What is Spark (SPK)?

Spark is a project that aims to give users more control and yield with their crypto assets by providing decentralized finance (DeFi) solutions in the Web3 ecosystem. At its core lies a new lending and borrowing platform inspired by the Dai Savings Rate (DSR) system, developed by the MakerDAO team, called the “Spark Protocol“. Spark offers a decentralized governance structure by enabling SPK token holders to vote on the protocol’s future and platform development. The primary goal of the project is to deliver innovative and secure DeFi solutions that allow users to utilize their crypto assets more efficiently.

Project Idea

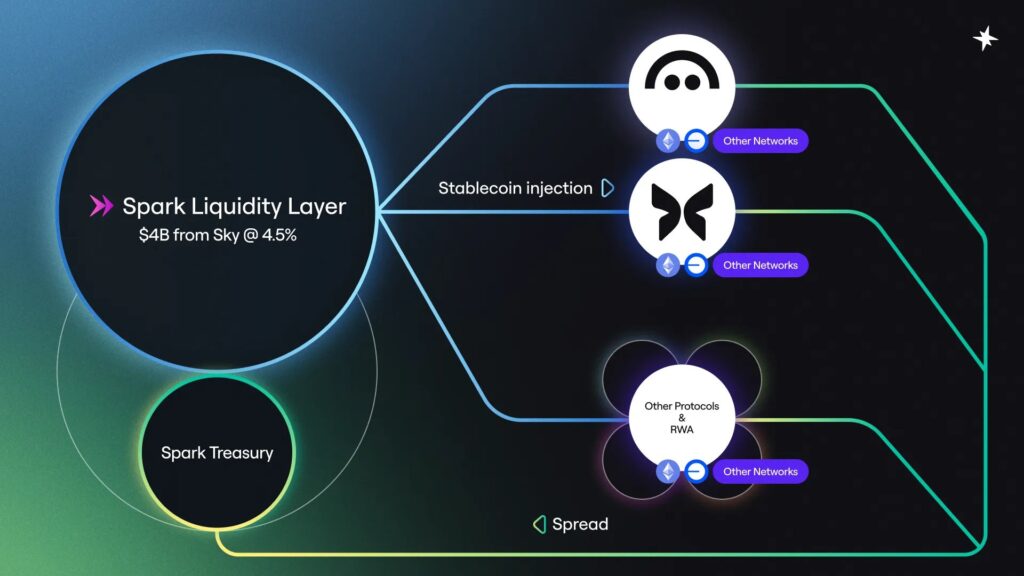

Spark’s core idea is to expand the scope of the Dai Savings Rate (DSR) system, one of the most crucial components of DeFi and built upon the success of MakerDAO. The project enables users to easily borrow and lend crypto assets while allowing the community to guide the protocol through decentralized governance. By aiming to facilitate interest earnings on crypto assets and ease access to DeFi, Spark seeks to address the shortcomings of traditional finance through blockchain technology. Spark is deployed across various blockchain networks such as Ethereum, Arbitrum, Base, Optimism, Unichain, and Gnosis Chain, managing over $3.5 billion in stablecoin liquidity. Spark borrows USDC from Sky up to a capacity of $4 billion based on U.S. Treasury yield rates, reallocating it to DeFi products to expand liquidity and ultimately capture the spread.

Team and Founders

The team behind Spark comprises experienced professionals in blockchain, financial technologies, and DeFi, with roots in the MakerDAO team. The project is developed by Spark Protocol, the main development arm of MakerDAO. The core developers and operational team combine technical expertise and strategic vision to bring Spark’s mission to life, making decentralized finance more accessible and integrating crypto assets into the mainstream.

Investors and Key Partnerships

As a MakerDAO subproject, Spark enjoys strong institutional support. It stands out within the MakerDAO ecosystem and the broader DeFi space through various notable partnerships. MakerDAO’s organizational structure and strong community lend significant momentum to Spark. Additionally, potential integrations with other major DeFi protocols and platforms will enhance Spark’s ecosystem and accessibility. Listings on major exchanges (e.g., Coinbase, Binance) also significantly increase the project’s accessibility and liquidity.

Governance Structure

Spark Protocol is a significant part of the MakerDAO ecosystem and thus does not have a traditional “CEO”. Instead, its governance and development are situated within MakerDAO’s decentralized framework. The project is managed and developed by the Spark Protocol team under MakerDAO’s broader governance.

Founders and Key Figures

Spark Protocol is directly developed and supported by the MakerDAO team. Therefore, Rune Christensen, the founder of MakerDAO and creator of the vision behind the Dai stablecoin and Maker Protocol, is a leading figure behind Spark. Spark Protocol strategically extends this vision into the lending and borrowing space of DeFi.

How It Works

Spark allows users to conduct various financial transactions through the Spark Protocol. Users can lend supported crypto assets or borrow using these assets as collateral. SPK is an ERC-20 token on Ethereum. Initially, SPK will be used for signaling and sentiment checks through Snapshot voting and will evolve as its distribution becomes more decentralized. Users can stake SPK tokens or use them in various DeFi protocols to earn passive income. Through DAO governance, SPK holders can vote on protocol decisions such as fee structures, product integrations, and strategic directions, ensuring community-led management. Staked SPK may also be used in the future to validate and secure products and services within the Spark ecosystem, earning Spark Points as rewards.

