Syndicate (SYND) is a platform that enables developers to easily create customized, application-specific blockchains (appchains). Equipped with programmable, atomically composable on-chain sequencers, these appchains differ from general-purpose chains by granting developers and their tokenized communities full control and ownership over the network, sequencer, and economy. Syndicate allows developers to customize transaction ordering rules, enshrined protocols, and economic systems, ensuring value flows directly back to communities on-chain. In this article, we will explore what Syndicate is, how it works, and the opportunities it offers in detail.

What is Syndicate (SYND)?

Syndicate enables developers to build application-specific blockchains (appchains) powered by programmable sequencer smart contracts, consisting of three main layers:

- Execution Layer: The environment where transactions are processed and the appchain’s state is updated. Syndicate appchains can leverage any rollup framework* (e.g., Arbitrum Orbit).

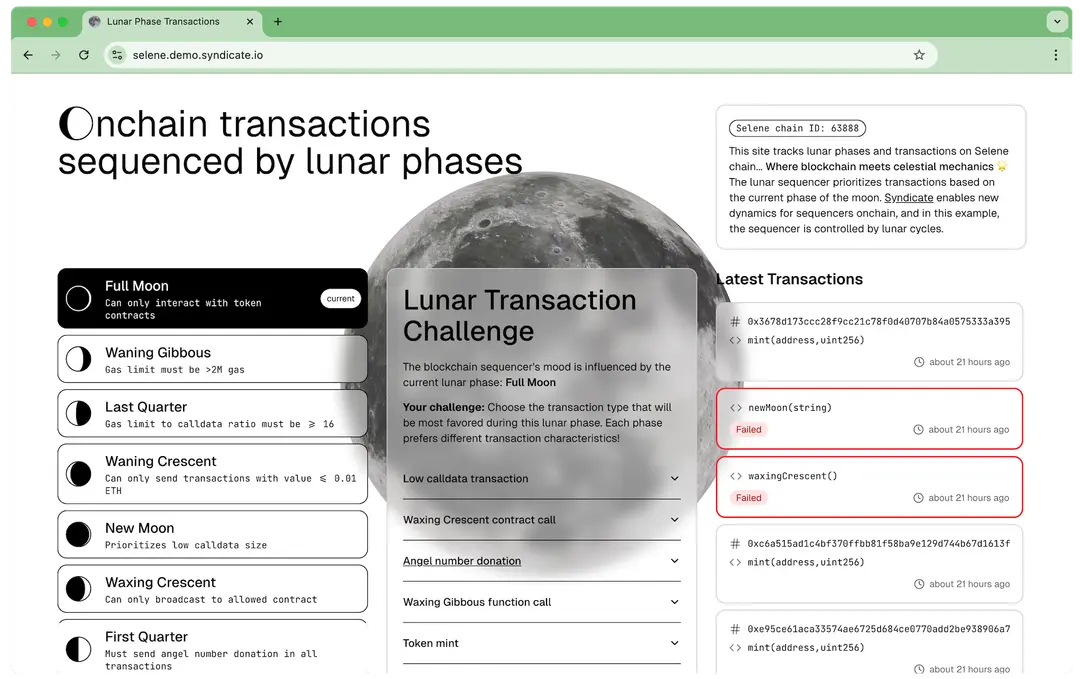

- On-Chain Sequencing Layer: Programmable sequencer smart contracts on Syndicate Chain define transaction inclusion and ordering rules. They provide developers and communities with full control over sequencing, economic mechanisms, and permission/governance models.

- Settlement Layer: Provides cryptographic security, finality, and settlement, hosting the appchain’s gas token. Developers can choose EVM-compatible settlement layers like Ethereum L1 or Base L2, with additional chains available upon technical evaluation.

Syndicate currently supports Arbitrum Orbit Stack; support for OP Stack and other frameworks is planned.

Syndicate appchains offer advantages such as easy customization of transaction ordering rules, designing custom economic models, reducing operating costs by 10-100x, integrating enshrined protocols (oracles, VRF, marketplaces), atomic cross-chain composability, and progressive decentralization. They cater to a wide range of applications, from consumer to finance, gaming, and decentralized physical infrastructure (DePIN).

