Decentralized finance has expanded rapidly, especially in the last two years, but it still has major shortcomings in user experience, liquidity integrity, and cross-chain compatibility. Navigating between different platforms, fragmented liquidity, bridge fees, and transaction delays make DeFi usage complicated. This is exactly where Rhea Finance steps in.

What is Rhea Finance (RHEA)?

Rhea Finance is a unified DeFi protocol built on NEAR by combining the strengths of Ref Finance and Burrow Finance. It offers the most critical DeFi components—swap, lending, borrowing, margin trading, cross-chain asset integration, CLMM pools, and liquid staking—through a single interface. Assets are not limited to NEAR only; Bitcoin and assets from EVM-compatible chains can also be seamlessly transferred to the platform.

Rhea’s vision is clear: to create a new financial layer with no borders, where liquidity flows freely between chains and users can access all DeFi tools through a single unified experience.

How Does Rhea Finance Work?

Unified Liquidity and Multi-Purpose AMM Structure

Rhea Finance brings different pool types under one roof:

- CLMM (Concentrated Liquidity) pools

- Stable pools

- Yield-focused pools

This architecture provides both high trading volume and low slippage, increasing cross-chain transaction efficiency. The protocol automatically selects the most efficient price with its smart routing algorithm. Users can earn a share of swap fees, add liquidity to pools to earn LP tokens, and stake those tokens in farms for double-sided yields.

Swap Transactions

Swapping on Rhea Finance is very simple. After connecting a wallet to the platform:

- Select the trading pair (e.g., NEAR → DAI).

- Adjust transaction settings if necessary.

- Check price, pool information, and estimated results in the “Details” section.

- Initiate the transaction and confirm from the wallet.

Swap fees are distributed according to a specific structure and provide continuous yield to LPs.

Limit Orders: Centralized Exchange Experience with Ref v2 DCL Pools

Rhea’s limit order system is built on Discretized Concentrated Liquidity (DCL) pools. This system allows users to place limit orders by setting a price, just like on centralized exchanges.

When creating a limit order:

- Select the buy/sell pair.

- The specified price must fit the “bin” structure of the pool (the system automatically rounds to the nearest value if needed).

- The order is created and active/passive orders can be tracked on the platform.

Users can:

- Cancel orders,

- Claim filled orders,

- Withdraw both received assets and remaining funds in partially filled orders.

This structure offers an advanced trading option that is rare in DeFi.

Lending & Borrowing

Rhea Finance’s lending system is fully decentralized and managed by smart contracts running on NEAR. Users can:

- Deposit assets as collateral to earn interest,

- Borrow against this collateral to create liquidity.

The ability to use LST (Liquid Staking Token) derivatives as collateral makes Rhea very strong in both staking and borrowing.

For example, users can:

- Deposit stNEAR and borrow NEAR to create a leveraged staking position,

- Or borrow stablecoins to open “self-repaying” positions.

Margin Trading

Rhea Finance offers a powerful margin trading system built on top of its lending infrastructure. The system automates manual “loop” operations in a single step, making it much easier.

Margin trading is available on the following assets:

- Meme tokens (selected assets)

- NEAR

- nBTC

Leverage ratios:

- Meme tokens: 2x

- NEAR and nBTC: 3x

Due to the volatile nature of the meme token market, these products operate through isolated positions. This separates risk from the main lending pool.

In Margin Trading, liquidation occurs fully. When a position is liquidated, the debt and all obligations are automatically closed.

