For 15 years, Bitcoin has been unbreakable—the ultimate economic collateral. Yet it has mostly sat idle as “digital gold”: hold it, HODL it, preserve value. What if BTC could actually work for you? What if it could secure oracles, bridges, DEXs, data-availability layers, and entire new chains using its own $1.5T+ cryptoeconomic weight?

That’s exactly what SatLayer (SLAY) delivers: a programmable shared-security platform that turns Bitcoin into the backbone of Web3 security. Built on Babylon with CosmWasm smart contracts, SatLayer lets BTC (and BTC LSTs) secure any dApp or protocol as a Bitcoin Validated Service (BVS). Full Turing-complete slashing logic, minimal trust assumptions, and pure Bitcoin collateral. In short: Bitcoin no longer just stores value—it earns and protects.

In this deep dive, we’ll explore how SatLayer works, the role of the SLAY token, its Babylon integration, roadmap, investors, and why it’s positioned to redefine Bitcoin’s future.

What is SatLayer (SLAY)?

SatLayer is the first programmable shared-security layer that uses native Bitcoin as the primary collateral for any decentralized application. By deploying CosmWasm contracts on Babylon Genesis, Bitcoin holders can restake their BTC or BTC LSTs to secure Bitcoin Validated Services (BVS)—any protocol, oracle, bridge, rollup, or data layer.

Unlike traditional restaking, security here comes directly from native Bitcoin via Babylon’s Finality Providers. SatLayer adds fully customizable, Turing-complete slashing rules, letting developers define exactly how and when collateral gets penalized. The result: bridges, oracles, and new chains can bootstrap world-class security from day one—backed by Bitcoin’s unmatched economic density instead of their own newborn tokens.

At the same time, Bitcoin becomes yield-bearing: restaked BTC earns rewards in the native tokens of the BVSs it protects, plus additional SatLayer incentives.

How SatLayer and Babylon Work Together

Babylon Genesis is a Cosmos SDK-based PoS chain and the first Bitcoin-Secured Network (BSN). Its security doesn’t rely solely on its own token—native Bitcoin is staked by Finality Providers. If a provider misbehaves (e.g., double-signing or supporting a fork), Extractable One-Time Signatures (EOTS) allow that Bitcoin to be slashed—without ever leaving the Bitcoin network (fully non-custodial).

However, Babylon’s native slashing only covers simple equivocation attacks. Most real-world applications need far more sophisticated penalty logic.

SatLayer solves this by layering Turing-complete CosmWasm contracts on top of Babylon:

- Each BVS can define custom slashing conditions (on-chain or off-chain).

- Penalties can go beyond fork protection—covering oracle misreporting, bridge theft, etc.

- Slashed funds can be burned or redistributed to honest operators.

In essence, SatLayer transforms Babylon’s raw Bitcoin-staking primitive into a fully programmable shared-security engine.

Bitcoin Validated Services (BVS)

A BVS is any application or protocol secured by Bitcoin collateral through SatLayer. Examples:

- Launching a new oracle? → Register as a BVS and attract BTC stake.

- Building a cross-chain bridge? → Define your slashing rules and go live with Bitcoin security.

- Creating a data-availability layer? → Same process.

The infamous “cold-start problem” disappears: projects no longer need to bootstrap their own token economics to achieve credible security. They simply borrow Bitcoin’s.

Key Players in the SatLayer Ecosystem

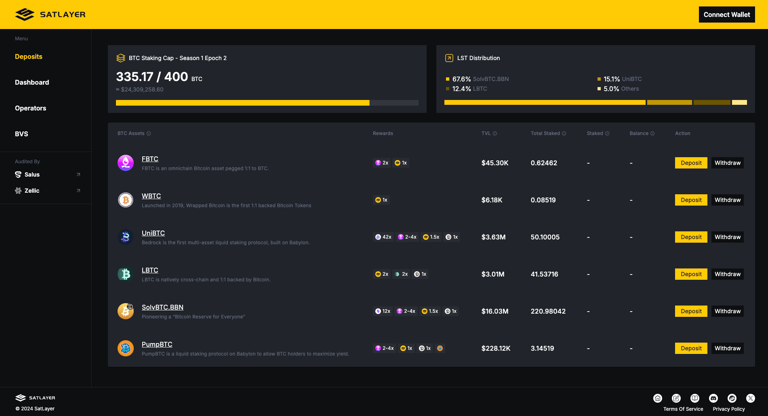

- Bitcoin Restakers Deposit WBTC, LBTC, or BTC LSTs into SatLayer vaults, delegate to operators, earn BVS tokens + SatLayer rewards. Risk slashing if their chosen operator misbehaves.

- Node Operators Run validation infrastructure for BVSs, receive delegated Bitcoin stake, earn fees from rewards.

