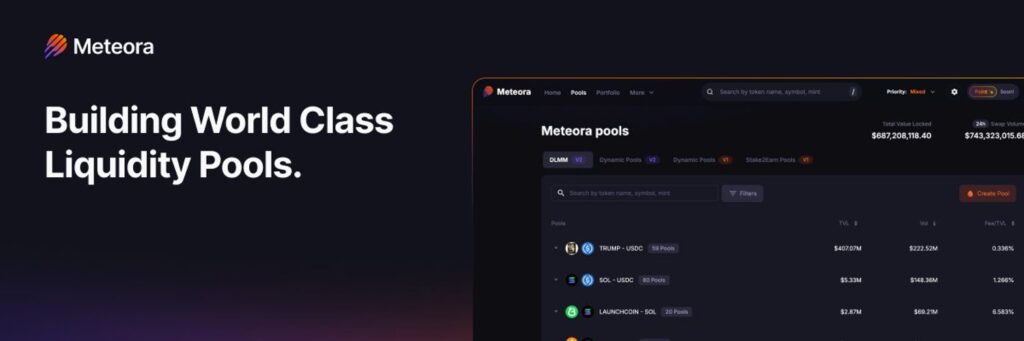

Meteora (MET) is a decentralized liquidity protocol built on the Solana blockchain, offering adaptive AMMs, dynamic AMM pools, and yield-optimizing vaults. The project aims to deliver a secure, sustainable, and efficient liquidity infrastructure for the DeFi ecosystem.

Innovative mechanisms such as DLMM (Dynamic Liquidity Market Maker), Dynamic AMM Pools, and Dynamic Vaults allow Meteora to optimize user yield, reduce slippage, and increase capital efficiency. This ensures a fair, transparent, and profitable market experience for both traders and liquidity providers.

Team and Founders

Meteora is the rebranded version of Mercurial Finance, a long-standing project in the Solana ecosystem. The founding team consists of experienced DeFi developers:

-

Meow – Co-founder

-

Ben Chow – Co-founder

-

Soju – Lead Developer

The team actively contributes to the Solana community and focuses on developing next-generation liquidity models.

Project Concept

Meteora aims to make liquidity management smarter, sustainable, and more efficient in the DeFi ecosystem. Traditional AMM models often face issues such as fixed price ranges and low efficiency. Meteora addresses these problems with dynamic pools that adjust according to market volatility.

-

Liquidity automatically rebalances based on market conditions.

-

LPs earn passive income optimized by price movements.

-

Users benefit from low-slippage trading.

How the Protocol Works

DLMM Pools (Dynamic Liquidity Market Maker):

Liquidity is divided into dynamic ranges and updated automatically according to market prices, providing higher capital efficiency than classic AMMs.

Dynamic AMM Pools:

Flexible pricing models support adaptable trading pairs while maintaining liquidity efficiency in volatile markets.

Dynamic Vaults:

Automatic auto-compounding system for LPs. Users can create LP positions in a single transaction, and rewards are reinvested automatically.

Additional features:

-

Anti Sniper Suite (bot and front-running protection)

-

Zap & Lock (single-click LP management)

Governance

MET token holders can vote on the future of the Meteora ecosystem. Governance decisions include protocol updates, fee settings, staking rewards, and new product integrations.

Phoenix Rising (M3M3) Plan

The M3M3 Plan, also known as Phoenix Rising, symbolizes the transition from Mercurial Finance to Meteora. MRV token holders were able to migrate to MET, ensuring the community is integrated into the new liquidity infrastructure.

