The financial world is full of macro data — inflation, interest rates, employment reports. Yet this data remains locked behind expensive terminals and institutional barriers. Retail traders are forced to bet through volatile proxies like gold or bonds. Opinion Labs tears down these walls with a high-performance prediction exchange. By combining AI oracles, on-chain infrastructure, and DeFi composability, it turns economic insights into directly tradable assets. Anyone can become a macro economist — without institutional gatekeepers or costly tools. The Opinion Stack is live on mainnet: Opinion.Trade, Opinion AI, Metapool, and Protocol.

In this post, we’ll dive into everything from the vision and stack to the point system and partnerships. Ready? Let’s step into the future where economic intelligence belongs to everyone.

What is Opinion Labs?

Opinion Labs is building a decentralized prediction, opinion market, and AI oracle platform for predictive trading, opinion aggregation, and AI-driven insights. It is the People’s Terminal — a seamlessly integrated infrastructure that removes cross-market friction and opens global economic trading to all.

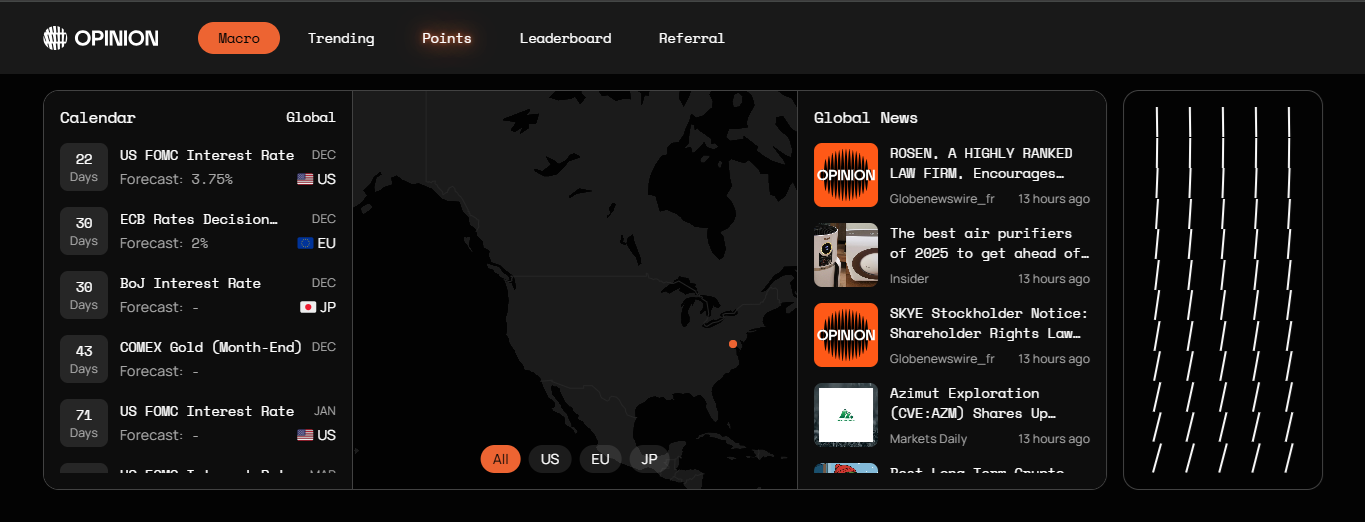

The Opinion Stack powers the mainnet with four layers:

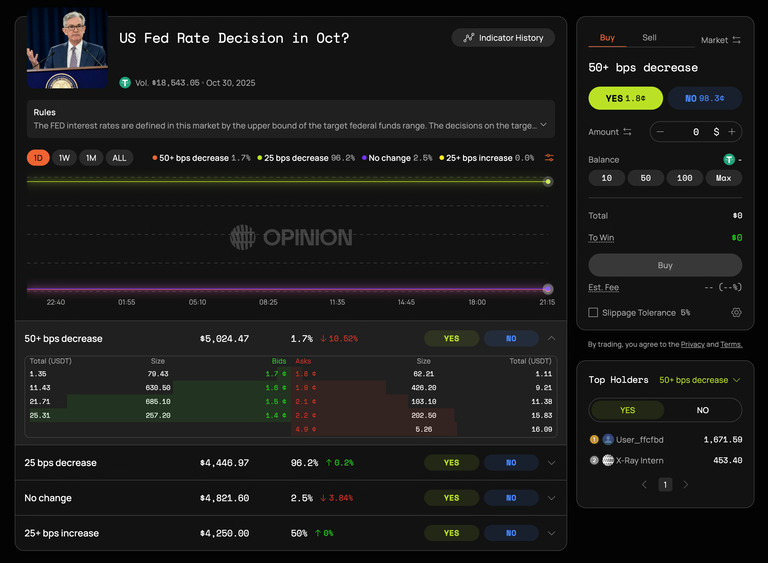

- Opinion.Trade: The live prediction exchange — create, trade, and resolve real-world markets.

