SwissBorg (BORG) is a community-driven cryptocurrency wealth management platform designed to offer innovative financial solutions in the era of digitalization and decentralization. It aims to create a democratic, transparent, and accessible ecosystem for individuals, decentralized autonomous organizations (DAOs), and financial experts. Built on blockchain’s core principles of fairness, accessibility, transparency, and trust, SwissBorg overcomes the limitations of traditional finance, empowering users to manage their crypto portfolios effectively.

What Is SwissBorg (BORG)?

Traditional financial systems rely on outdated technologies and cater primarily to elite clients, while the blockchain ecosystem, despite its rapid growth, lacks robust wealth management solutions. SwissBorg bridges this gap with a community-centric approach, prioritizing meritocracy and swarm intelligence to deliver investment services aligned with its users’ best interests. The platform provides innovative tools and strategies to manage crypto assets while leveraging blockchain’s advantages.

Investment Management and Cryptallion Fund

SwissBorg’s Investment Management Division comprises experienced portfolio managers and financial advisors who apply traditional market strategies to cryptocurrencies. Its flagship product, the Cryptallion Token Hedge Fund (CSB), adopts a multi-strategy, absolute-return approach to enhance investment security by hedging market risks and using diversified strategies. The fund’s allocation includes:

-

Index Pocket (50%-100%): Investments in large and mid-cap cryptocurrencies and ICO tokens.

-

Opportunistic Pocket (0%-50%): Tactical strategies like systematic trading, arbitrage, special situations, and crypto lending.

Launched during the Token Generation Event (TGE) in the first half of 2018, the Cryptallion Fund was exclusive to that period. It stands out with a competitive fee structure and 100% token distribution, ensuring transparency without entry/exit fees or unfair discounts.

SwissBorg Crypto Indices

SwissBorg develops tokenized index strategies to provide transparent and diversified investment opportunities. Two main indices were launched in 2018:

-

SwissBorg Large Cap Index: Targets the top 20 cryptocurrencies by market cap, with a maximum weight of 25% per coin.

-

SwissBorg Mid Cap Index: Focuses on the next 30 cryptocurrencies (ranks 21-50), with a maximum weight of 10% per coin.

These indices offer passive investment with smart beta rebalancing components, promoting portfolio growth through diversification.

Smart Mandate

SwissBorg’s Smart Mandate framework leverages smart contract technology to address the shortcomings of traditional finance. It uses AI to analyze clients’ expectations, risk tolerance, and KYC/AML parameters, creating tailored investment plans. Documents are securely stored using solutions like IPFS or Storj, and users can manage their portfolios via 24/7 accessible reports. The platform ensures a seamless experience across web and mobile applications.

Technology and Security

SwissBorg partners with BitGo to utilize industry-standard multi-signature wallets for secure asset storage. It also employs a hybrid audit process with the IPFS protocol to enhance portfolio transparency and build investor trust. Smart contracts automate investment fund operations, reducing costs and boosting efficiency compared to traditional systems. For instance, entry/exit fees are less than 0.01 ETH, and the minimum investment is approximately 0.1 ETH.

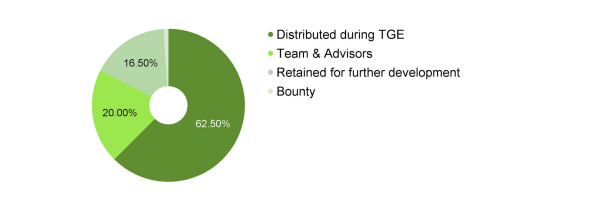

SwissBorg Tokenomics

The SwissBorg Network Token (BORG), a multi-utility ERC-20 token with a fixed supply of 1 billion, enables users to contribute to network development through the “proof of meritocracy” concept. Token distribution is as follows:

-

TGE Distribution: 62.5%

-

Team and Advisors: 20% (distributed over 4 years)

-

Reserved for Development: 16.5%

-

Bounty: 1%

BORG token holders can participate in referendums via RSB tokens to shape the network’s future. Voting power depends on the amount of BORG held, and voting is free.