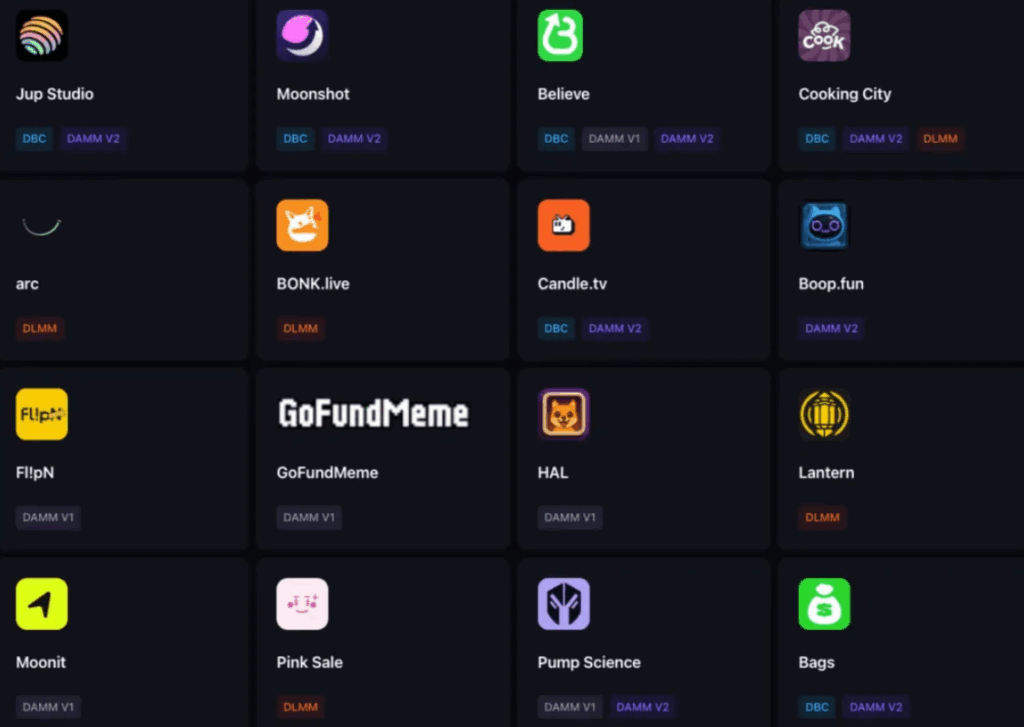

Partnerships & Integrations

Meteora benefits from a strong Solana partnership network:

-

Jupiter: Trade routing and swap engine integration

-

Kamino: Automated investment strategies

-

Tensor: NFT liquidity

-

Marinade: Staking and liquidity pools

-

Raydium: Swaps and LP optimization

MET Token Use Cases

MET token powers:

