RAX Finance is a full-stack infrastructure finance protocol aiming to tokenize the two core inputs of the AI era — compute power (GPU/Compute) and energy — as Real World Assets (RWAs).

Simply put:

RAX brings data-center GPUs and the electricity that powers them on-chain, turning them into tradable, yield-generating digital assets.

The premise is straightforward: AI is growing fast, GPUs are scarce; GPUs exist, but energy is expensive. RAX positions itself directly at this bottleneck.

What Is RAX Finance?

The project was previously known as HashPower (HPX) and rebranded to RAX Finance in 2025. With this transition, the focus shifted entirely to AI infrastructure, repositioning RAX as an AI-native RWA blockchain project that tokenizes physical resources such as GPU compute and energy.

RAX Finance describes itself as “the sovereign financial layer for AI infrastructure.” But it doesn’t resemble traditional DeFi protocols. Yield here doesn’t come from speculative trading — it comes from real machines running and real kilowatts consumed. By bringing massive server farms and compute capacity on-chain, RAX offers investors direct exposure to AI infrastructure.

RAX does the following:

-

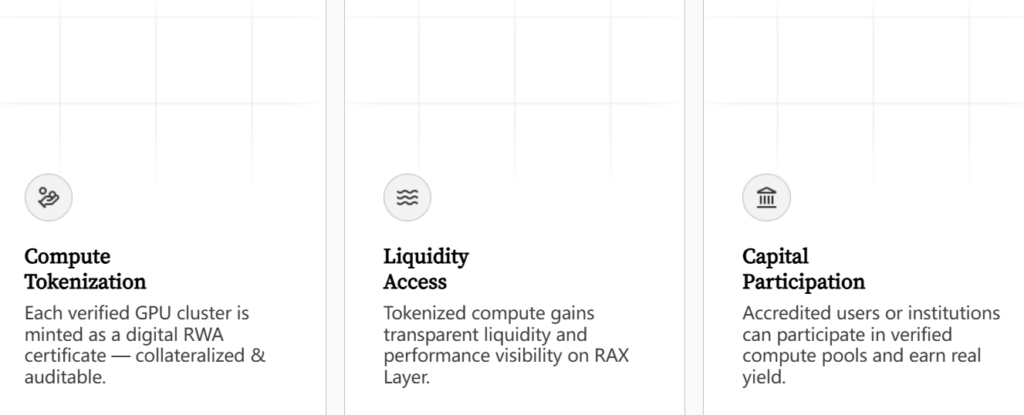

Tokenizes GPU clusters (Compute RWAs)

-

Tokenizes data-center electricity (Energy RWAs)

-

Combines both into a unified on-chain market

-

Distributes the resulting cash flows to investors

Yield comes from physical infrastructure, not trading.

That part matters.

Team and Founders

Individual founders are not publicly disclosed. RAX currently presents itself with an infrastructure-first, institutional profile.

The core team reportedly includes:

-

Engineers with AI infrastructure and data-center backgrounds

-

Operations staff with energy-market experience

-

Web3 developers specialized in RWA and stablecoin architecture

It’s a “stealth-institutional” approach — system over personalities.

Project Thesis

RAX’s central thesis:

GPU and energy will become the next global asset class.

Today:

GPU → expensive hardware

Electricity → operating expense

RAX’s vision:

GPU → income-generating financial instruments

Energy → on-chain, bond-like yield assets

Accordingly, RAX introduces two primary asset types:

-

Compute RWAs – Net rental income from GPU/TPU leasing

-

Energy RWAs – Utility yield from data-center electricity payments

The key innovation is internalizing what is typically ~40% of OpEx (electricity) back into the protocol.

Internally, they call this OpEx → TVL conversion.