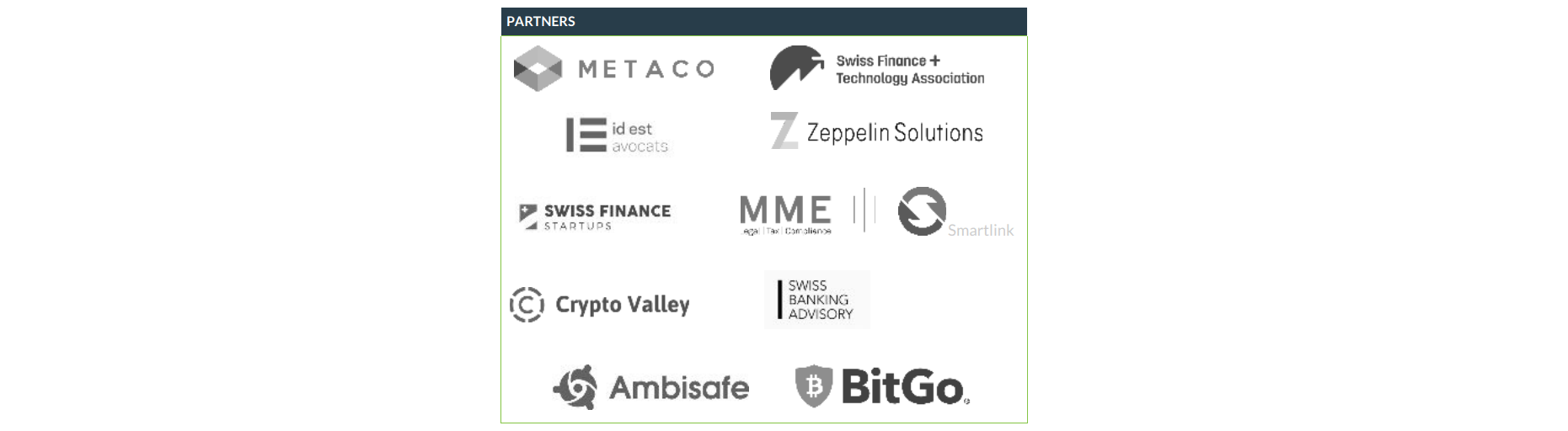

SwissBorg Partners

SwissBorg collaborates with leading organizations, including Metaco, Swiss Finance+Technology Association, ID Est Avocats, Zeppelin Solutions, Swiss Finance Startups, MME, Smartlink, Crypto Valley, Swiss Banking Advisory, Ambisafe, and BitGo. These partnerships strengthen its financial and technological infrastructure.

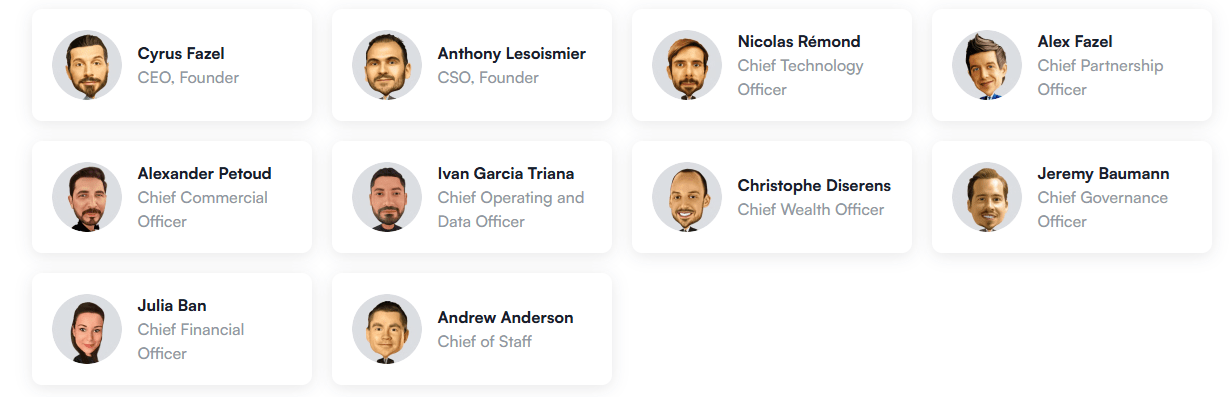

SwissBorg Team

SwissBorg is led by a seasoned team:

-

Cyrus Fazel – CEO and Founder

-

Anthony Lesoismier – Chief Strategy Officer and Founder

-

Nicolas Rémond – Chief Technology Officer

-

Alex Fazel – Chief Partnership Officer

-

Alexander Petoud – Chief Commercial Officer

-

Ivan Garcia Triana – Chief Operating and Data Officer

-

Christophe Diserens – Chief Wealth Officer

-

Jeremy Baumann – Chief Governance Officer

-

Julia Ban – Chief Financial Officer

-

Andrew Anderson – Chief of Staff

SwissBorg democratizes wealth management with a community-driven approach, embracing blockchain’s principles of fairness and transparency. By offering low-cost, secure, and innovative investment solutions, it plays a significant role in the Web3 ecosystem.

Official Links

You can present own thoughts as comment about the topic. Moreover, you can follow us on Telegram and YouTube channels for the kind of the news.