What Is Orderly?

Orderly is a unified trading infrastructure developed for decentralized exchanges (DEXs). It offers an on-chain and decentralized version of the traditional order book system and high liquidity.

Without a native front-end, Orderly acts as a powerful infrastructure layer that other projects can build on. This allows developers to quickly launch their own trading applications while saving time and capital.

In the future, Orderly aims to become an omnichain protocol that unifies users across both EVM-compatible and non-compatible blockchains under a single shared order book.

Use Cases

Brokers: Launch your own perpetual futures DEX on EVM or Solana easily.

Perpetual Aggregators: Access Orderly’s unified liquidity across platforms with one frontend.

Wallets & Custodians: Provide users with the best swap rates using Orderly-powered widgets.

Professional Traders & Trading Desks: Experience CEX-level performance via low-latency order books.

Games & dApps: Enhance in-game swap features and boost user interaction.

Trading Bots: Access top-tier perpetual rates with SL/limit orders, gasless transactions, and flexible fees.

Hedging: Hedge positions from other exchanges using Orderly’s order book.

The Omnichain Vision

- Despite DeFi’s growth, cross-chain fund transfers remain slow and complex. Orderly will enable users to trade across blockchains through a single order book without needing bridges.

- This means users only need to deposit funds once to start trading instantly.

- Developers can also leverage omnichain advantages to create powerful, flexible DeFi apps.

- Think of it as merging crypto’s separate “banks” into one fast and accessible “main branch.”

Orderly Founders

Orderly was founded in 2022 by Ran Yi and Terence Ng, seasoned experts in crypto and finance.

- Ran Yi – Co-Founder (CEO)

- Terence Ng – Co-Founder (CTO)

- Arjun Arora – COO

- Drew Pierson – Chief Vibes Officer

- Andrey Lazorenko – Advisor

Their vision is to offer pro-level trading infrastructure in DeFi while ensuring users maintain full control of their assets.

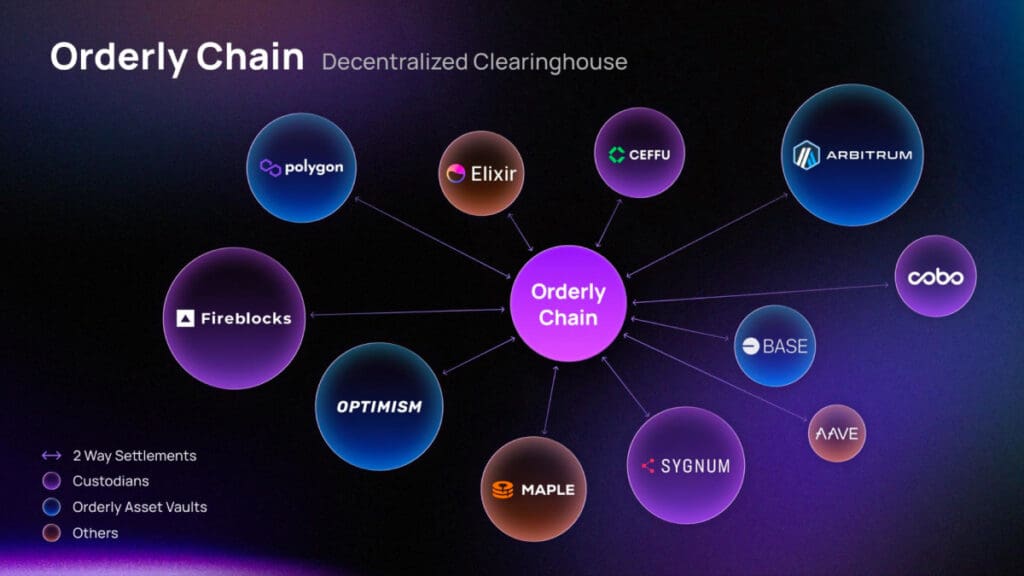

Orderly Ecosystem

- Orderly has a dynamic multi-layered ecosystem:

- Developers: Use SDKs and APIs to build quickly.

