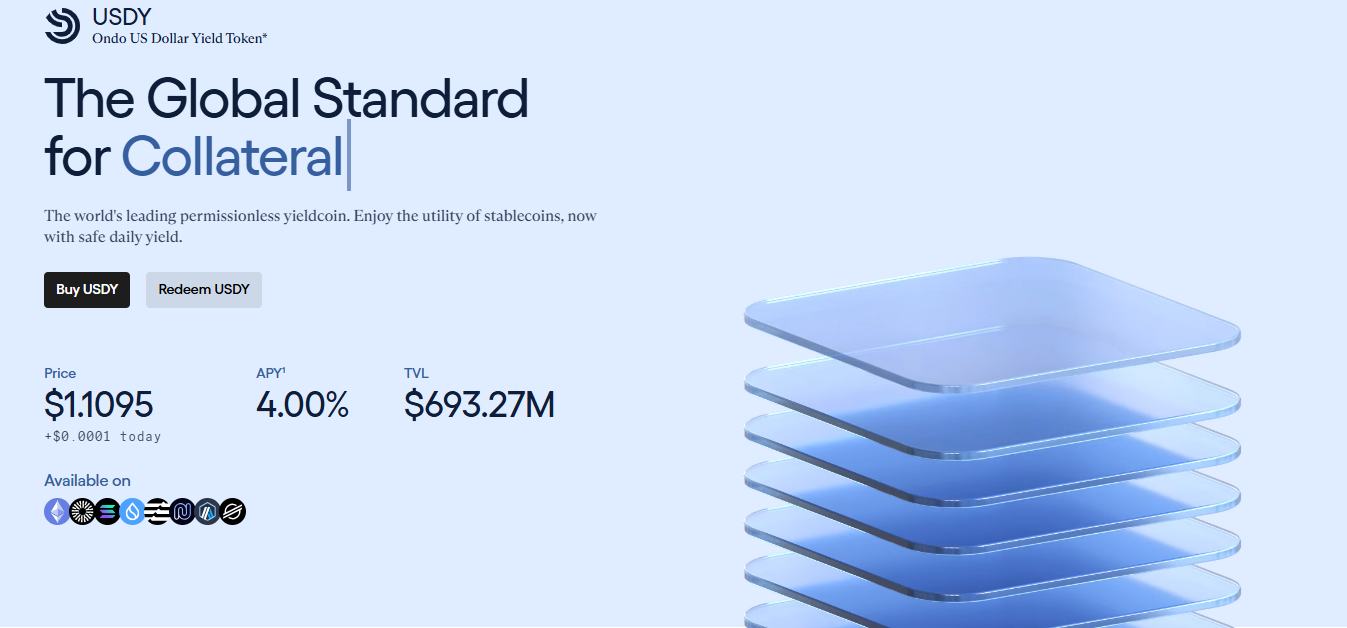

Ondo US Dollar Yield (USDY), offered by Ondo Finance, is a tokenized note secured by short-term U.S. Treasury Bills and bank demand deposits. Tailored for non-U.S. individual and institutional investors, USDY blends the accessibility of a stablecoin with high-quality, USD-denominated yield. This article explores what USDY is, how it functions, and the opportunities it provides.

What is Ondo US Dollar Yield (USDY)?

USDY, issued by Ondo USDY LLC, is a tokenized secured note distinct from other Ondo Finance tokens. It comes in two forms: “accumulating” USDY, where the per-token price rises with accrued yield, and “rebasing” rUSDY, which maintains a fixed $1 price with yield reflected as additional tokens. USDY tokens are minted 40-50 days after investment and can only be redeemed in USD to non-U.S. bank accounts. For example, if 100 rUSDY tokens at $1 each increase in value to match a USDY price of $1.01, you’d hold 101 rUSDY tokens at $1 each. Conversion between USDY and rUSDY is instant via the Ondo website.

Unlike Ondo’s OUSG, which provides tokenized access to short-term Treasury Bills and is limited to Qualified Purchasers, USDY is accessible to both retail and institutional investors. OUSG represents fund membership/equity, while USDY is a senior secured loan.

