The cryptocurrency ecosystem is evolving beyond being merely a buy-sell market, positioning itself as a candidate to rebuild the foundational building blocks of the financial system. At the center of this transformation are stablecoins, DeFi protocols, and automation. Sperax (SPA) stands out as a blockchain ecosystem positioned exactly at the intersection of these three areas, aiming to eliminate intermediaries and center financial autonomy.

What is Sperax (SPA)?

Sperax aims to provide an infrastructure where users can manage their assets, generate income, and automate financial processes without needing banks, brokers, or complex financial structures. At the heart of this vision are SperaxOS and its core product, the USDs stablecoin.

SperaxOS: Intelligent Financial Operating System for DeFi

SperaxOS is designed not as a classic DeFi application but as an AI-powered financial operating system. This structure allows users to manage their financial decisions through autonomous “Smart Agents” that operate based on predefined rules, rather than manually.

The core goal of this system is to eliminate friction in financial transactions. Users can keep processes like investing, payments, lending, or yield optimization running 24/7 via smart contracts and automated agents without needing to track them individually.

SperaxOS shifts financial transactions from paper-based, approval-dependent, or trust-based structures to a fully code- and logic-based order.

Why Does SperaxOS Stand Out?

The structure offered by SperaxOS aims to significantly reduce the tool gap between individual investors and institutional actors. It stands out with the following core capabilities:

- Generating passive income with yield-bearing stablecoins

- Cross-border transfers in seconds

- Investing and lending without intermediaries

- Access to financial instruments previously available only to institutions

- Automation of financial processes (payments, portfolio management, goal-based operations)

All these operations can be performed permissionlessly and without trusting a central authority.

What Can Smart Agents Do?

The most distinctive element of SperaxOS is the Smart Agent infrastructure at its center. These agents can be defined as autonomous financial modules that operate according to goals set by the user.

Key functions offered by Smart Agents include:

- Programmable Financial Logic: Maintaining a specific yield rate or automating regular payments

- Autonomous Yield Farming: Automatically directing to the most efficient opportunities in DeFi and RWA markets

- Automated Payments: Scheduled and conditional payments

- Token Sniping Mechanism: Instantly analyzing and acting on new token listings

- Idle Capital Management: Automatically evaluating unused funds

- Risk Control Layer: Depeg alerts, bridge risks, and security scores

This structure offers an approach that shifts financial management from a manual process to software delegation.

Sperax’s History and Product Development

Sperax was founded in 2019 and is managed by a team that has developed its products step by step through different market cycles. The project not only offers a theoretical vision but has developed actively used products in the market.

USDs – Yield-Bearing Stablecoin (2021) USDs is one of the most critical components of the Sperax ecosystem. This fully on-chain stablecoin allows users to automatically generate yield simply by holding it in their wallets.

Demeter – No-Code DeFi Tool (2022) Demeter was developed as a toolset that enables DAOs to create liquidity pools on different DEXs without any coding knowledge.

Web2 – Web3 Bridge Through its collaboration with the regulated fintech application Streetbeat, Sperax aims to bring traditional users into DeFi.

What is USDs? (Sperax USD)

USDs is a yield-generating stablecoin operating on Arbitrum, Ethereum’s largest Layer-2 ecosystem. Users holding USDs can earn passive income without any staking process or paying gas fees.

Key features of USDs:

- Auto-yield: Automatic yield while held in the wallet

- Layer-2 advantages: Low transaction fees

- Fully collateralized structure: 100% stablecoin collateral

- Decentralized and transparent model

How Does USDs Work?

USDs is collateralized with different stablecoins (such as USDC, USDT) and these collaterals are invested in audited DeFi protocols to generate organic yield.

Of the generated yield:

- 70% is automatically distributed to USDs holders as yield

- 30% is used for SPA token buybacks and burns

This system keeps USDs supply stable while user balances increase over time.

USDs Peg Mechanism

Multiple security layers exist to maintain USDs’ $1 peg:

- Limiting collateral prices to $1 during mint and redeem operations

- Redemption fees

- Halting mint operations in case of depeg

- Balancing selling pressure with the auto-yield mechanism

- Activating SPA reserves when necessary

This structure aims to keep the system standing even in extreme market conditions.

What is SPA Token?

SPA is Sperax ecosystem’s value-accrual and governance token. SPA holders stake their tokens to obtain veSPA and have a say in decisions shaping the protocol’s future.

veSPA holders:

- Determine protocol parameters

- Vote on new collateral types and products

- Receive a share of protocol revenues

Governance is currently conducted off-chain via Snapshot, with plans to implement on-chain governance infrastructure.

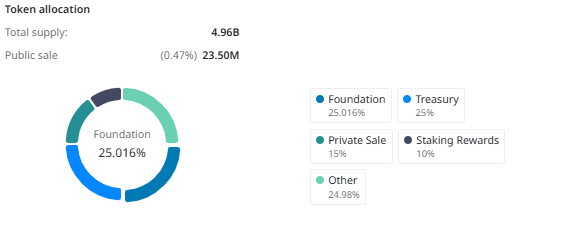

SPA Tokenomics

The SPA token economy is structured to balance long-term sustainability and in-protocol incentive mechanisms. The distribution aims to support ecosystem growth while increasing user participation through governance and staking.

SPA token supply distribution is as follows:

- Treasury: 25%

- Foundation: 25.02%

- Private Sale: 15%

- Bootstrap Liquidity: 10%

- Staking Rewards: 10%

- Team & Advisors: 9.98%

This distribution positions SPA not merely as a speculative asset but as a tool for governance, revenue sharing, and protocol ownership.

Staking and veSPA Mechanism

Users staking SPA earn veSPA based on lock duration. As lock duration increases:

- Voting power rises

- Weekly staking rewards increase

Rewards are funded by fees and yields from the USDs protocol. These revenues are converted to SPA for distribution, creating constant demand for the token.

Sperax Farms and Liquidity Management

Sperax Farms offers a no-code infrastructure that enables DAOs to create and manage liquidity pools on different DEXs. It integrates primarily with Arbitrum, as well as platforms like Uniswap, Camelot, and Balancer.

This system:

- Automates liquidity management

- Reduces token emission costs for DAOs

- Provides more efficient yields for LPs

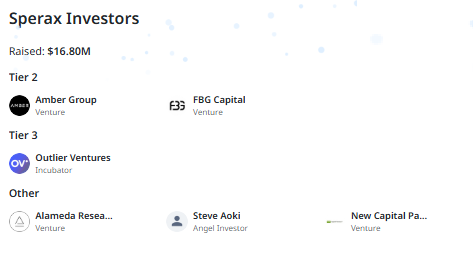

Sperax Investors

The Sperax team consists of experienced individuals in blockchain engineering, economics, and operations. The project has raised $16.8 million to date and received support from various investor profiles.

Investors include:

- Amber Group

- FBG Capital

- Outlier Ventures

- Alameda Research

- Steve Aoki

Sperax (SPA) Team

Sperax is managed by a global team experienced in blockchain development, economics, and operations. The team structure is designed to focus on both technical infrastructure development and economic model sustainability.

Key team members include:

- Alec Shaw – CEO

- Marco Di Maggio – Economic Research Advisor

- Mourad Dayaa Eddine – Blockchain Developer

- David Zhao – Blockchain Engineer

- Yash Pitroda – Blockchain Developer

- Ayush Aman – Front-End Developer

- Shaleen Pandey – Operations

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.