Roadmap

Spark’s roadmap generally includes the following stages:

- Early Development and Spark Protocol Launch: Establishing core lending and borrowing infrastructure.

- DAO Formation and SPK Token Governance: Enabling SPK holders to vote and participate in protocol development.

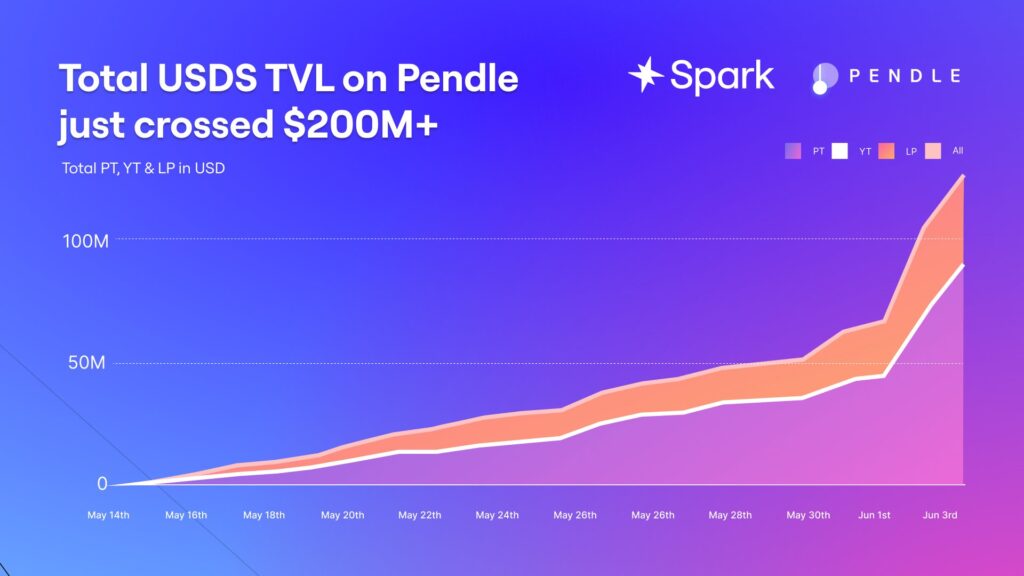

- DeFi Integrations: Expanding integrations with various decentralized finance protocols and products (e.g., Ethena, Pendle, Morpho, Fluid, Base, Maple).

- Global Expansion and Regulatory Compliance: Working on licensing and compliance in various jurisdictions.

- New Product and Service Development: Adding new collateral types, diverse lending/borrowing mechanisms, and advanced yield strategies.

Community Growth and Incentives: Launching initiatives and marketing campaigns to increase user engagement (e.g., Spark airdrop program, Pre-farming, Ignition & Overdrive, Layer3 campaigns).

Features

- Decentralized Lending and Borrowing: Enables users to borrow with or without collateral using crypto assets.

- Decentralized Governance (DAO): SPK holders have voting rights on the protocol’s future.

- MakerDAO Integration: Compatibility with MakerDAO and its Dai Savings Rate (DSR) system.

- Yield Generation: Stake SPK or provide liquidity for passive income.

- Flexible Collateral Options: Supports various crypto assets as collateral.

- Multi-Chain Support: Operates on Ethereum, Arbitrum, Base, Optimism, Unichain, and Gnosis Chain.

- Security: Strong security measures and smart contract audits to protect user assets.

Tokenomics and SPK Token Utility

- Token Name: Spark (SPK)

- Total Supply: 10 billion SPK tokens minted at genesis

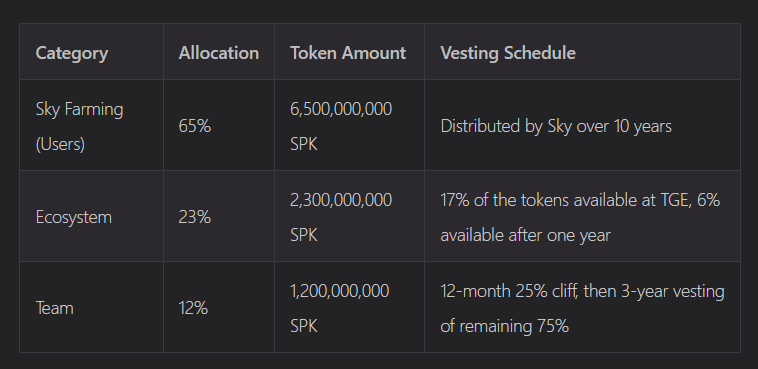

Allocation:

- 23% for ecosystem growth

- 12% for the team

- 65% allocated to the Sky ecosystem to be distributed via a 10-year SPK farming campaign

- Circulating Supply: 10 billion SPK

SPK Token Use Cases

- Governance: Vote on protocol changes including interest rates, collateral types, fee structures, and developments.

- Staking: Stake SPK to secure Spark ecosystem products and earn Spark Points.

- Liquidity Provision: Used in liquidity pools.

- Incentives and Rewards: Earn SPK through participation in farming campaigns and other activities.

- Ecosystem Funds: Support development and expansion of the project.

Social Media and Community Channels

You can freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram ,YouTube and Twitter channels for the latest news and updates.