Purpose of Syndicate (SYND)

Syndicate’s vision is to make web3 mainstream by scaling to billions of users. Appchains maximize technical and economic alignment with applications and tokenized communities. Syndicate breaks the core tradeoff between customization and composability, offering appchains full control and atomic composability. Its mission is to overcome the limitations of centralized sequencers (lack of control, single points of failure, value leakage, high costs, loss of composability, data loss risks, and lack of community control) by providing programmable on-chain sequencers for flexibility, resilience, and community ownership.

Syndicate represents the shift from general-purpose chains (congestion, high fees) and scaling solutions (limited customization) to application-centric chains. Projects like Uniswap, Jupiter, and Ethena are moving to appchains for greater control over networks, fees, and economies. Syndicate makes these appchains programmable, composable, and community-driven, realizing web3’s ultimate goal.

How Syndicate (SYND) Works

Syndicate enables appchains to scale web3 horizontally through a network of networks. The Syndicate Stack integrates custom components with existing rollup solutions (e.g., Arbitrum Nitro). The transaction flow is as follows:

- User: Initiates a transaction via a wallet or dApp.

- Syndicate Mempool (optional): Collects and batches transactions.

- Syndicate Sequencer: Submits transactions to Syndicate Chain.

- Syndicate Chain: Applies on-chain sequencing, rules, and permissions.

- Syndicate Translator: Prepares blocks for execution.

- Rollup Framework: Executes transactions and updates state (e.g., Arbitrum Nitro).

- Syndicate Proposer: Submits data to the settlement chain.

- Settlement Chain: Ensures security and finality (Base, Ethereum Mainnet, etc.).

Syndicate moves sequencing logic to on-chain smart contracts, enhancing decentralization and reducing costs. The management console simplifies technical operations, allowing developers to focus on economics and governance.

Use Cases

Syndicate appchains cater to a broad range of applications:

- Consumer and Social Applications: Low-fee, community-driven appchains.

- Finance and Real-World Assets (RWA): Scalable DeFi networks and RWA tokenization platforms.

- Decentralized Physical Infrastructure (DePIN): Customized networks for specific industries.

- Gaming: High-performance chains with custom transaction ordering for gameplay.

- Examples: Loyalty-based commerce appchains, manufacturing appchains sharing fees with supply chains, volume-based finance appchains, real-time reward gaming appchains, and usage-based incentive social appchains.

