optimization

-

Aerodrome Finance: DEX liquidity and MAMO trading

-

Coinbase: cbBTC and fiat onramps

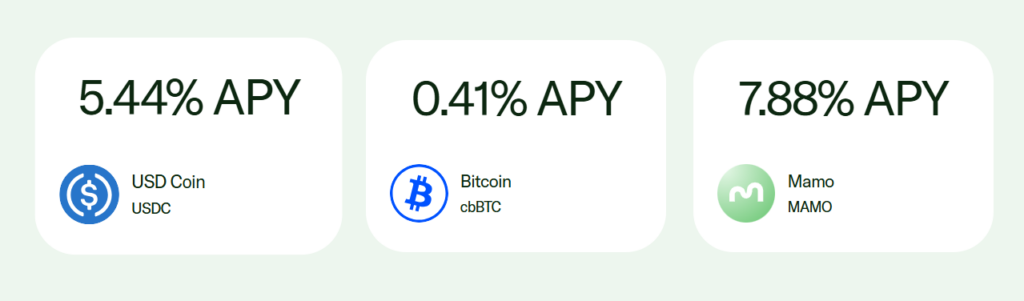

Supported Assets & APY:

-

USDC: 5.44% APY

-

cbBTC: 0.41% APY

-

MAMO: 7.88% APY

Features

-

User-friendly interface with simple navigation

-

Automatic fund allocation and yield optimization

-

Risk-aware and safe strategies

-

Full user control: add, pause, withdraw anytime

-

Auto-compounding of rewards and interest

-

Community-focused, transparent token distribution

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.