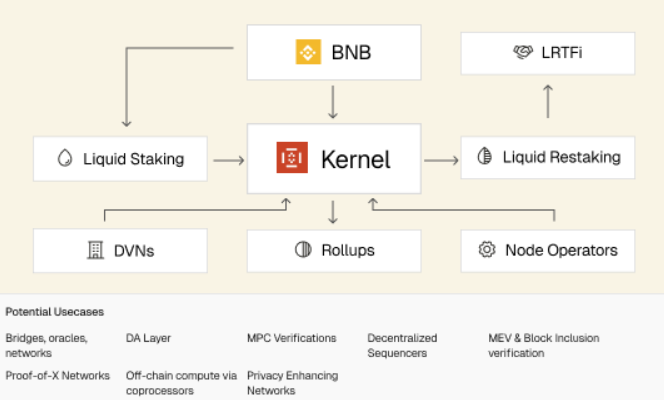

KernelDAO is a blockchain project that introduces restaking as a key innovation in Proof-of-Stake (PoS) ecosystems. Restaking allows users to utilize their already staked assets to provide security and generate rewards across multiple protocols. This approach increases capital efficiency while offering crypto-economic security at up to 10x lower cost.

KernelDAO operates through three main products:

-

Kernel – Shared security product on BNB Chain

-

Kelp LRT (rsETH) – Liquid restaking token for Ethereum

-

Gain – Automated reward vaults on Ethereum

These products cater to both DeFi and Real-World Assets (RWAs), offering a wide range of utility.

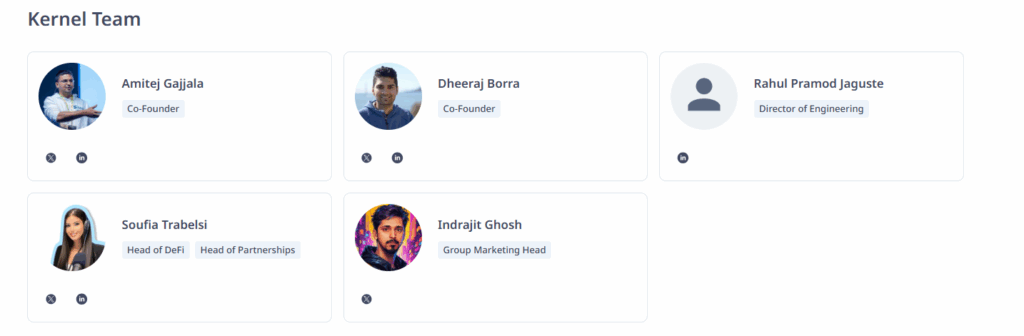

KernelDAO Team

Co-Founders:

-

Amitej Gajjala – Co-Founder

-

Dheeraj Borra – Co-Founder

Management & Technical Team:

-

Rahul Pramod Jaguste – Director of Engineering

-

Soufia Trabelsi – Head of DeFi

-

Indrajit Ghosh – Head of Partnerships & Group Marketing Head

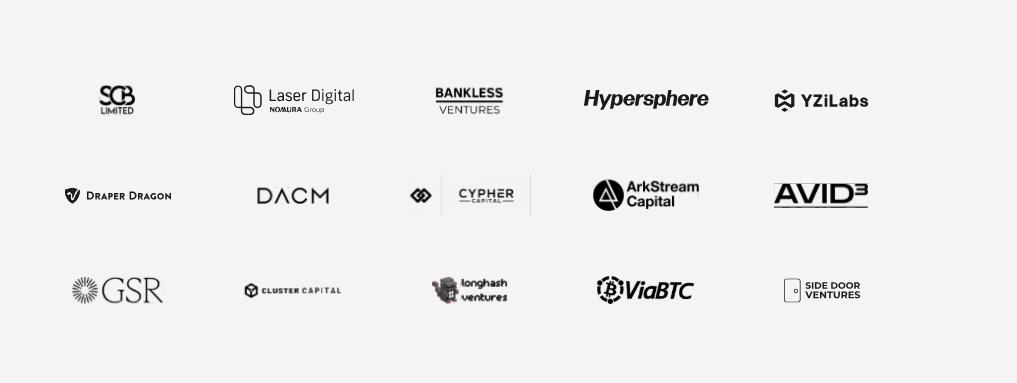

Investors and Partnerships

KernelDAO has quickly established a strong network of investors and partners. Key contributors include Binance Labs, Laser Digital (Nomura), SCB Limited (SCB Ventures), Cypher Capital, Hypersphere Ventures, Bankless Ventures, GSR, HTX Ventures, DWF, and ArkStream Capital.

Other ecosystem collaborations include over 50 DeFi platforms such as Aave, Compound, Balancer, and Morpho.