- Opinion AI: The first decentralized multi-agent AI oracle that resolves complex, unstructured data. It also assists in permissionless market creation by generating objective rules and verifying resolvability standards.

- Opinion Metapool: Unified liquidity layer delivering deep cross-market liquidity and trusted resolution.

- Opinion Protocol: A universal token standard enabling full interoperability across prediction venues.

Together, the stack transforms macro risk into a new, transparent, and tradable asset class — bridging traditional macro instruments with permissionless participation.

The Problem & Solution: The Proxy Trading Trap

Macro trading is still largely inaccessible due to infrastructure gaps and expensive institutional tools. Both retail and institutional players lack direct access to core indicators like inflation or interest rates, so they trade volatile proxies instead.

Real-world example (Q3 2025): Market prices a 90% chance of a 25 bps Fed cut. You can either chase BTC at $110K with all its noise, or directly trade “Fed cuts 25 bps” at 89¢ for a clean 11% return. The second option gives pure exposure to your actual macro view.

Proxy trading creates structural inefficiencies:

- Complexity: Every proxy reflects multiple unrelated factors, diluting your macro bet.

- Indirection: Layers of reasoning needed to connect the trade to the real outcome.

- Noise: Irrelevant market forces distort the signal.

Even hedge funds have to build costly, illiquid swap structures through banks. Opinion Labs fixes this with a prediction exchange, integrated dashboards, and trading tools that let anyone trade macro outcomes directly.

Click here to sign up for a discounted Opinion membership.

Dual-Sided Value Creation

For Retail Traders Institutional-grade macro instruments, clean exposure without proxy volatility, AI-powered data visualization, and the ability to monetize personal insights.

For Institutions Real-time probability signals for quant funds, precise hedging tools for banks, and market-derived consensus data to enhance research.

Future Applications

- DeFi Composability: Prediction contracts become programmable primitives — risk parameters auto-adjust to CPI signals, tokens serve as lending collateral.

- Institutional Innovation: Quant funds use probability distributions as signals, asset managers package contracts into structured products.

- Real-World Shift: Forecasting evolves from centralized expert reports to decentralized market intelligence backed by real capital — enabling policy hedging, earnings plays, and macro arbitrage.

Opinion represents the fourth evolution in crypto: Bitcoin (money) → DeFi (finance) → RWA (assets) → InfoFi (information democratization). Economic intelligence is born from markets, not gatekeepers.

Understanding Market Prices

Prices reflect the crowd’s current probability estimate. Example: In “Will the US FOMC keep rates unchanged?”

- ‘Yes’ at 65¢ → 65% probability of no change

- ‘Yes’ at 10¢ → only 10% probability ‘No’ shares move inversely — e.g., ‘No’ at 80¢ implies 80% chance of a change.

How to Profit

If you believe the true probability is higher than 65%, buy ‘Yes’ shares at 65¢. If the outcome is correct, they settle at $1 → 35¢ profit per share (53.85% return). You can sell anytime before resolution — buy at 20¢, sell at 70¢, lock in gains early.

Getting Started with Trading

Finding markets is simple — use filters, sorting, and search on the markets page. To buy shares:

- Choose outcome (Yes/No)

- Enter dollar amount

- Click Buy

Confirmation appears instantly. Sell anytime using current odds.

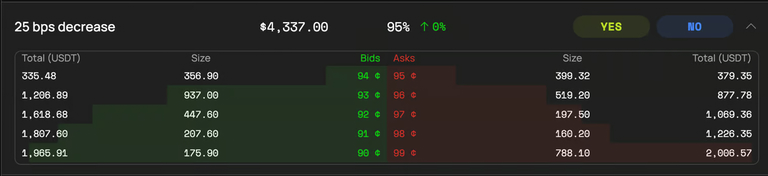

Understanding the Order Book

Market orders execute immediately; limit orders only fill at your price. Example: ‘No’ shares trade at 97.7¢ but you place a limit buy at 90¢ — it fills only when someone sells at 90¢ or lower.

Pro Tip: Limit orders can fill partially.

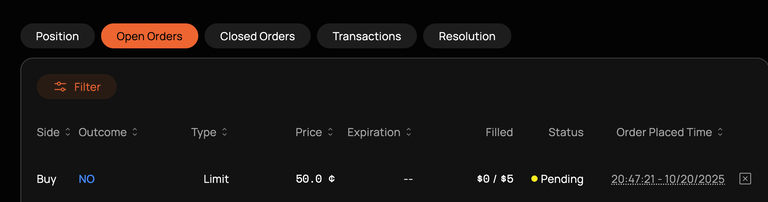

Steps for Limit Order

- Select ‘Limit’ in the Buy menu

- Set your price

- Enter quantity

- (Optional) Add expiration

- Confirm

Order Book View Green = bids (highest buyer prices) Red = asks (lowest seller prices) Gap between them = spread

Managing Open Orders

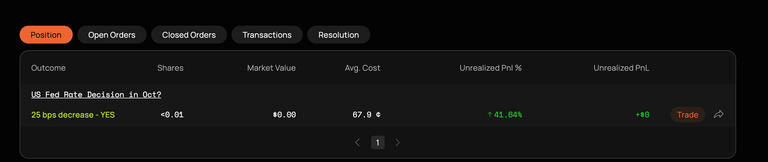

Open orders appear in the Open Orders tab. Cancel with the × button. Track everything easily in “My Portfolio”.