- BVS Developers Register their protocol, set custom slashing logic, attract Bitcoin collateral, distribute their native tokens as incentives.

Core Features of SatLayer

- Vaults – Secure deposit points where BTC/LSTs are locked and liquid receipt tokens (e.g., satSLAY) are minted.

- Programmable Slashing – Fully customizable penalty conditions tailored to each BVS’s needs.

- Services (BVS) – Any protocol leveraging SatLayer for Bitcoin-backed security.

- Operators – Professional validators and infrastructure providers forming the network backbone.

- Rewards System – Continuous token emissions from BVSs and SatLayer to restakers and operators.

SatLayer (SLAY) Tokenomics

SLAY is the governance and utility token that coordinates the entire ecosystem.

SLAY Utilities

- Governance over protocol parameters, treasury spending, and new incentive programs

- Mandatory co-staking alongside BTC to align incentives

- Value accrual via protocol fees flowing to the SatLayer Foundation Treasury

- Staking → receive satSLAY (liquid staked representation)

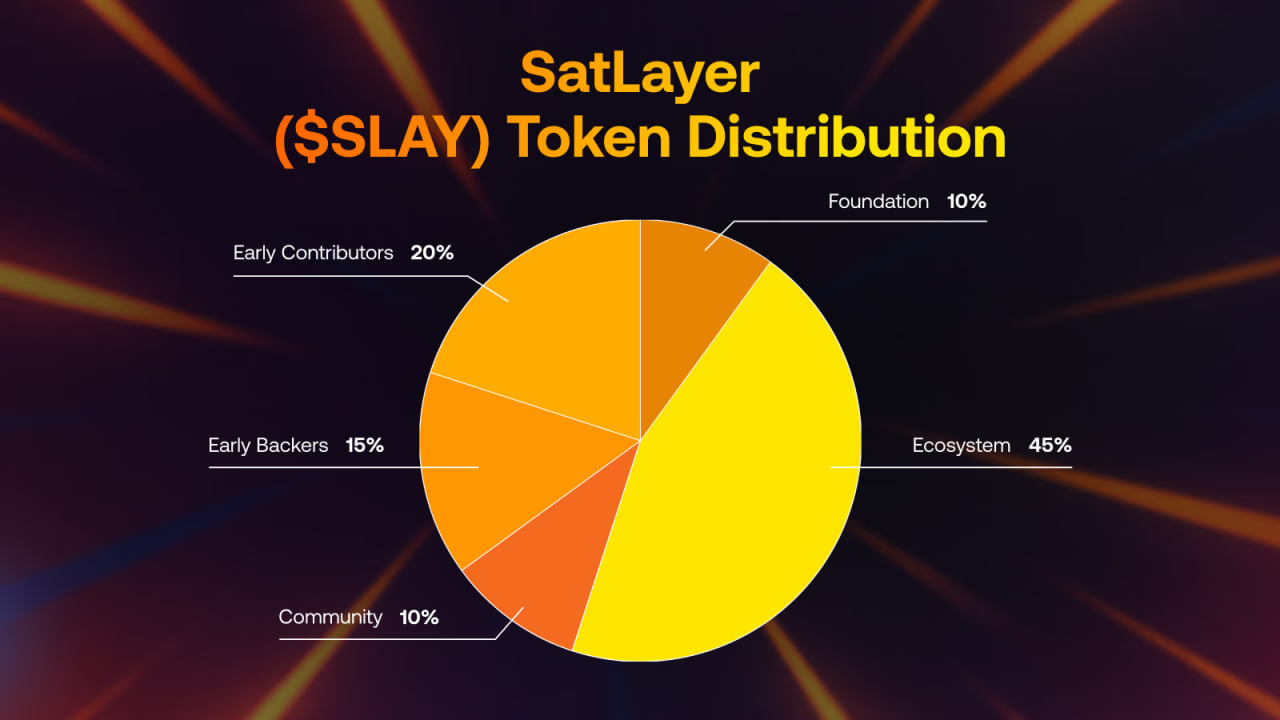

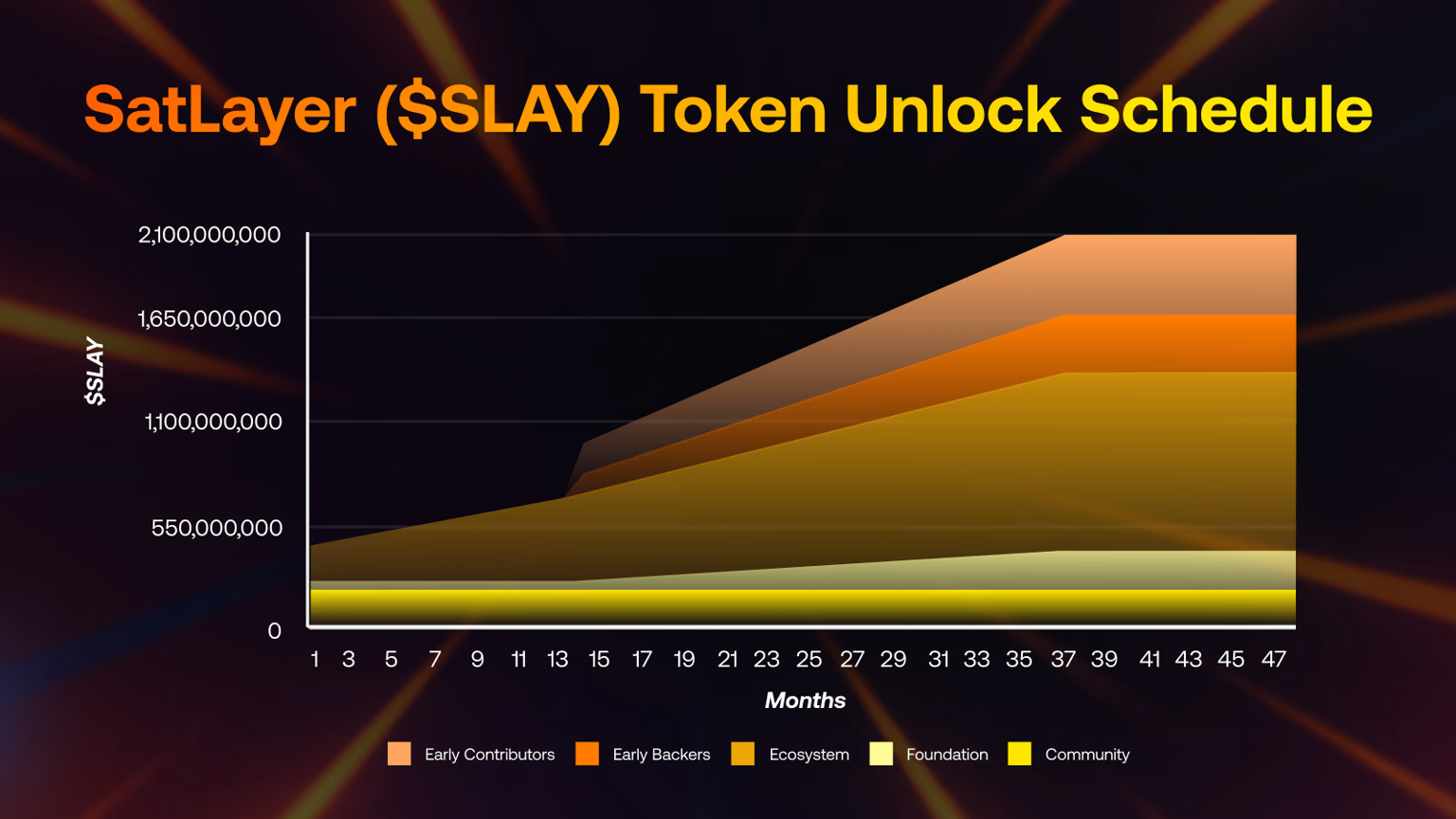

SLAY Distribution (Total Supply: 2,100,000,000)

- Community – 10% (SlayDrop + TGE initiatives)

- Ecosystem – 45% (BTC staker rewards, grants, strategic investments)

- Foundation – 10% (research, development, global adoption)

- Early Backers – 15%