-

Total TVL: ~$300M for Kernel, ~$2B for Kelp LRT

Project Concept and How It Works

KernelDAO aims to:

-

Allow users to earn additional rewards from their staked assets

-

Provide efficient security for operators and validator networks

-

Bridge DeFi and CeFi, creating new financial products

- Kernel: Provides shared security on BNB Chain with enhanced reward opportunities and capital efficiency.

- Kelp LRT (rsETH): Offers instant liquidity, risk management, and higher rewards for staked Ethereum.

- Gain Vaults: Non-custodial vaults that optimize rewards across DeFi, CeDeFi, and RWAs.

Governance

The native token $KERNEL serves as the governance and economic security tool across the ecosystem.

-

Governance: Users vote on platform fees, slashing conditions, and operator selections.

-

LRT & Gain: Participate in AVS selection, rebalances, operator proposals, and protocol fee management.

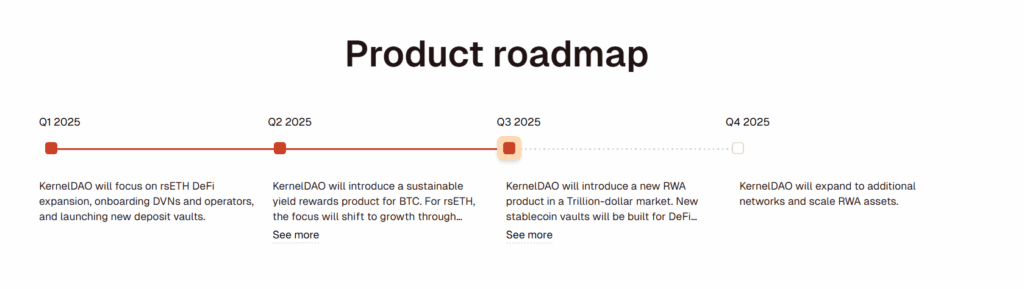

Roadmap

KernelDAO Ecosystem:

-

Q2 2025 – Operator Testnet launch

-

Q3 2025 – Operator Mainnet & Middleware Testnet

-

Q4 2025 – Middleware Mainnet launch & slashing introduction

Kelp LRT:

-

Integration of rsETH on Ethereum L2s

-

Capacity expansion on lending and DeFi platforms

Gain Vaults:

-

Expansion to BTC and stablecoin assets

-

RWAs and CeDeFi vaults

-

Multi-asset class expansion

KernelDAO Token Information

-

Token: $KERNEL

-

Total Supply: 1 Billion

-

Max Supply: 1 Billion

-

Circulating Supply: 282.36 Million

Use Cases

-

Stake for restaking security

-

Slashing insurance for rewards

-

Governance voting

-

Protocol participation in LRT & Gain products

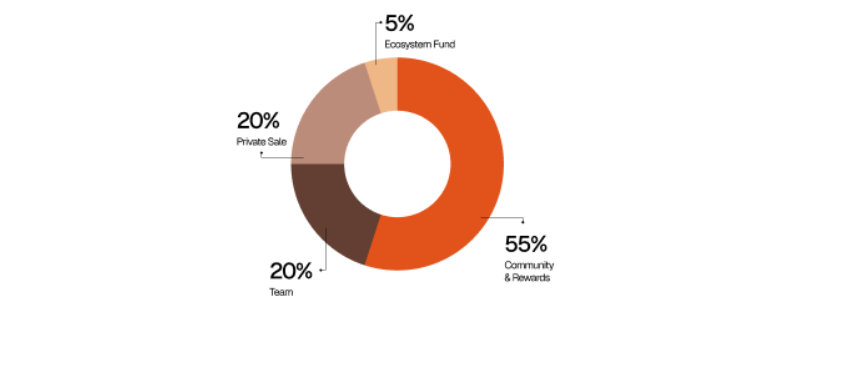

Token Distribution

-

Community & Users: 55%

-

Team & Project: 15%

-

Investors & Partners: 20%

-

Reserve & Ecosystem Funds: 10%

Exchanges & Listings

KernelDAO ($KERNEL) has been listed on Upbit. Additional listings on other centralized and decentralized exchanges are planned, including Binance, Huobi, OKX, Gate.io, and Uniswap, improving liquidity and accessibility for users.

Ecosystem & Features

-

Kernel: Shared security, multi-node validation

-

Kelp LRT (rsETH): Liquid restaking token, high rewards, instant liquidity

-

Gain Vaults: Non-custodial, professionally managed reward strategies, DeFi & RWA compatible

KernelDAO introduces a new paradigm in PoS restaking and liquid staking, providing capital efficiency and risk management benefits for both investors and DeFi users.

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.