Purpose of Ondo US Dollar Yield (USDY)

USDY combines stablecoin accessibility with USD yield, though U.S. regulatory compliance imposes constraints. Yield accrual begins upon deposit processing, but tokens are minted 40-50 days later, and redemptions are restricted to USD transfers to non-U.S. bank accounts. Unlike OUSG, which targets Qualified Purchasers with tokenized Treasury exposure, USDY serves a broader audience with a distinct legal structure: OUSG is fund-based, while USDY is a secured note.

How Does Ondo US Dollar Yield (USDY) Work?

USDY operates through three key processes: Subscription, Redemption, and Transfer.

Subscription

-

Investment: After onboarding, invest via USDC or USD wire transfer ($100,000+). Yield begins once funds are processed (2-3 business days).

-

Cohort Assignment: Investments are assigned to weekly cohorts (Wednesday to Tuesday), determining token minting dates.

-

Certificate and USDYc Issuance: Within 3 business days of processing, a Temporary Global Certificate is issued, and USDYc tokens are minted as placeholders. USDYc, used for bookkeeping, is burned upon USDY minting.

-

Token Minting: After the Restricted Period (40-50 days), USDY is minted and sent to the designated wallet.

Transfer

Post-Restricted Period, tokens can be freely transferred in eligible non-U.S. regions, usable in DeFi or secondary markets.

Ondo US Dollar Yield (USDY) Use Cases

USDY serves dual purposes:

-

USDY: Accumulating; price per token rises, ideal for holding and collateral.

-

rUSDY: Rebasing; fixed at $1 with yield as additional tokens, suited for payments.

Usage Steps:

-

Log into the Ondo portal with an email and complete the onboarding questionnaire.

-

Select the USDY product, click “Request Access,” and submit KYC documents.

-

Upon approval, mint or redeem via the USDY portal.

Advantages of Ondo US Dollar Yield (USDY)

-

Security: Ondo USDY LLC is bankruptcy-remote from other Ondo entities.

-

Yield: Offers Treasury-backed returns, distinct from other Ondo tokens.

-

Transparency: Daily price updates and rebasing.

-

Accessibility: Available to non-U.S. retail and institutional investors.

Risks of Ondo US Dollar Yield (USDY)

-

Collateral Risk: Potential value loss in Treasury Bills or repos.

-

Blockchain Risk: Irreversible transactions or forks.

-

Smart Contract Risk: Vulnerabilities, despite ChainSecurity audits.

-

Liquidity Risk: Market fluctuations.

-

Legal Risk: Regulatory changes.

-

Exchange Risk: Platform disruptions.

-

Trading Risk: Volatility.

-

Banking Risk: Fiat transaction issues.

-

No Insurance: No deposit insurance.

-

Third-Party Risk: Unverified integrations.

-

Blocked Addresses: Blacklisting for illicit activities.

-

Termination Risk: Inability to redeem post-account closure.

-

Inaccuracy Risk: Losses from incorrect addresses.

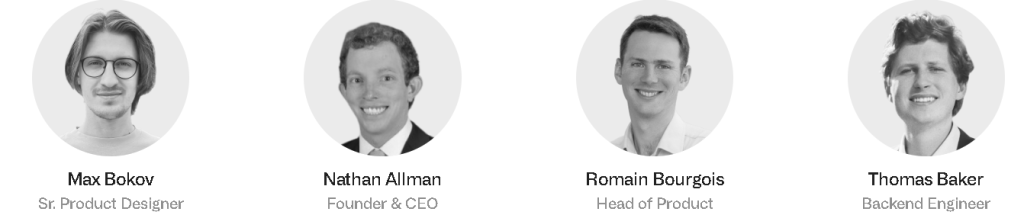

Ondo US Dollar Yield (USDY) Team

The Ondo US Dollar Yield team comprises Ondo Finance’s founding members. Established by Nathan Allman, a Stanford University graduate in Economics and Business, Ondo Finance reflects Allman’s transition from traditional finance to crypto, driven by a vision to innovate. Allman founded Ondo to bridge decentralized and traditional finance.

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.