Prediction markets are one of the most powerful tools for forecasting and incentivizing future outcomes, yet today’s platforms remain largely centralized, heavily restricted, and focused only on high-profile events. Rain (RAIN) completely flips this model: a 100% decentralized prediction markets protocol built on Arbitrum with full cross-chain capabilities. It’s often called the Uniswap of prediction markets—anyone can instantly create and trade custom markets without gatekeepers.

From invite-only Private Markets for closed communities to Public Markets resolved by an advanced AI oracle, every resolution is backed by a robust decentralized arbitration layer featuring an AI judge (Lex) and escalation to human oracles when needed. The protocol supports secondary trading, account abstraction for seamless UX, and a strongly deflationary token where 2.5% of all trading volume is used to buy back and burn $RAIN. Full governance sits with $RAIN holders via a DAO.

In this deep dive, we’ll walk through Rain’s architecture, mechanics, fee structure, tokenomics, and roadmap. Ready to see how the future gets predicted—and shaped?

What is Rain (RAIN)?

Rain is a next-generation decentralized prediction markets protocol that fuses battle-tested DeFi primitives with powerful incentive-driven markets. It works for everything from global macro events to hyper-niche scenarios. An AMM-based engine, decentralized oracle suite, and transparent pricing turn possible outcomes into tradable, incentivized assets.

Market creation and participation are fully permissionless, real-world actions get financially aligned, collective forecasting accuracy skyrockets, and desired results can actually be pulled forward through incentives. Built on Arbitrum with cross-chain deposits already live and more chains coming, Rain is governed transparently by the $RAIN token—delivering accessible, dynamic markets that make the future more predictable and actively shape it.

Breaking the Old Model: Why Rain Exists

Legacy prediction platforms (centralized or semi-centralized) obsess over major world events while ignoring everything else. Creating diverse, scalable markets is clunky or outright impossible, and access is limited. Rain fixes this with a universally adaptable AMM protocol that elegantly handles events of any size.

Its hybrid design delivers fluid dynamics, auto-adjusted liquidity, and pinpoint pricing. Outcome verification is trust-minimized and resilient thanks to a decentralized oracle + multi-tier dispute system. Starting on Arbitrum and expanding cross-chain, Rain evolves through community governance—building the open, unstoppable prediction layer the world needs.

How Rain Works

Getting in is straightforward: connect wallet → deposit → create or join markets → resolution → claim winnings.

Deposits & Getting Started

Supports USDT, USDC, ETH, BNB across Arbitrum, Ethereum, Base, and BNB Chain. Deposits are either direct from your wallet or via a generated address—cross-chain transfers are handled automatically.

Market Creation

Anyone can launch a market in seconds:

- Define the question and possible outcomes

- Add at least $10 initial liquidity

- Choose market type and resolver

Two Market Types:

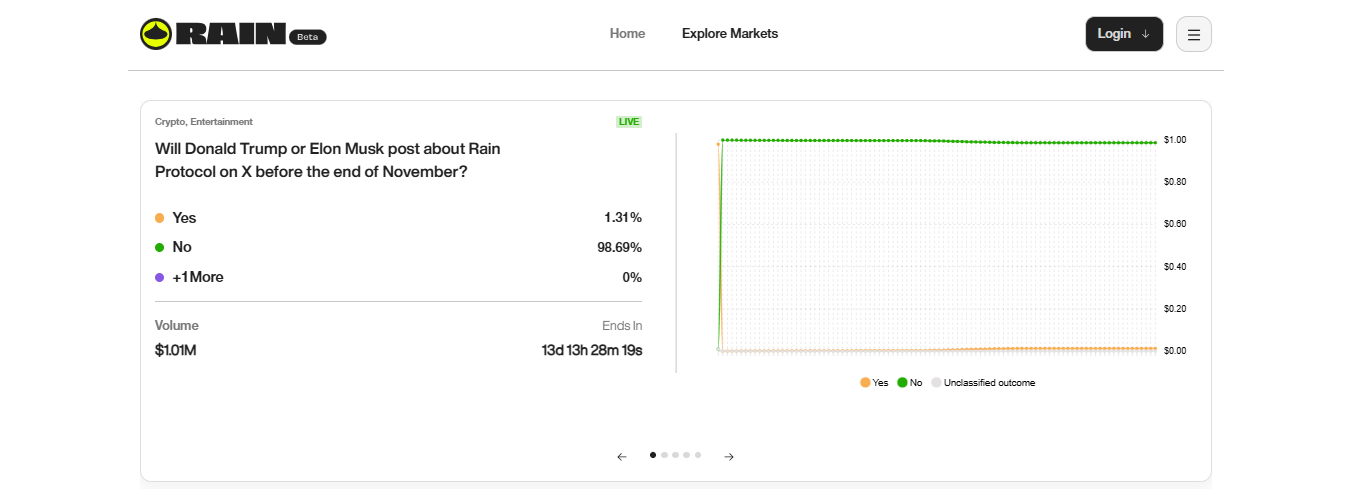

- Public Markets – visible to everyone; resolved by the creator or by Delphi (AI oracle)

- Private Markets – access via invite code; resolved only by the creator

Both support disputes with escalation to human oracles. Public markets using Delphi pay an extra flat $1 fee.

Outcome Resolution & Dispute System

Rain’s resolution stack is built for accuracy and anti-fragility.