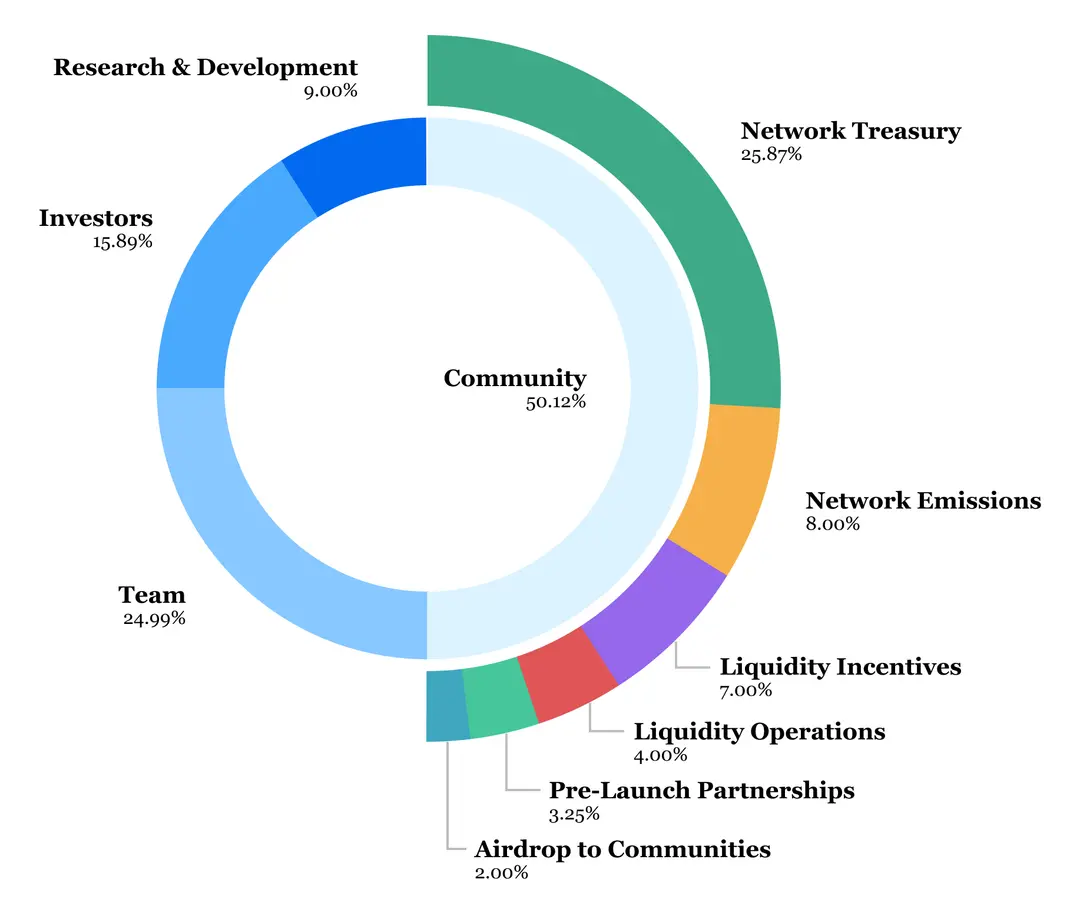

Tokenomics Structure

The SYND token is the native asset of the Syndicate Network, powering appchains, facilitating transactions, and securing the network. Key details:

- Token Standard: ERC-20

- Total Supply: 1,000,000,000 SYND (fixed)

- Minted at Genesis: 920,000,000

- Emissions: 80,000,000 (over 48 thirty-day epochs)

- Initial Circulating Supply: Non-transferable until public launch

Distribution:

- Treasury: 25.87% (controlled by SYND holders via governance)

- Team: 24.99% (4-year vesting, 1-year cliff)

- Investors: 15.89% (4-year vesting, 1-year cliff)

- R&D: 9%

- Network Emissions: 8% (48 epochs)

- Liquidity Incentives: 7%

- Liquidity Operations: 4%

- Pre-Launch Partnerships: 3.25%

- Airdrop: 2% (August 15, 2025)

Emission Schedule: 80M SYND is distributed over 48 epochs with geometric decay (first epoch: 2,577,259 SYND; final epoch: 997,205 SYND). Staking operates on 30-day epochs, distributing rewards via Base Pool (30%), Performance Pool (30%), and Appchain Pool (40%). Stakers earn based on stake size and appchain performance.

Syndicate (SYND) Investors

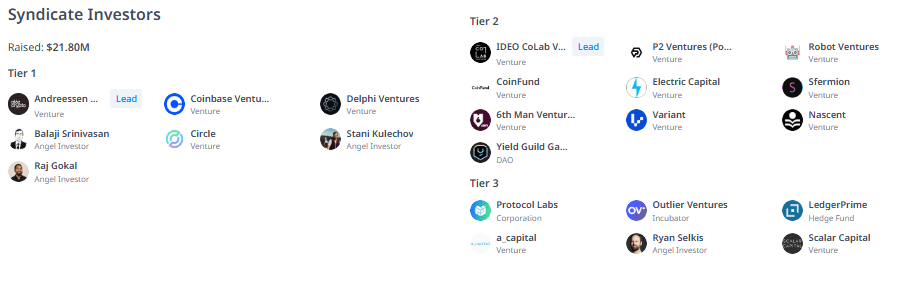

Syndicate is backed by investors, raising $21.8M. Key investors include:

- Tier 1: Andreessen Horowitz (a16z crypto), Coinbase Ventures, Delphi Ventures, Balaji Srinivasan, Circle, Stani Kulechov, Raj Gokal.

- Tier 2: IDEO CoLab Ventures, P2 Ventures, Robot Ventures, CoinFund, Electric Capital, Sfermion, 6th Man Ventures, Variant, Nascent, YGG.

- Tier 3: Protocol Labs, Outlier Ventures, LedgerPrime, a_capital, Scalar Capital, Sound Ventures, OpenSea, Global Coin Research, BlueYard Capital, True Ventures, Kleiner Perkins, Uniswap Labs Ventures, Ryan Sean Adams, FalconX, CoinList, Tyler Ward, 35Ventures, Weekend Fund, Aave.

- Tiers 4 and 5: DeFi Alliance, South Park Commons, Xoogler, Broadhaven Capital, Chainforest, Afropolitan DAO, Makena Capital, PoolSuite, Reach Capital, States DAO, Steel Perlot, WE3, and others.

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.