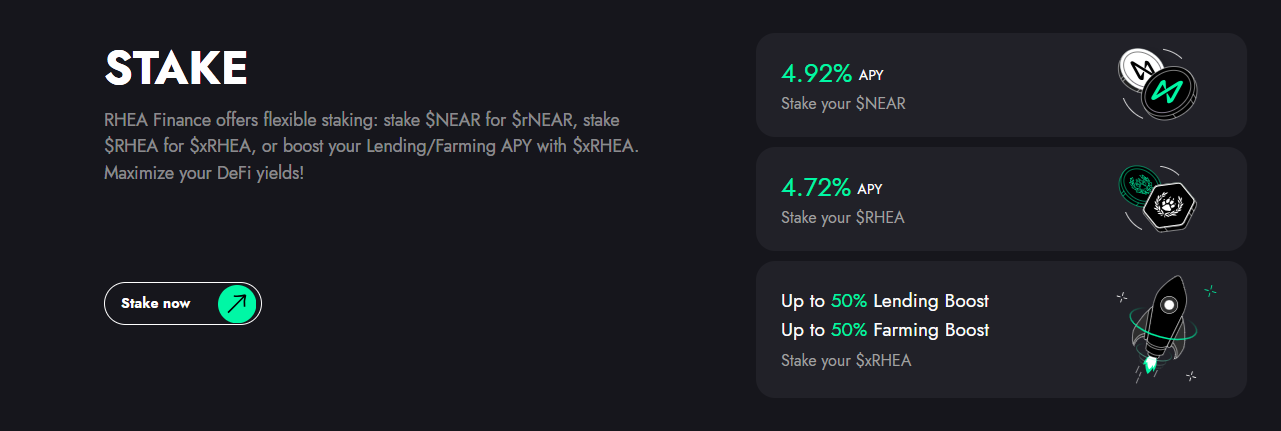

Liquid Staking: rNEAR

Rhea Finance has developed the first multi-chain liquid staking protocol for NEAR.

Users:

- Stake NEAR → receive rNEAR in return.

- rNEAR is a yield-bearing token that increases in value over time.

- Users can unstake at any time to get their NEAR back.

- rNEAR can also be used on other chains.

This feature is very important for investors who want to earn yield while keeping their assets liquid without locking them up.

RHEA Investors

RHEA is a project that attracts the attention of top-tier investors with its strong institutional capital structure and multi-chain growth vision. Working with funds that are critical for both Tier-1 and the global ecosystem clearly demonstrates the confidence in the project’s long-term potential. Thanks to these strategic partnerships, RHEA is in a position to rapidly advance both its technological infrastructure and ecosystem expansion.

Main Investors:

- Jump_

- Dragonfly Capital

- OKX Blockdream Ventures

- KuCoin Ventures

- Kronos

- SevenX Ventures

- Move Capital

- Puzzle Ventures

Farming (Yield Farming)

Users can stake their LP tokens in farms to earn additional income from:

- Swap fees,

- Farming rewards,

- Extra incentives.

Farms are consolidated in a single smart contract and can distribute up to 16 different reward tokens simultaneously. This makes the Rhea ecosystem extremely attractive in terms of liquidity.

RHEA Tokenomics

The platform’s native token, RHEA, sits at the center of governance and value accrual.

RHEA’s roles:

- Core asset for staking and liquidity provision,

- Target token into which oRHEA rewards are converted,

- Central component that captures all value flows in the ecosystem,

- Main token that provides utility through fee burn models.

