When it comes to institutional investments in the crypto world, one of the first companies that comes to mind is undoubtedly MicroStrategy (Strategy). However, the company’s story did not begin with Bitcoin. Founded in 1989 by Michael Saylor under the name MicroStrategy, the firm was known for many years for its software and business intelligence solutions.

At the beginning of 2025, the company decided to drop the word “Micro” from its name and continue solely with the Strategy brand. This simplification aimed to create a stronger brand perception, similar to the example of “The Facebook.” Today, Strategy is referred to as “The World’s First and Largest Bitcoin Treasury Company.”

What is MicroStrategy (Strategy)?

In its early years, Strategy helped companies analyze big data and make better decisions with its business intelligence and data analytics software. The company went public on NASDAQ in 1998 under the ticker MSTR, but after accounting issues with the SEC in the early 2000s, its shares traded in a narrow band for a long time.

The real turning point came in 2020. Led by Michael Saylor, the company made a historic move in the financial world by adopting Bitcoin as its reserve asset. Initially purchasing $250 million worth of BTC, the firm became one of the pioneers of bringing crypto onto corporate balance sheets.

Strategy’s Bitcoin Treasury

Strategy views Bitcoin not just as an investment tool but also as a hedge against inflation and a long-term store of value. In line with this vision, the company’s Bitcoin purchases grew steadily.

-

The company financed its Bitcoin investments through methods such as issuing convertible bonds and stock sales.

-

At the beginning of 2025, it launched a new stock under the ticker STRK, aiming to raise $584 million.

-

In February 2025, it announced a $2 billion convertible bond issuance.

This strategy was later adopted by other publicly traded companies (e.g., MARA, Riot Platforms). Michael Saylor compared this approach to real estate development in Manhattan: “As value increases, new debt is issued and more assets are acquired.”

Bitcoin and Corporate Financing: An Innovative Approach

Strategy’s financing model allowed the company to accumulate Bitcoin not only through cash reserves but also through debt instruments. This set a unique example in the corporate world.

-

In October 2024, the company announced plans to raise up to $42 billion to increase Bitcoin purchases.

-

In January 2025, it decided to increase the number of its Class A shares by 30 times, paving the way for much larger-scale Bitcoin investments.

Today, Strategy holds 478,740 BTC, the largest Bitcoin portfolio among publicly traded companies. The total value of these holdings exceeds $72 billion, and the company has made $15.5 billion in profit from its purchases to date (as of February 2025).

Michael Saylor’s Bitcoin Vision

Although Michael Saylor is one of the strongest advocates of Bitcoin today, he was not always so. In a 2013 tweet, he even said that Bitcoin’s “days were numbered.” However, from 2020 onward, he took a completely different stance.

Saylor describes Bitcoin as “digital gold” and projects its price at $13 million in a 21-year outlook. According to him, “Everything that can be tokenized will be tokenized.”

In line with this vision, Strategy’s goal is not only to build a massive Bitcoin treasury but also to transform into a trillion-dollar Bitcoin bank. The company plans to offer Bitcoin-based financial products and capital market instruments in the future.

Criticisms and Risks

Although Strategy’s Bitcoin strategy has been praised, some criticisms have also emerged.

-

At the end of 2024, Sherwood Media argued that the company’s valuation was three times the value of its Bitcoin holdings and that this math could pose risks in the long run.

-

Citron Research considered the company’s shares overvalued and took short positions.

One of the biggest risks is that if Bitcoin prices drop significantly, the company may be forced to sell BTC to pay off its more than $4 billion in convertible debt. This could create a chain reaction for both the company and the market.

Strategy’s Role in the Crypto Ecosystem

Today, Strategy is not only a software company but also a symbol of institutional Bitcoin adoption. The company’s aggressive purchases paved the way for giants like Tesla and Square to invest in Bitcoin.

Despite the volatility in Bitcoin prices, Strategy’s long-term vision is clear: accumulate more BTC and play a leading role in the global financial world.

For this reason, Strategy stands out as one of the most important players shaping both the future of the crypto ecosystem and institutional investment.

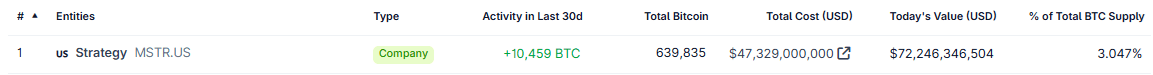

Strategy’s Current Bitcoin Data (February 2025):

-

Total Bitcoin: 639,835 BTC

-

Total Cost: $47.3 billion

-

Current Value: $72.2 billion

-

Profit/Loss: +$15.5 billion

-

Share of Total BTC Supply: 3.04%

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.