The DeFi ecosystem has grown rapidly in recent years, with decentralization, capital efficiency, and stable yield strategies becoming increasingly important. Sigma.Money (SIGMA) stands out by offering a fully on-chain, scalable, and volatility tranching-based financial infrastructure on the BNB Chain.

What is Sigma.Money (SIGMA)?

Sigma.Money is an innovative DeFi protocol that separates yield into two risk classes. The system divides BNB-based assets into Volatile Tranche (xBNB, sBNB) and Stable Tranche (bnbUSD).

This allows both high-leverage investment opportunities and stablecoin-based yields within a single ecosystem. The platform draws inspiration from the f(x) Protocol model and adapts it specifically for the BNB Chain. All processes are fully transparent on-chain.

Purpose and Concept

Sigma.Money aims to address three key DeFi challenges:

-

Dependence on centralized stablecoins

-

High liquidation risks in leveraged models

-

Capital inefficiency

The project proposes an interest-free, fully decentralized, and automated risk-rebalancing structure.

How It Works

Volatile Tranche (xPOSITION / sPOSITION)

Users can open 1x to 7x leveraged LONG or SHORT positions using xBNB or sBNB tokens.

-

Fully on-chain

-

Low liquidation risk

-

No funding fee under normal market conditions

Stable Tranche (bnbUSD)

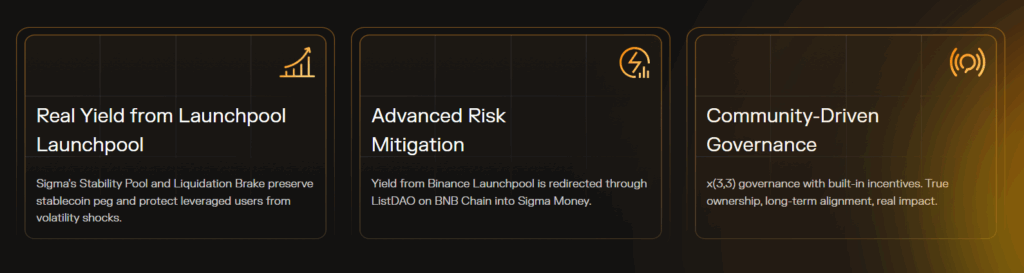

This tranche focuses on real yield. bnbUSD leverages BNB staking rewards to provide a secure, capital-efficient stablecoin alternative.

Liquidation-Brake & Stability Pool

Automatic rebalancing and stability pool mechanisms prevent sudden liquidations during market volatility, protecting user funds and maintaining liquidity.

Team & Founders

The Sigma team consists of experienced DeFi developers, maintaining anonymity while delivering robust protocol design.

-

Chris (Co-founder): Key technical architect of the protocol

Investors & Partnerships

Sigma.Money integrates with native BNB Chain projects, including:

-

ListaDAO (bnbUSD liquidity support)

-

BNB Chain DappBay (official integration)

-

Various BNB ecosystem liquidity providers

Audits by SlowMist and Supremacy are also officially listed.

Governance

Governance will be DAO-based using the SIGMA token. Although not fully active yet, 40% of token supply is allocated for governance. Community votes will determine protocol upgrades and parameters.

Tokenomics

-

Token Name: SIGMA

-

Blockchain: BNB Smart Chain

-

Roles: Governance, revenue sharing, staking

-

Distribution: On-chain activities and liquidity incentives

Use Cases of $SIGMA

-

Governance: DAO voting (40%)

-

Staking Rewards: 30% for yield boosting

-

Fee Discounts: Trading and tranching fee reductions

-

Ecosystem Incentives: Rewards for trading/minting, airdrops

-

Liquidity Provision: LP staking with extra APY, incentivizing volatility tranching

Ecosystem & Integrations

Sigma is fully BNB Chain compatible and interacts with ListaDAO, BNB Liquid Staking, and other DeFi protocols. bnbUSD may expand to multi-chain use in the future.

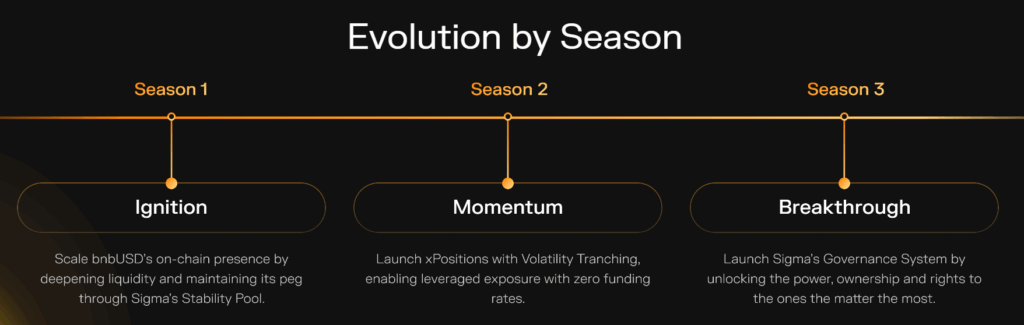

Roadmap

-

Season 1 – Ignition: On-chain stablecoin (bnbUSD) setup, liquidity deepening. Q4 2025: TGE (Oct 21, Binance Alpha), Points System v2, airdrops, RWA+AI integration.

-

Season 2 – Momentum: Volatility Tranching and xPositions launch, enabling up to 7x leveraged trading with zero funding fee.

-

Season 3 – Breakthrough: Community-led decentralized governance, xPOSITION expansion, short positions, NFT integrations, farming updates, multi-chain expansions. Maximum supply capped at 1 billion SIGMA tokens.

Key Features of Sigma.Money

-

100% on-chain

-

BNB-native stablecoin (bnbUSD)

-

7x leveraged positions

-

Funding-fee-free

-

Automatic liquidation protection

-

Real-yield stablecoin

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.