- Core Contributors – 20%

All allocations follow long-term vesting schedules with cliffs and linear unlocks to ensure alignment.

SatLayer (SLAY) Roadmap

Phase I – Signaling Users deposit BTC/LSTs into Babylon Genesis vaults to signal support for SatLayer.

Phase II – Core Functionality

- Operator-driven vault factory

- BVS registration & stake delegation

- Basic quorum-based slashing

- Tokenization of Babylon vaults (liquid receipt tokens)

Phase III – Full Programmability

- Advanced slashing models

- Redistribution or insurance-style use of slashed funds

- Sophisticated economic security primitives

SatLayer (SLAY) – $8M Raise

SatLayer is backed by a powerhouse funds from both crypto-native and traditional finance worlds, totaling $8 million.

- Tier 2 Hack VC, OKX Ventures, CMS Holdings, Mirana Ventures, Amber Group, MH Ventures, Paul Taylor (angel)

- Tier 3 Castle Island Ventures,Big Brain Holdings, ArkStream Capital, Franklin Templeton Investments, Finality Capital Partners, Mantle

- Tier 4–5 & Others UTXO Management, Bloccelerate, Bing Ventures, Press Start Capital, Arcanum Capital, Kenny Li (angel)

SatLayer (SLAY) Team

The project is led by builders with deep expertise in Bitcoin staking and shared-security systems:

- Luke Xie – Co-Founder & CEO

- Arun Devabhaktuni – Co-Founder & CSO

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.