What is the BTC Spot Inflow/Outflow Indicator?

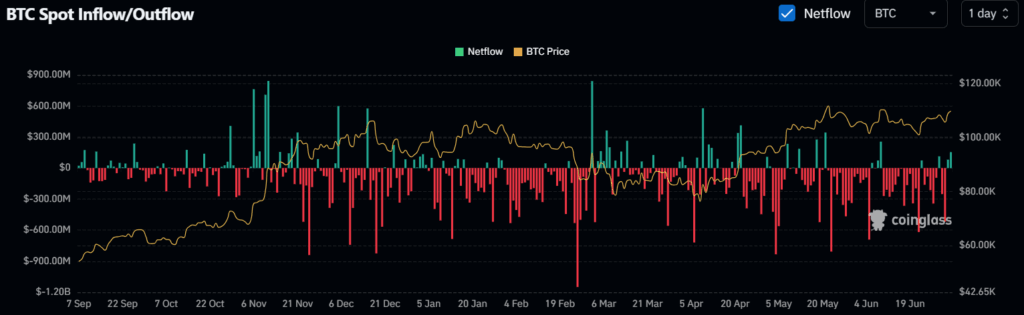

The Spot Inflow/Outflow is a crucial on-chain analytical indicator that measures the amount of Bitcoin entering or leaving exchanges. This indicator helps in understanding investor behavior and potential market direction by showing how much BTC is being sent to or withdrawn from crypto exchanges.

Inflow: Refers to the amount of BTC transferred to exchanges. When this rate increases, it is often interpreted as investors moving their Bitcoin to exchanges for potential selling. This can signal increased selling pressure and short-term bearish sentiment.

Outflow: Represents the amount of BTC withdrawn from exchanges. If investors are transferring Bitcoin to their personal wallets, it generally indicates an intention to hold (HODL) long-term. This may suggest reduced selling pressure and potential for upward price movement.

Net Flow: Shows the difference between inflows and outflows.

- Positive Net Flow (more inflow): Indicates that more Bitcoin is being sent to exchanges, potentially signaling increased selling pressure.

- Negative Net Flow (more outflow): Indicates more BTC is leaving exchanges, possibly showing accumulation or long-term holding behavior.

How to Interpret It?

- High Spot Inflow: Heavy transfer of BTC to centralized exchanges could mean investors are preparing to sell. This typically suggests profit-taking or bearish expectations.

- High Spot Outflow: A large withdrawal of BTC from exchanges usually shows investors moving their assets to secure wallets. This often correlates with reduced supply and potential price increases.

Divergences (Inconsistencies): Divergences between price action and inflow/outflow can offer critical signals. For example, if the price is rising while net flow turns positive (more inflows), it may indicate the rally is unsustainable.

- Bullish Divergence: While the price forms new lows, net flow turns negative (more outflows), signaling strong accumulation.

- Bearish Divergence: While the price hits new highs, net flow turns positive (more inflows), signaling potential selling pressure.

Difference Between Spot Data and On-chain

Spot Inflow/Outflow is based on on-chain data. However, since pricing typically occurs in spot markets, this data indirectly reflects off-chain activities as well. Interpreting it alongside spot movements can generate stronger price signals.

Importance of BTC Spot Inflow/Outflow

- Understanding Market Sentiment: Indicates whether investors lean toward selling or holding.

- Liquidity Tracking: Shows how much BTC is available on exchanges, providing insights into potential volatility.

- Risk and Opportunity Analysis: Sudden inflows can signal downside risk; sudden outflows may present buying opportunities.

- Monitoring Institutional Activity: Large-scale outflows could signal institutional buying activity.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.