-

Protocol fee payments

-

Launchpad access

-

Revenue sharing

-

Liquidity incentives

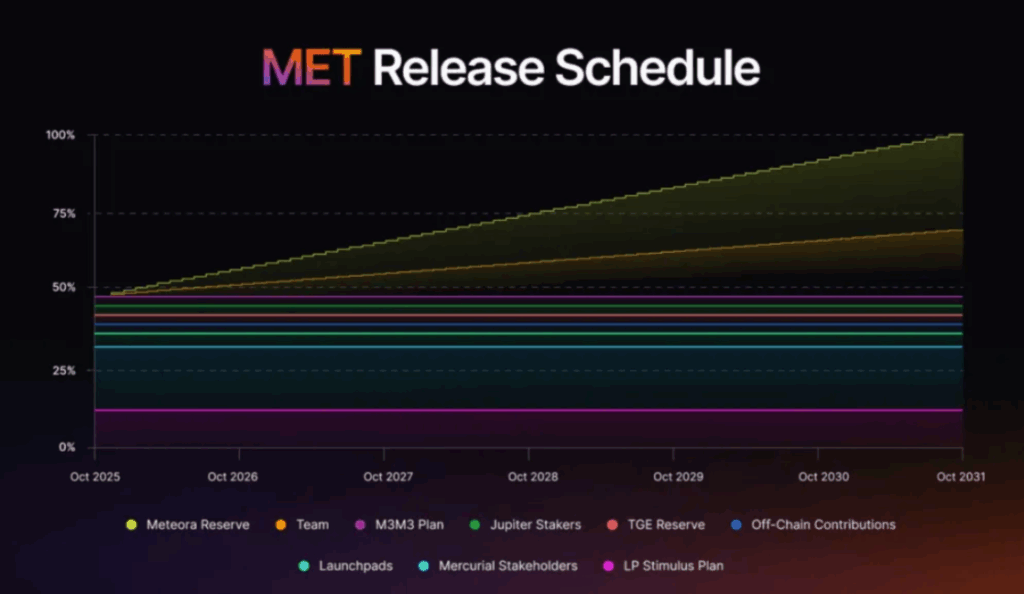

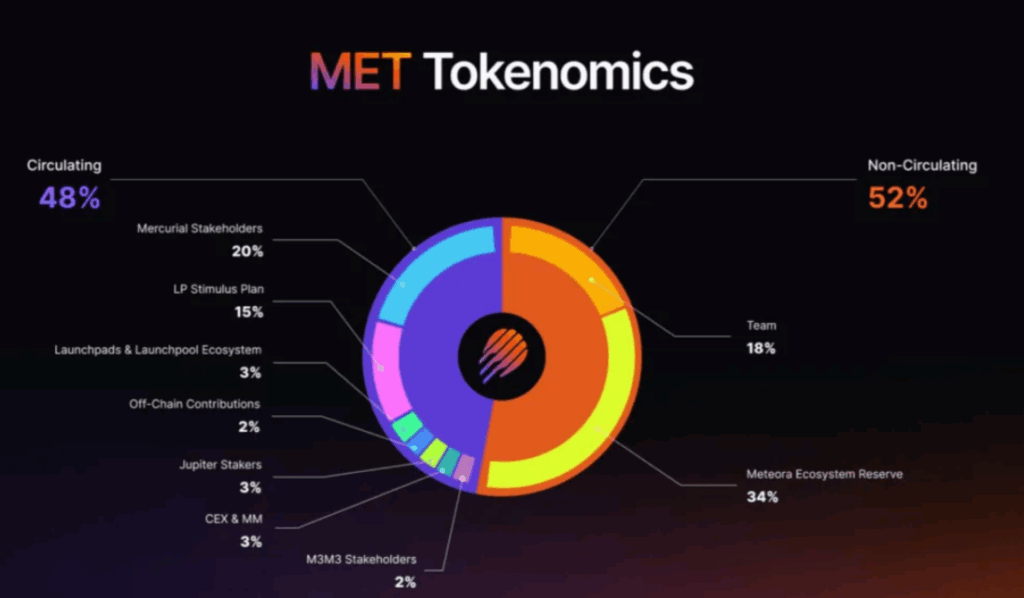

Token Info & Distribution

-

Total Supply: 1,000,000,000 MET

-

Max Supply: 1,000,000,000 MET

-

Circulating Supply: 480,000,000 MET

Distribution

-

Team: 18%

-

Meteora Reserve: 34%

-

M3M3 Plan: 2%

-

Off-Chain Contributions: 2%

-

Jupiter Stakers: 3%

-

Launchpads & Launchpool Ecosystem: 3%

-

TGE Reserve: 3%

-

Mercurial Reserve: 5%

-

Remaining: Community contributions, ecosystem incentives, and development fund

Roadmap

-

2021: Mercurial Finance launch

-

2022: Rebrand to Meteora

-

2023: Introduction of DLMM and Dynamic Vaults

-

2024: MET token preparations, testnet, community incentives

-

2025: MET launch, governance model, cross-chain integrations

Note: MET token will be listed on Binance Alpha on October 24, 2025, providing early access and increased liquidity.

Ecosystem & Security

Meteora implements OtterSec and Solana Foundation security protocols. Multi-signature (multisig) and timelock mechanisms ensure fund safety. Developers can integrate dApps using Meteora’s open infrastructure and incentive pools.

Key Features

-

High speed and low cost on Solana

-

Dynamic liquidity management

-

Advanced AMM architecture

-

Auto-compounding vault system

-

Community-driven governance

-

Strong partnership network

-

Sustainable tokenomics

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.