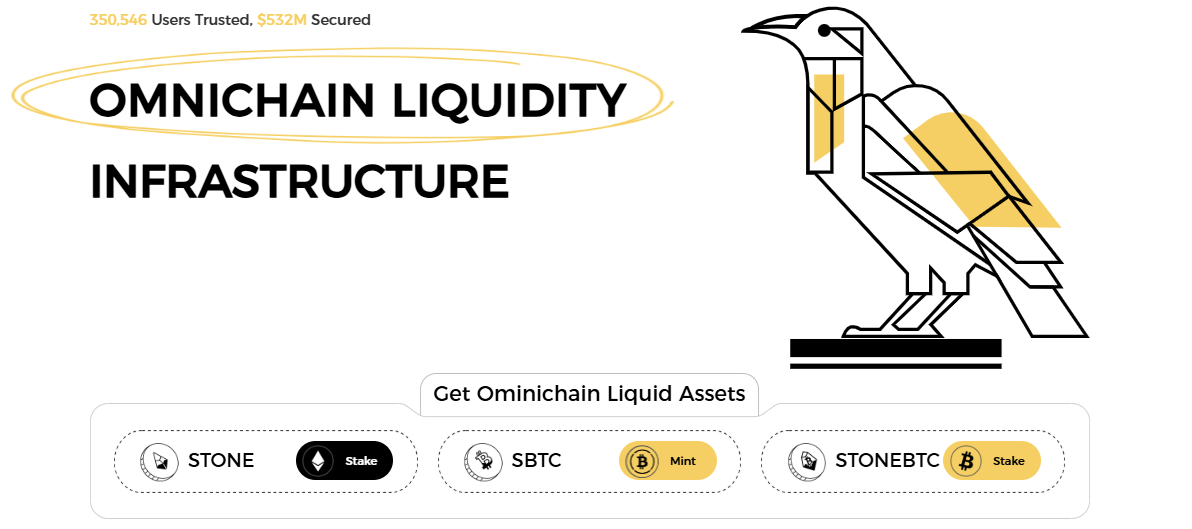

StakeStone (STO) is an omni-chain LST protocol that offers local staking returns and liquidity on Layer 2. With the development of the DeFi (Decentralized Finance) ecosystem, the need for cross-chain liquidity has become greater than ever. The fact that liquidity is trapped in different blockchains leads to significant inefficiencies for users and protocols. This is where StakeStone comes into play and stands out as an omnichain liquidity infrastructure protocol that aims to solve this fundamental problem in blockchain-based financial systems. So, what exactly is StakeStone and what does it do?

What is StakeStone (STO)?

StakeStone is a decentralized protocol that enables organic, efficient and sustainable liquidity flow between different blockchains thanks to its omnichain architecture. StakeStone increases capital efficiency in both advanced and emerging blockchain networks, enabling DeFi users to achieve higher and sustainable returns.

What is StakeStone (STO) for?

StakeStone’s main goal is to enable liquidity to flow freely between chains. To achieve this, it offers its users a variety of innovative tools:

- STONE: Yield-bearing and liquid ETH representation token. It offers users who want to stake ETH the opportunity to earn without losing liquidity.

- SBTC and STONEBTC: Liquid and yielding BTC assets that enable Bitcoin’s integration into the omnichain DeFi world.

- LiquidityPad: Helps new blockchain projects gain liquidity in a sustainable and decentralized way.

With these assets, StakeStone users earn efficient returns when moving their assets between chains, minimize the complexity of bridge transactions, and can manage their capital more strategically.

STONEBTC: What Does Yield-Bearing BTC Provide?

Built on SBTC’s infrastructure, STONEBTC offers a yield-generating model that fundamentally changes the way Bitcoin generates value in the DeFi ecosystem. By integrating advanced yield strategies across a variety of domains, including DeFi, CeDeFi, and Real World Assets (RWA), STONEBTC both increases BTC capital efficiency and provides access to robust liquidity. This diversified approach reduces dependency on a single yield source while offering sustainable returns.

STONEBTC’s architecture is based on accessibility and efficiency. Users can automatically switch to STONEBTC by depositing SBTC or LBTC directly into the protocol. With this conversion, the yield generation process begins immediately. The system automatically selects the most appropriate yield sources through strategy vaults that optimize asset allocation. Thus, users achieve optimal returns without having to actively manage their positions.

The protocol maintains high capital efficiency with many mechanisms. In particular, the omnichain liquidity infrastructure allows users to easily switch between different ecosystems without the typical friction associated with time-locked BTC assets. This structure balances both liquidity and yield by supporting withdrawals within a maximum of seven days.

STONEBTC maintains full functionality across many DeFi use cases, such as lending, CDP collateral, derivatives, and GameFi integrations. Strategy vaults prioritize risk management, continuously monitor performance, and dynamically allocate assets based on market conditions. This approach provides stable and risk-adjusted returns for users.

Governance and Token Economics (Tokenomics)