General Information

- Token Name: RHEA

- Ticker: RHEA

- Total Supply: 1,000,000,000

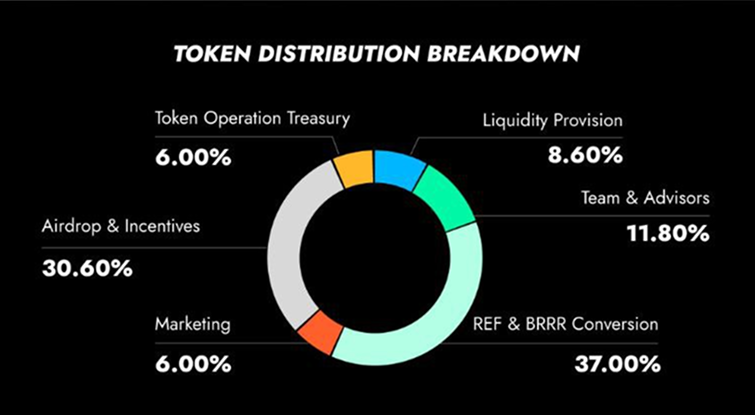

Token Distribution

- Team & Advisors: 11.8%

- REF & BRRR Conversion: 37%

- Airdrop & Incentives: 30.6%

- Liquidity: 8.6%

- Marketing: 6%

- Treasury: 6%

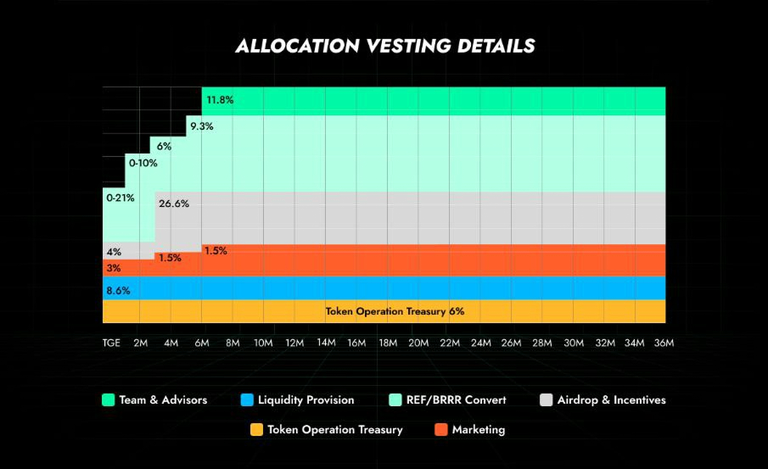

Vesting The team has adopted a long-term unlock plan:

- 6-month cliff

- 30-month linear vesting

- Zero tokens unlocked at TGE

This approach demonstrates strong commitment to the long-term sustainability of the ecosystem.

RHEA Token Stack: 3-Token Ecosystem

Rhea Finance uses an advanced three-token economic architecture to optimize DeFi growth and user incentives.

- RHEA – Main Token

- Primary governance asset

- Center of value transfer

- Core component for liquidity provision, staking, and incentive conversion

- xRHEA – Staked RHEA

- Non-transferable

- Used for gas payments

- Can be used as collateral in borrow/lending

- Determines oRHEA → RHEA conversion rate

- Signal of long-term commitment

- oRHEA – Participation-Focused Reward Token

- Earned through user behavior and on-chain activity

- Non-transferable

- Convertible to RHEA based on xRHEA ratio

- Distributed seasonally

- Replaces traditional “points system”

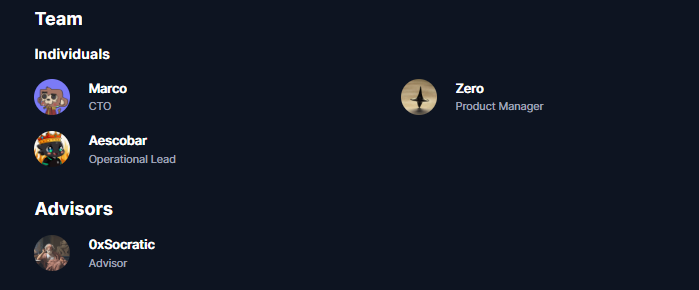

Rhea Finance Team

Ref Finance was launched in 2021 by Illia Polosukhin, one of the founders of NEAR Protocol. The first commit was made on March 9, 2021.

- Proximity Labs accelerated the project’s growth with funding received from the NEAR Foundation.

- In June 2021, Ref Finance DAO was established.

- Early contributing developers include Illia, Evgeny, Marco, Joe, and other key NEAR community members.

- Aescobar: Operations Lead

- Zero: Product Manager

- Marco: CTO

- 0xSocratic: Advisor

Today, Rhea Finance continues its journey as the next-generation unified DeFi platform built on this accumulated expertise.

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.