Profit & Loss (P&L)

P&L shows potential gains/losses on open positions = (current price − average entry) × position size. Unrealized P&L fluctuates with the market. Account value = current holdings value + available balance.

Fees

Fees are designed for liquid, accurate, sustainable markets:

- Only takers pay (market orders) — makers pay 0%

- 0%–2% range — higher near 50% probability (maximum uncertainty)

- $5 minimum order, $0.5 minimum fee

- Discounts stack up to 100% ($0.5 min still applies)

- Paid in settlement asset (e.g., USDT)

- Referral program: invitees get extra discount, inviters earn 5% of paid fees

- We cover gas for match/settle; rare actions have small user-paid gas

Key: Provide liquidity with limit orders → trade fee-free.

Resolution

Resolution method is listed on each market page. Most markets are resolved by Opinion AI, the primary oracle.

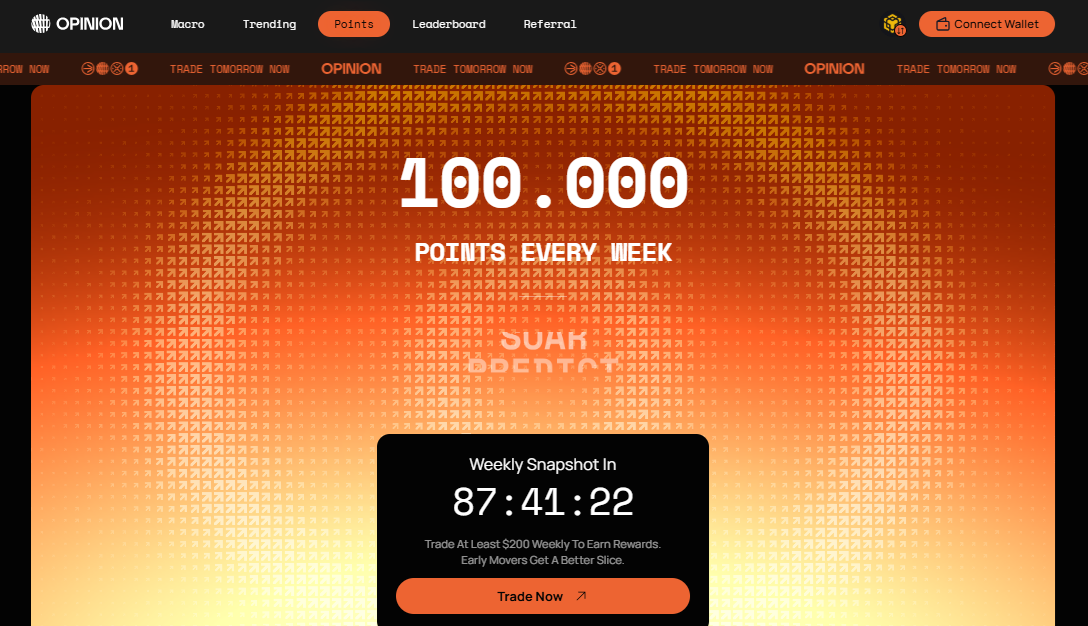

Point System (PTS)

Goal: Reward contributions that improve markets and price discovery. Early participants earn the highest multipliers.

How it works Points determine your share of future incentives (no fixed conversion rate).

Weekly fixed pool → earlier users earn more per action. Three main ways to earn on mainnet:

- Limit Orders (Liquidity): Closer to market price, larger size, longer duration = more points ($10+ orders count as liquidity).

- Trading Activity: Bigger conviction trades earn proportionally more.

- Position Holding: Hold conditional tokens over time for ongoing rewards.

High-impact activities Early maker liquidity, designated markets, research-backed trades.

Opinion Partnerships

Opinion Labs has integrated Chainlink Functions to bring off-chain macroeconomic data on-chain, making real-world macro indicators accessible and tradable for everyone.

The project is backed by a strong investor lineup led by YZi Labs ($5M seed round), with participation from Echo.xyz, Animoca Ventures, Manifold Trading, Amber Group, and others.

Opinion Labs Team

The Opinion Labs team consists of experts with deep experience in macro trading, AI oracles, and DeFi infrastructure. They meticulously build every layer — from AI integration to composability.

Forrest Liu, Founder: The visionary architect driving the mission to democratize economic insights.

Nicki L, Core Contributor: Leads technical development and user-focused innovation. Together they are turning Opinion into more than an exchange: the open terminal for economic intelligence that removes institutional barriers and empowers retail traders worldwide.

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.