In the crypto market, fragmented cross-chain liquidity and the integration of real-world assets (RWA) into DeFi may appear as separate challenges. In reality, they intersect at the same point: inefficiency. MultichainZ aims to become the credit and liquidity layer of Web3. Positioned precisely at this structural gap, it is an omnichain RWA lending protocol. Its native token is $CHAINZ.

Below is a full breakdown of the project, covering all critical components in a structured yet natural flow.

What Is MultichainZ Trying to Achieve?

The core thesis is simple:

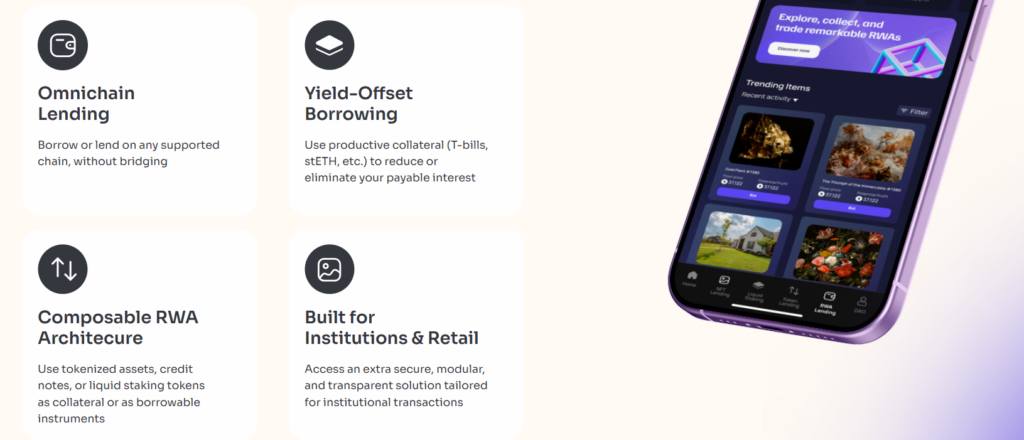

Users should be able to use yield-generating real-world assets (such as tokenized bonds, institutional debt instruments, or yield-bearing stablecoins) as collateral and borrow on another blockchain — without manually bridging assets.

The protocol seeks to bridge Traditional Finance (TradFi) and Decentralized Finance (DeFi) through a cross-chain credit layer.

This enables:

-

Collateral locked on one chain

-

Liquidity accessed on another chain

-

Yield generation continuing uninterrupted

The model directly addresses liquidity fragmentation.

What Is MultichainZ Building?

MultichainZ combines cross-chain lending infrastructure with RWA integration and liquid staking into an omnichain DeFi protocol.

The model allows borrowing against:

-

Crypto assets

-

NFTs

-

Tokenized real-world assets (bonds, debt instruments, commodities)

-

Derivatives

In addition, integrated liquid staking and re-staking allow users to continue earning yield on collateral while borrowing.

Capital Efficiency & RWA Integration

Overcollateralization is a structural issue in DeFi. Borrowers typically need to deposit more value than they borrow.

MultichainZ aims to optimize capital efficiency through:

-

Unified liquidity pools

-

Cross-chain collateral aggregation

-

Yield-bearing RWA collateral

Users can:

-

Maintain yield exposure

-

Borrow without interrupting asset returns

-

Reduce opportunity costs

Trust, Transparency & Smart Contract Design

All lending mechanics operate through smart contracts.

This means:

-

Collateral ratios are verifiable on-chain

-

Interest calculations are automated

-

Liquidation rules are predefined

-

Loan data is publicly auditable

Trust is derived from code, not intermediaries.

Ecosystem Structure: Beyond Token Lending

MultichainZ structures its ecosystem across three lending verticals:

1) Token Lending

Traditional supply-and-borrow DeFi model.

2) NFT Lending

NFT holders can use digital collectibles as collateral.

3) Real-World Asset Lending

Tokenized real estate, bonds, commodities, and institutional debt instruments can serve as collateral.

This expands the protocol beyond crypto-native users into institutional territory.