- Market Makers: Provide deep liquidity and reduce volatility.

- Trading Bots: Automate strategies to boost liquidity and volume.

- Wallets & Custodians: Offer secure trading with optimal swap rates.

- DEXs: Build high-liquidity trading platforms on Orderly’s backend.

Key Features & Benefits

- Unified Order Book & Liquidity: Trade on all major chains via a single order book.

- Fast Development: Launch in 1–2 weeks using APIs and SDKs.

- Built-in Liquidity: Leading market makers ensure deep, constant liquidity.

- Fully Decentralized & Transparent: On-chain trades with full user control.

- Gasless Trading: After initial deposit, trading costs are minimized.

- Omnichain Future: Cross-chain users trade on one book without bridging.

Investors & Partners

Since its 2022 launch, Orderly has raised over $25 million from top-tier investors:

- Pantera Capital – Crypto and blockchain VC leader.

- Jump Crypto – A key trading/investment firm in crypto.

- Sequoia China – Global VC powerhouse.

- Dragonfly Capital – Focused on crypto/blockchain investments.

- OKX Ventures – Investment arm of major exchange OKX.

- Laser Digital (Nomura) – Digital arm of banking giant Nomura.

- Also supported by Bybit (Mirana Ventures), Amber Group, IOSG Ventures, GSR, and others.

What Is ORDER Token?

$ORDER is the native token of the Orderly ecosystem. It’s designed to support decentralization, growth, user engagement, and economic stability.

Its tokenomics ensure a sustainable ecosystem by promoting governance, staking, liquidity, and community rewards.

$ORDER Token Utility:

- Governance: Vote on platform proposals.

- Earn VALOR: Stake to earn rewards from protocol treasury.

- Boosted Rewards: Staked traders and makers earn more.

- Future Use Cases: More DeFi applications will integrate $ORDER.

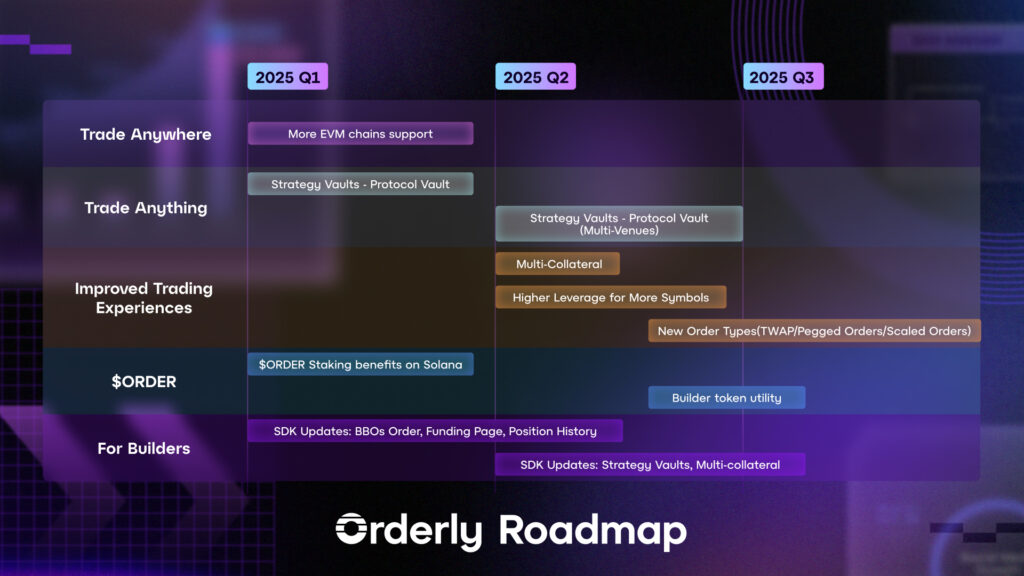

Roadmap

2022: Mainnet Alpha/Beta launch, wallet support.