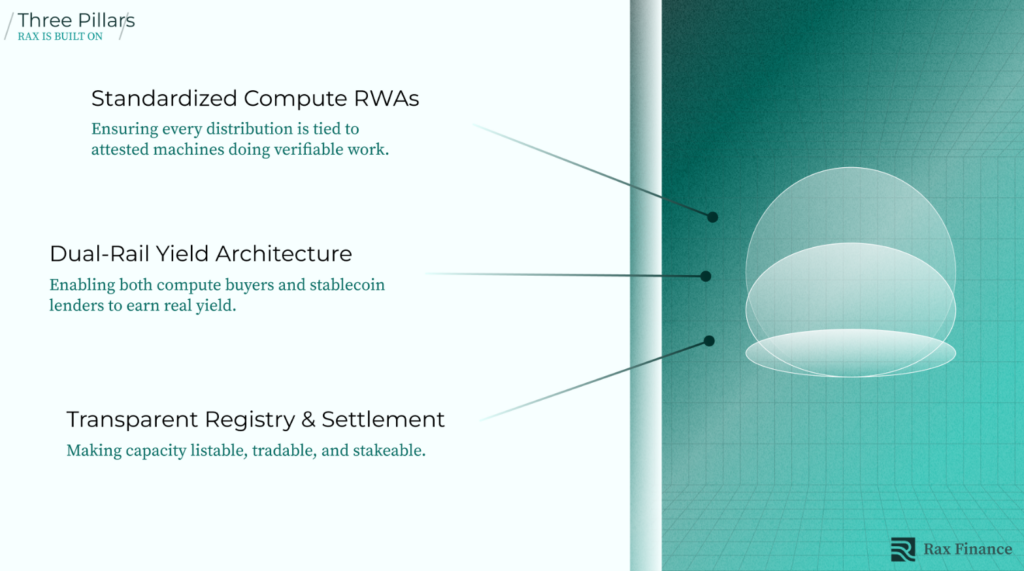

How Does RAX Work?

RAX separates capital into two rails:

1) Stablecoin Rail (Savings Layer)

Users deposit USDT/USDC → mint USDR → stake sUSDR.

Most funds are held in:

-

US Treasury Bills (risk-free rate)

A smaller portion is deployed as:

-

Senior loans to verified GPU and energy providers

Interest plus a share of compute revenue is distributed to stakers.

This pool has priority settlement during stress events.

2) AI Infra Asset Rail (Investment Layer)

Here, users directly own tokenized physical assets:

-

Specific GPU batches

-

Specific energy infrastructure

These tokens can be:

-

Traded

-

Staked

-

Used to earn real rental and electricity income

Effectively, it functions like on-chain ownership of data-center infrastructure.

Protocol Revenue Model

RAX Finance isn’t just a yield distributor — it operates as a multi-revenue infrastructure protocol.

Primary revenue sources include:

-

Compute RWA trading and settlement fees

-

Energy Series infrastructure service fees

-

USDR mint/burn spreads

-

Interest from stablecoin credit lines

-

Future DAO-directed protocol revenues

The goal is to distribute physical cash flows while building sustainable protocol income.

Governance

The DAO is not yet live.

According to the roadmap:

-

RAX Token launches first

-

DAO formation follows

-

Committees for listings, risk, oracle/compliance, and treasury are created

For now, governance remains with the core team — a “product first, governance later” approach.

Roadmap: What’s Next?

RAX is currently in its Foundation phase. Bridges across Ethereum, Base, and BNB are being deployed, and initial GPU providers are onboarding. The RAX Token is not yet live, making the current waitlist and points system critical for early participants.

After TGE, governance will transition to a community-led DAO.

Token Utility (Planned)

The RAX Token is not live yet, but intended utilities include:

-

Governance voting

-

Staking

-

Protocol revenue sharing

-

Infrastructure and listing fees

A standard utility + governance hybrid.

Investors and Partnerships

As of June 2025, RAX Finance raised $4M in strategic funding, led by HashKey Capital, with participation from FBG Capital, DePIN X, and Hailstone Labs.

These backers provide early institutional credibility, particularly within Asia’s crypto capital markets.

Key ecosystem integrations include:

-

Cache Wallet – Multichain DeFi access and yield strategies

-

World3 – Scalable compute for AI agents

-

InitVerse – Privacy-first chain and Web3 SaaS integration

-

Block Sec Arena – Security audits, real-time monitoring, insurance layer

-

Moonn.Fun – DeFi and AI ecosystem expansion

RAX also collaborates with numerous DePIN, AI, and RWA projects, positioning itself as an infrastructure coordination layer.

Ecosystem

The RAX ecosystem consists of:

-

Compute providers

-

Energy providers

-

Capital allocators (DeFi + institutions)

All converge on RAX Layer.

Assets are:

-

On-chain

-

Auditable

-

Insured

Key Features

-

GPU + energy tokenized together (rare in the market)

-

Yield backed by physical usage, not speculation

-

T-Bill-anchored stablecoin protection

-

Institutional-grade verification (uptime, hashes, audits)

-

Real-time dashboards

-

Internal value loop (electricity → yield)

Quick Assessment

RAX Finance is fundamentally different from typical “AI + crypto” projects.

The focus isn’t:

-

Memes

-

Layer-2s

-

GameFi

It’s GPU, electricity, and cash flow.

Risk is high — physical infrastructure, regulation, and operations always are. But if AI infrastructure truly becomes a new asset class, RAX is positioning itself among the earliest builders.

Current Status (February 2026)

RAX Finance is currently running the RAX Spark campaign with check-in tasks across 10+ partners, including OrTradeX and Phnx_fi. The waitlist remains open, while the RAX Token TGE has not yet occurred. The current phase focuses on community growth, partner integrations, and early user onboarding.

Project Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.