Public markets: Creator or Delphi (Olympus AI oracle) Private markets: Creator only

Delphi – The AI Oracle

Consensus-driven multi-agent system:

- 5 independent Explorer Agents (powered by frontier LLMs) scour the web

- 1 Extractor Agent synthesizes findings

- Outcome confirmed only when ≥3/5 agents agree

- Always picks one of the listed options—even in edge cases—so markets never stay unresolved

Current accuracy: 96%, expected to rise as Olympus AI finalizes development.

Dispute & Arbitration Flow

Think the resolution is wrong? Open a dispute by posting collateral (0.1% of market volume or $1000, whichever is lower).

- Initial resolution stands

- Dispute window opens

- Lex – the AI Judge (Olympus AI) reviews evidence and rules in minutes using multi-model reasoning

- Appeal option → escalates to decentralized human oracles for final binding decision

- Collateral & rewards:

- Disputer wins → collateral returned + human oracles paid from the original 0.1% resolver reward

- Disputer loses → collateral goes to the original resolver + human oracles still paid

No dispute filed → initial resolution becomes final.

Winnings are auto-distributed once the dispute window closes. Important: All bets are final—no refunds, ever.

AMM Pricing & Payouts

Super transparent:

- Total pool funds are split proportionally across outcomes

- Share price of an outcome = % of pool betting on it

- Line (payout multiplier) = 1 / Share Price

Example: If an outcome’s share price is $0.24 → Line = 4.17x → $1 bet pays $4.17 if it wins.

Fees at a Glance

5% total fee on market volume:

- 2.5% Participation Rewards (to be paid in $RAIN in the future) → 1.2% Market Creator | 1.2% Liquidity Providers | 0.1% Resolver

- 2.5% Buyback & Burn → $RAIN purchased on open market and permanently destroyed

Extra $1 flat if Delphi resolves a public market.

Liquidity-Preserving Exits

Thanks to account abstraction, users can exit positions without removing liquidity:

- Buy shares → minted into the pool

- Place conditional sell order (amount + min price)

- New buyers automatically match existing sell orders internally

- Liquidity stays intact, slippage minimized

True Decentralization

Rain blends Proof-of-Work (creating markets, providing liquidity, resolving) and Proof-of-Stake (liquidity commitment + dispute staking). Multiple front-ends and embeddable widgets are supported—pure decentralized control via the Rain DAO.

RAIN Tokenomics

$RAIN – native utility & governance token on Arbitrum (audited by Hacken).

Core Utilities

- Trading Power Holding $RAIN unlocks how much of your deposited balance you can actually trade. Example: $1 worth of $RAIN → trade up to $100 of your funds (ratio scales linearly). No leverage, no yield—just gated access that ties activity to skin-in-the-game.

- Governance Propose & vote on everything: fees, oracle rules, treasury spending, upgrades, partnerships.

Deflationary Engine

2.5% of every market’s volume → open-market buyback + permanent burn. The more trading, the scarcer $RAIN becomes.

Controlled Inflation

10% of burned tokens are re-minted and manually claimed by the team for:

- Team compensation

- Ecosystem growth

- Marketing & partnerships

- Community initiatives

Usage-driven deflation + contribution-driven inflation = balanced, sustainable economy.

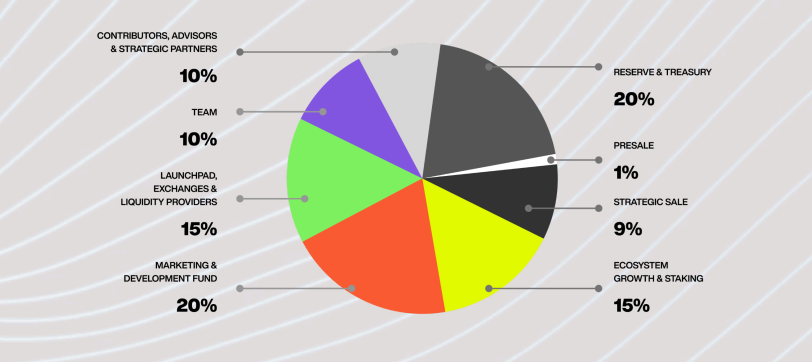

Supply & Allocation

- Initial supply: 1.15 trillion (no hard cap)

- Deflation offsets inflation as activity grows

Key allocations (all figures % of total):

- Presale: 1% – 18-month momentum vesting

- Strategic sale: 9% – 8-month cliff + vesting

- Contributors/Advisors: 10% – 18 months

- Team: 10% – 1-month cliff + 24-month linear

- Marketing & Dev Fund: 20% – ~1% unlocked at TGE

- Launchpads/Exchanges/LPs: 15% – unlocked as needed

- Ecosystem & Staking: 15% – 12-month linear

- Treasury/Reserve: 20% – long-term locked

In-App Credits: Earn credits for deposits, trading, liquidity, referrals → convert to $RAIN + bigger airdrop share (2% of ecosystem allocation, 12-month vesting).

Roadmap

Q4 2025 – Platform Maturity

- Community bootstrapping & Alpha launch

- Burn mechanism live

- Full cross-chain deposits

- Official app release

- Strategic integrations

- In-app credits launch

- DAO governance rollout

2026 – Ecosystem Expansion

- Curated liquidity programs

- Anti-abuse & reporting tools

- Advanced analytics & discovery

- Institutional-grade access

Partners

- Arbitrum

- Hacken (audit)

- Gems

- Olympus AI (Delphi & Lex)

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.