2023: Launch of perpetuals, on-chain order book, lending, swaps, options, asset bridging.

2024: Smart contract trading, TP/SL orders, DEX listings, strategy vaults, Solana integration.

2025: Staking on Solana, multi-collateral leverage (ETH, SOL, stETH), new order types (TWAP, Pegged, Scaled), full omnichain rollout.

$ORDER Token Details

Token Name: $ORDER

- Total Supply: 1 Billion

- Max Supply: 1 Billion

Uses: Governance, staking, liquidity, rewards.

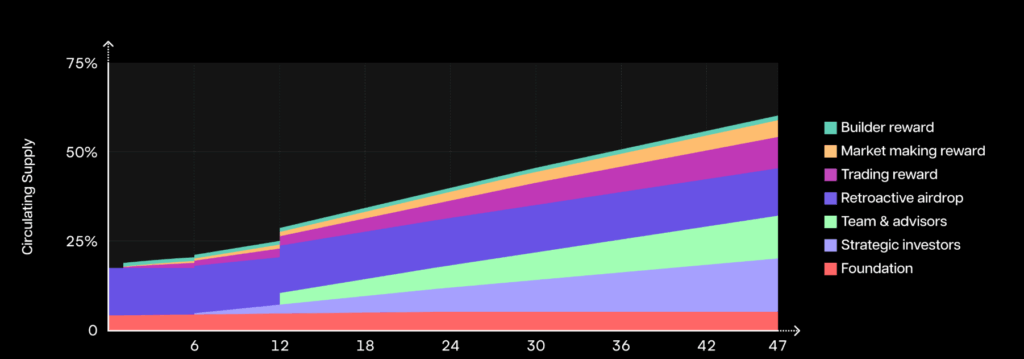

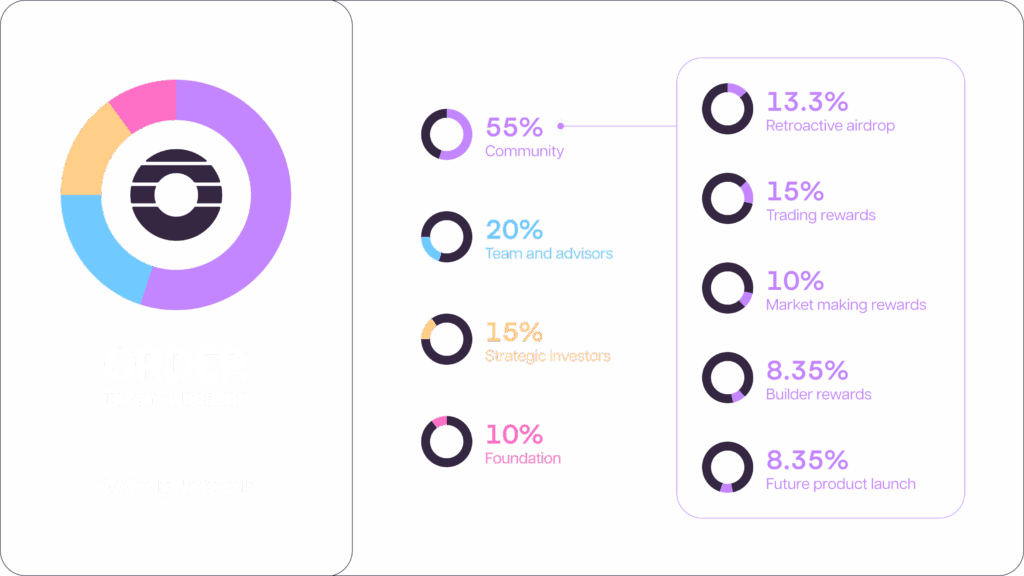

Token Allocation:

- Airdrop: 13.3%

- Trading rewards: 15%

- Maker rewards: 10%

- Developer incentives: 8.35%

- Future products: 8.35%

- Strategic investors: 15%

- Team & advisors: 20%

- Foundation: 10%

Socials