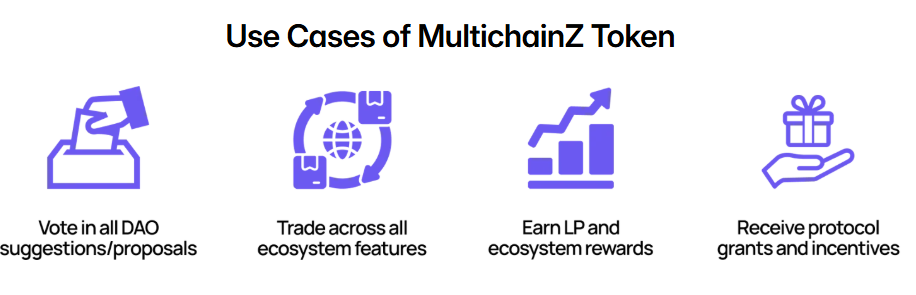

Governance: Fully On-Chain

Governance is entirely on-chain.

$CHAINZ holders can:

-

Submit proposals

-

Vote on protocol upgrades

-

Delegate voting power

Key decisions such as treasury management, emissions, and chain integrations are governed by DAO voting with time-lock executors.

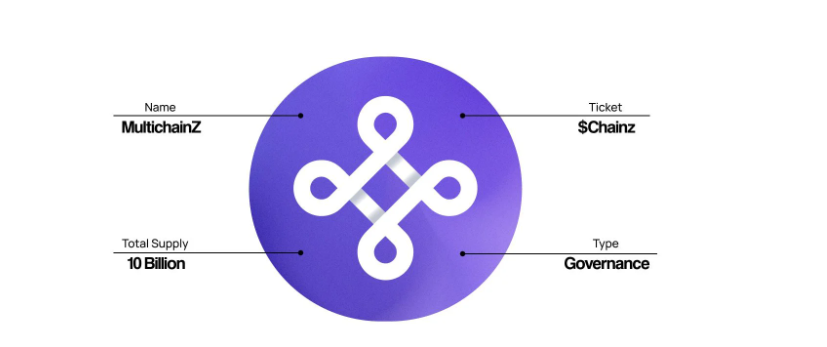

$CHAINZ Token: Role & Design

- Token Name: MultichainZ Token

- Ticker: $CHAINZ

- Network: Omnichain (Plume, Base, Arbitrum, Ethereum, BNB Chain, Optimism)

- Type: Utility + Governance + Incentive

Utility

-

Governance voting

-

Emission control

-

Protocol fee mechanism

-

Treasury oversight

-

Future collateral early

CHAINZ functions not just as an investment token but as an ecosystem passport. “Ecosystem Rewards” aim to reinforce long-term participation.

Token Allocation

-

25% Treasury – development, operations, strategic stability

-

17% Liquidity Incentives – lending pool rewards

-

3% Initial Airdrop – early community distribution

The remaining ~55% typically includes team, early investors, and ecosystem allocations. Vesting schedules will be critical in assessing long-term supply pressure.

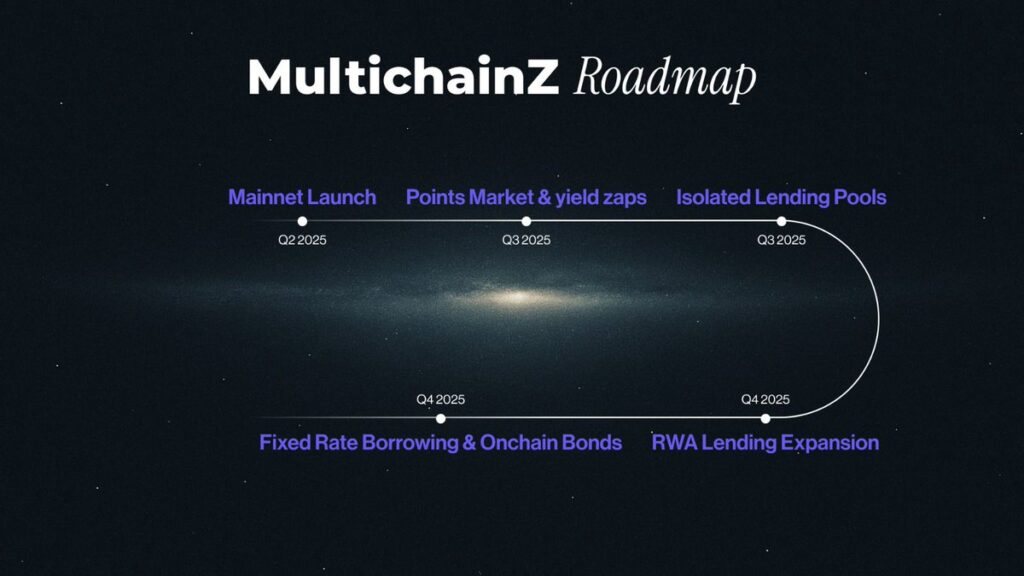

Roadmap (2026+)