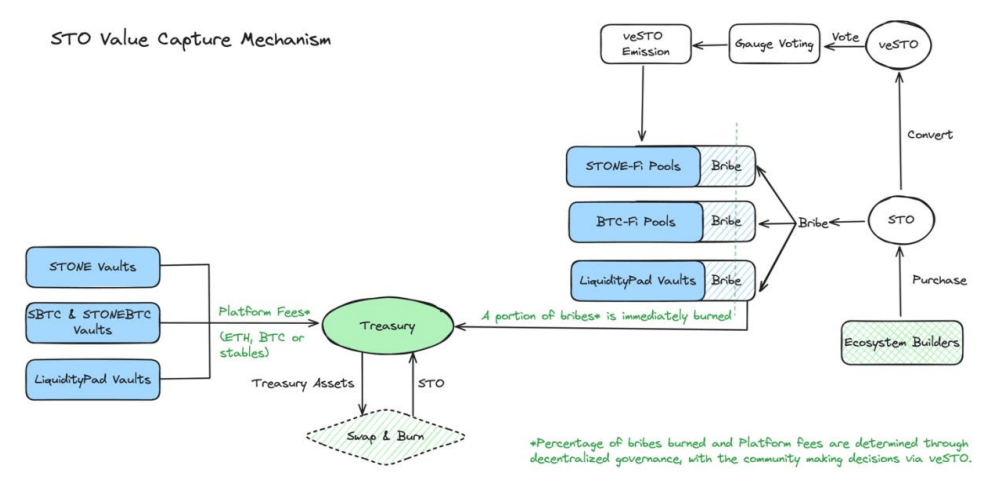

StakeStone’s governance token, $STO, coordinates all value flows across the protocol’s omnichain liquidity infrastructure while enabling decentralized governance. Thanks to its carefully designed token economy, the STO token establishes a sustainable incentive balance between liquidity providers, projects, and users.

StakeStone (STO) Governance Mechanism

StakeStone uses the vote-escrowed (veSTO) model, which forms the basis of its governance system. Users who lock their STO tokens receive veSTO in return, and thus have the right to vote.

Users can convert an STO to veSTO at any time; thus gaining governance rights and benefiting from the yield boost advantage. When they want to convert veSTO back to STO, a 30-day waiting period (vesting) begins. This system encourages long-term commitment while also providing liquidity flexibility to token holders.

veSTO holders have a say in the following through governance votes:

- Distribution of Liquidity Incentives: veSTO holders determine the direction of incentives by voting for specific areas such as STONE-Fi, BTC-Fi pools or LiquidityPad vaults, and also gain the right to share in the relevant rewards. This system naturally strikes a balance between governance participation and value creation.

- Yield Boost: Liquidity providers who own veSTOs can lock up more tokens to get higher yield boosts. If there are not enough veSTOs, the boost will only apply to a portion of the liquidity invested.

StakeStone (STO) Token Economics and Revenue Model

StakeStone has developed an integrated tokenomics system that offers sustainable value gains to STO holders. Basically, the StakeStone treasury has two main revenue sources:

- Withdrawal Fees (Platform Fees): Platform fees are charged for all exit transactions made from the protocol — including STONE-Fi, BTC-Fi pools, and LiquidityPad vaults. These fees are mostly in blue chip assets (ETH, BTC, stablecoins).

- Bribe Mechanism: Projects that want to attract liquidity can buy STOs and deposit them into pools as incentives. Some of these incentives are burned, creating deflationary pressure on the STO, while the rest is distributed as rewards to governance participants. In addition, both STO holders and the treasury earn from incentives made with governance tokens of partner ecosystems.

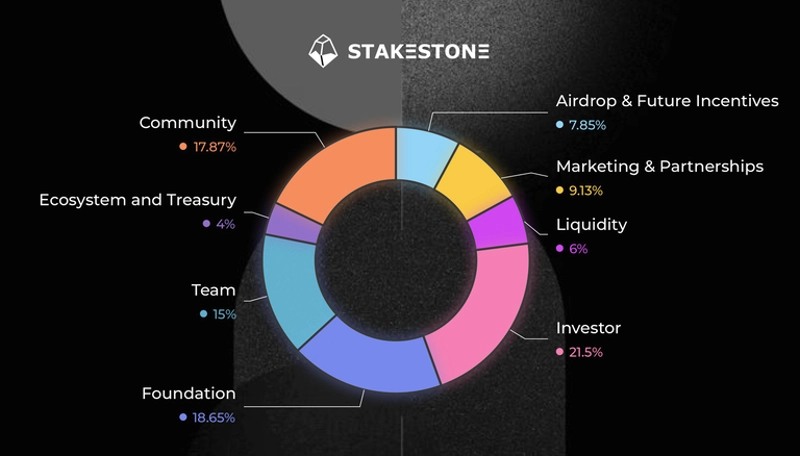

StakeStone (STO) Token Distribution

- Investors: 21.5%

- Foundation: 18.65%

- Community: 17.87%

- Team: 15%

- Marketing & Partnerships: 9.13%

- Airdrops & Future Incentives: 7.85%

- Liquidity, Ecosystem & Treasury: 10%

Emission Plan: STO token emission is designed to gradually decrease by 2031.

This structure aims to provide a sustainable token economy by creating incentives that are compatible with the long-term growth of the ecosystem.

StakeStone (STO) Founding Team

The StakeStone (STO) Founding Team consists of experienced names in the field. Charles K is among the founding partners of the project, while Ivan K is the CMO responsible for marketing strategies. Rose Li, who leads the growth and business development processes of the project, is the CSO.

StakeStone (STO) Partners

In addition, StakeStone works integrated with a strong and broad ecosystem. Its partners include leading Ethereum-based Layer-2 networks such as Arbitrum, Optimism, Base, Scroll, Linea, Polygon, Mantle, BNB Chain, Zircuit, Mode, Manta Pacific, Astar zkEVM, Blast, X Layer, MorphL2, Merlin, BSquare, BEVM, Movement, BOB, Sei and Berachain.

In terms of wallet support, MetaMask is compatible with popular wallets such as Binance Web3 Wallet, OKX Wallet, Trust Wallet, Coinbase Wallet, Bitget Wallet and Gate Wallet.

Which Exchanges Can Trade?

The StakeStone (STO) token is listed on many leading exchanges, including Binance, PancakeSwap, Bitget, MEXC, Gate.io, KuCoin, and BingX. Users can easily trade on these platforms.

Official Links

- Whitepaper: StakeStone

- Discord: StakStone Discord

- X (Twitter): StakeStone X

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.