PAX Gold (PAXG) is a digital asset issued on the blockchain, with each token backed 1:1 by real, physical gold. The project is developed by Paxos Trust Company, a U.S.-based and fully regulated financial infrastructure firm. PAXG’s core proposition is to combine direct ownership of gold with the portability, transparency, and liquidity advantages of crypto assets.

Each PAXG represents one fine troy ounce of physical gold sourced from London Good Delivery bars that meet the standards of the London Bullion Market Association (LBMA). The gold is stored in professional vaults in London and is directly matched with tokens circulating on-chain. In this respect, PAXG is not a synthetic product tracking gold prices; it is a structure that digitizes actual gold ownership. This positioning becomes particularly relevant during periods of macroeconomic uncertainty, when demand for gold increasingly shifts toward digital channels.

How Does PAX Gold Work?

Tokenization and Physical Backing Structure

PAXG is an ERC-20 token operating on the Ethereum blockchain. For every PAXG issued into circulation, Paxos purchases an equivalent amount of physical gold and stores it in LBMA-approved vaults. Token minting and burning processes are directly tied to these physical reserves.

Each PAXG is linked to specific gold bars identified by serial numbers. Through Paxos’ infrastructure, users can enter their wallet address to view which gold bars they hold an interest in. This system transforms reserve transparency from a theoretical claim into a verifiable technical reality.

The distinction here is clear:

PAXG is not a gold-pegged derivative. The gold itself is brought on-chain.

How Is PAX Gold Stored?

Wallet Compatibility and Security

As an ERC-20 token, PAX Gold can be stored in most Ethereum-compatible wallets. Hardware wallets (Ledger, Trezor), software wallets (MetaMask, Trust Wallet), and centralized exchange wallets all support PAXG.

Users who hold PAXG in their own wallets retain direct digital ownership of the gold. Paxos is responsible solely for the secure custody of the physical gold in vaults. Hardware wallets are generally preferred for long-term holding, while exchange wallets may be more practical for active traders. However, assets held on centralized exchanges remain subject to exchange-related operational risks.

How to Buy and Sell PAX Gold?

Liquidity and Trading Mechanics

PAXG is traded on the spot markets of many major cryptocurrency exchanges. Users can purchase PAXG in the same way they buy Bitcoin or Ethereum. Trading continues uninterrupted, even when traditional gold markets are closed.

This highlights one of PAXG’s key advantages: unlike physical gold, PAXG can be bought and sold 24/7.

On the sell side, PAXG can be exchanged for stablecoins, fiat currency, or other crypto assets. Investors who reach certain thresholds also have the option to redeem PAXG for physical gold.

The Paxos Ecosystem and Institutional Infrastructure

The credibility behind PAXG is rooted in Paxos’ long-standing regulatory track record. The company:

-

Became a NYDFS-regulated trust company in 2015

-

Obtained a Major Payments Institution license under the Monetary Authority of Singapore (MAS) in 2022

-

Came under federal-level oversight by the U.S. Office of the Comptroller of the Currency (OCC) as of 2025

In addition to PAXG, Paxos issues other regulated digital assets such as USDG (Global Dollar), USDP, and PayPal USD (PYUSD). This ecosystem demonstrates Paxos’ ability to operate regulated infrastructure across both stablecoin and commodity-backed token models.

Within this framework, PAXG is positioned not as a standalone token, but as part of a regulated and sustainable financial infrastructure.

Key Differentiators of PAX Gold

Why Does It Stand Out?

The core factors that distinguish PAXG from other gold-backed tokens include:

-

Regulated structure: Paxos operates under NYDFS oversight

-

Full physical backing: Each token represents allocated physical gold

-

Divisibility: Gold can be owned in very small fractions

-

Transparency: Reserves are reported on a regular basis

-

On-chain portability: Gold can be transferred globally within seconds

Why Is PAXG Considered Cost-Efficient?

Comparison With ETFs and Physical Gold

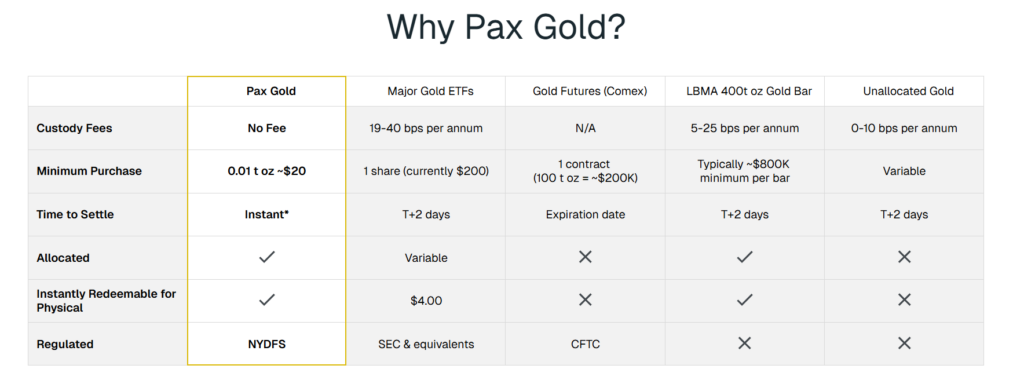

PAX Gold provides access to gold with a lower overall cost structure. Paxos does not charge storage fees to PAXG holders, whereas gold ETFs typically apply annual management fees ranging from 0.19% to 0.40%.

The minimum investment threshold is another key difference. Physical gold bars often require hundreds of thousands of dollars, while PAXG can be purchased in amounts as small as 0.01 tokens. This significantly lowers the barrier to entry for individual investors.

Allocated vs. Unallocated Gold

Where Does PAXG Stand?

Allocated gold refers to specific physical bars held on behalf of the investor, identified by serial number and purity. Unallocated gold represents a claim against an institution rather than ownership of specific bars, introducing counterparty risk.

PAXG is built entirely on allocated gold. This feature sets it apart from many ETFs and derivative gold products.

Redeeming PAXG for Physical Gold

Redemption Mechanism

Investors who accumulate sufficient PAXG can redeem their tokens for LBMA-accredited London Good Delivery gold bars. Smaller investors can convert PAXG into USD at prevailing market prices. All redemption processes are executed based on current gold market valuations.

Regulatory Framework and Oversight

Paxos’ Role

Paxos Trust Company is regulated by the NYDFS as a trust entity. Client assets are segregated from the company’s balance sheet. PAXG reserves undergo independent monthly audits to verify the 1:1 backing between circulating tokens and physical gold holdings.

Smart Contracts and Technical Infrastructure

ERC-20 Flexibility

Operating under the ERC-20 standard, PAXG integrates seamlessly with wallets, exchanges, and DeFi protocols. Total supply, transfers, and balances are transparently verifiable on-chain. Delegation mechanisms provide additional flexibility for institutional integrations.

Who Is PAXG Suitable For?

PAXG can serve different roles depending on investor profile:

-

A hedge against inflation for long-term investors

-

A volatility-balancing asset for crypto-native investors

-

On-chain gold liquidity for institutional participants

-

A collateral or yield component for DeFi users

This multi-layered structure positions PAXG not merely as a token, but as a functional bridge between traditional gold markets and blockchain-based finance.

Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.