- Q1 2026 – Institutional MVP launch

- Q2 2026 – Fully autonomous governance (veCHAINZ)

- Q3 2026 – Institutional lending onboarding

- 2026 – AI-powered underwriting & predictive risk engine

- Q1 2027 – Secondary markets for tokenized bonds and private credit

Ecosystem & Growth Metrics

According to investment disclosures:

-

16+ ecosystem partners

-

30,000+ testnet signups

-

600% social growth (Jan–Sep 2024) across Twitter, Discord, Telegram

Omnichain support includes:

-

Ethereum

-

BNB Chain

-

Arbitrum

-

Optimism

-

Base

xETH Liquid Staking

Users staking ETH receive $xETH, which can be deployed across DeFi while retaining staking exposure.

Investors & Regulatory Structure

Backers include:

-

NGC Ventures

-

Bluechips Capital

-

Horizon Ventures

A Reg D 506(c) offering was conducted via OpenDeal Broker LLC for accredited U.S. investors.

- Company: A S Labs Pte Ltd

- Founded: March 2022

- Jurisdiction: Singapore

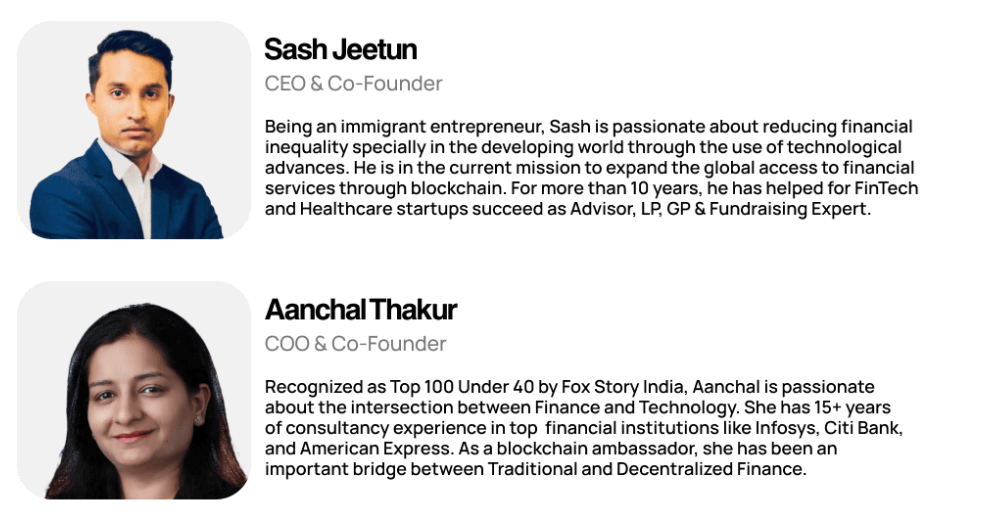

Leadership

Sash Jeetun – Co-founder

Active in crypto and DeFi since 2014; researcher, angel investor, advisor.

Aanchal Thakur – Co-founder

15+ years in finance, banking, and blockchain consulting; 6+ years in Web3.

Combined experience exceeds 40 years.

Strengths

-

RWA + Omnichain positioning

-

Capital efficiency focus

-

Institutional roadmap

-

Multi-chain architecture

Risks

-

RWA verification sustainability

-

Cross-chain security risks

-

Regulatory exposure

-

Token supply dynamics

-

Execution complexity

Final Assessment

MultichainZ is positioning itself at the intersection of RWA tokenization and omnichain credit infrastructure. If successfully executed, it could evolve beyond a lending protocol into a cross-chain credit layer for Web3.

However, the complexity of RWA integration, regulation, and cross-chain liquidity makes execution quality the defining factor.

Project Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.