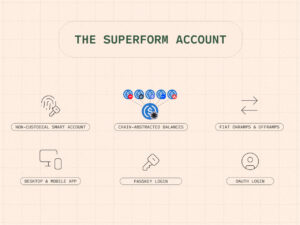

As the DeFi ecosystem has grown, one of the biggest challenges users have faced is multi-chain complexity: wallet management across different networks, bridging, transaction fees, strategy tracking, and risk control. Superform (UP) is a protocol positioned as a cross-chain yield marketplace with a “user-owned neobank” vision, aiming to simplify this complexity through a “single interface + intent-based routing” approach. Superform documentation defines the system as an infrastructure that enables transaction execution and yield optimization across chains using a single signature.

What Does Superform Do?

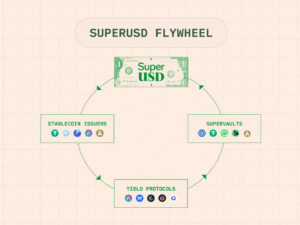

Superform’s core promise is simple: once a user deposits assets into the protocol, they no longer need to manually track yield opportunities across different chains, perform bridging operations, or switch between multiple wallets and applications. Instead, Superform’s routing and product infrastructure automatically activates the most suitable strategies in line with the user’s defined goals, delivering a simpler and more efficient experience. This approach seeks to reduce common DeFi frictions such as fragmented liquidity, high transaction costs, and operational overhead, while enabling users to utilize their capital more effectively.

How Does Superform Work?

Superform brings together yield strategies across multiple blockchains under a single infrastructure to simplify user interaction with DeFi. The protocol’s architecture is built around two main components: SuperVaults and SuperPositions.

SuperVaults (Vault Infrastructure)

- Yield strategies are offered through vaults

- ERC-4626–compliant structure ensures a standardized and transparent vault architecture

- Dynamic rebalancing to adapt to changing market conditions

- Non-custodial design; asset control remains with the user

SuperPositions and ERC-1155A (Position Representation)

- Yield positions are aggregated under a single representation layer

- Flexible structure based on ERC-1155A

- Advanced approval mechanisms

- “Transmute” logic enables conversion between positions

What Is the UP Token?

UP is Superform’s native token, designed to balance ownership, governance coordination, and security incentives within the protocol. According to Superform documentation, UP can be used in upkeep mechanisms that support vault operations and can be bonded by strategy managers and validators, placing them under economic accountability. Poor performance or malicious behavior can result in slashing penalties, helping protect the system’s security.

When UP tokens are staked, users receive sUP. sUP provides governance voting power, allowing holders to participate in key decisions such as incentive distribution, risk parameters, and protocol upgrades.

Canonical contract (Ethereum):

0x1d926bbe67425c9f507b9a0e8030eedc7880bf33

According to the documentation, 15% of the total supply has been bridged to the Base network via LayerZero’s OFT structure. This approach supports multi-chain usage of UP and contributes to the scaling of the Superform ecosystem across different networks.

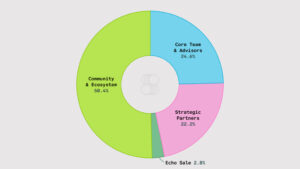

UP Token Supply and Distribution (Tokenomics)

According to Superform’s official blog announcement:

- Initial supply: 1,000,000,000 UP (1B)

- No minting for the first 3 years (hard cap); afterward, governance may activate inflation of up to 2% annually.

Official distribution:

- Community & Ecosystem: 50.4%

- Core Team & Advisors: 24.6%

- Strategic Partners: 22.2%

- Echo Sale: 2.8%

Vesting (official blog):

Team and strategic partner allocations are locked for 3 years from token launch, with a 12-month cliff followed by linear monthly vesting over 24 months.

UP Token Use Cases

According to official Superform communications, UP token use cases are centered around protocol security, governance, and economic sustainability.

- Staking and security: Validators and strategy managers stake or bond UP tokens to take active roles in the protocol. In cases of incorrect or malicious behavior, slashing mechanisms impose economic penalties.

- Governance (sUP): Staking UP yields sUP. sUP holders gain voting rights on incentive distribution, treasury usage, risk parameters, and validator policies.

- Protocol fee surfaces: Superform’s blog notes that revenues from vault management and performance fees, swap routing fees, SuperAsset mint/redeem operations, and execution processes contribute to the protocol’s economic structure.

Superform Founders and Core Team

Superform is built not only by its founders but also by a broader team with deep experience in blockchain infrastructure, protocol design, and product development. Key founders and core team members include:

Founders

- Vikram Arun – CEO & Co-Founder

- Blake Richardson – COO & Co-Founder

- Alex Cort – CPO & Co-Founder

Experienced Contributors

The Superform team is additionally supported by professionals with experience from the following organizations:

- LayerZero

- Matter Labs

- Consensys

- Biconomy

This strong team structure supports Superform’s ambition to be not just a theoretical DeFi product, but a scalable, secure, and institution-grade cross-chain infrastructure. The founders’ and core contributors’ prior experience stands out as an important trust factor for the project’s long-term vision.

Superform (UP) is a protocol that aims to bring multi-chain yield management in DeFi closer to a “single-flow” experience, differentiating itself through its vault infrastructure (SuperVaults), position representation (SuperPositions / ERC-1155A), and governance-security design (UP/sUP, bonding, and slashing). On the token side, official sources outline a structured token economy with a fixed initial supply of 1B UP, a 3-year minting restriction, clearly defined distribution percentages, and a long-term vesting plan.

Official Links

- Website

- X (Twitter)

- Whitepaper

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.