While decentralized finance (DeFi) has undergone a massive transformation in recent years, it has also brought increasing complexity. Liquidity management, yield optimization, derivatives trading, automated strategies, and risk control are no longer structures that individual users can manage manually. This is exactly where Theoriq (THQ) steps in — aiming to transform DeFi into a self-optimizing financial system using artificial intelligence-powered autonomous agents and agent swarms.

Theoriq’s core mission is to build an agentic economy infrastructure that thinks, coordinates, and executes complex on-chain operations on behalf of users. In this system, humans only set the direction, while the vast majority of transactions are carried out by autonomous AI agents.

So, what exactly is Theoriq (THQ) and what does it do? Let’s dive into the details.

What is Theoriq (THQ)?

Unlike a classic DeFi protocol, Theoriq is not a single product — it is an infrastructure layer that produces products. This infrastructure enables:

- Autonomous agents to execute transactions directly on-chain

- Multiple agents to collaborate and share tasks

- Fully automated liquidity management, trading, yield optimization, and risk control

- Minimal human intervention

In short, Theoriq stands out as one of the infrastructure protocols that truly merges artificial intelligence with DeFi.

Alpha Protocol: The Backbone of Theoriq

At the heart of the Theoriq ecosystem lies Alpha Protocol, which provides the foundational infrastructure allowing autonomous agents to operate securely on-chain.

Key building blocks of Alpha Protocol:

- Agent Autonomy: Agents are independent actors capable of acting on their own.

- Swarm Coordination: Multiple agents can work together to complete complex tasks.

- Agent Reputation System: Agents’ past performance is recorded, creating reliability scores.

- Trust-Minimized Design: Reduces the need for centralized trust between agents and users.

Thanks to this structure, DeFi evolves from a static system of individual smart contracts into a dynamic, self-organizing financial system.

What is AlphaSwarm?

AlphaSwarm is one of Theoriq’s flagship products. This AI-powered agent swarm automatically executes on-chain operations. Main use cases include:

- Liquidity Provision AlphaSwarm provides on-chain liquidity in areas where traditional market makers cannot enter due to economic or technical limitations. Agents dynamically open positions by analyzing price, volatility, and liquidity depth.

- Yield Optimization Yield rates across different DeFi protocols are continuously compared. Agents automatically move capital to the most efficient pools to maximize returns.

- Autonomous Trading Market data is analyzed in real time. Agents can execute delta-neutral, risk-minimizing, or volatility-based strategies. Liquidation risk is predicted in advance and positions are automatically rebalanced.

This allows users to access passive income models powered by AI automation instead of constantly monitoring screens.

THQ Tokenomics

THQ is the native token of the Theoriq ecosystem and goes far beyond being just a payment or governance token. THQ directly:

- Secures agents

- Manages reward distribution

- Powers staking, locking, and delegation mechanisms

- Forms the economic backbone of the Agentic Economy

Total supply is capped at 1 billion tokens, designed for long-term incentive alignment.

THQ Token Distribution

- Community: 18%

- Treasury: 28%

- Core Contributors: 24%

- Investors: 30%

Core contributor tokens are subject to 3-year vesting + 1-year cliff, while investor allocations prioritize long-term alignment. The community portion is used to incentivize agent operators, ambassadors, and contributors.

Staking, Locking & Delegation Mechanism

THQ is not just a hold-to-earn asset. It operates within a three-stage economic system:

- Staking (THQ → sTHQ) Users stake THQ to receive sTHQ. This provides:

- Network security

- Regular token emissions to stakers

- Additional rewards from partner projects

- Locking (sTHQ → αTHQ) sTHQ can be locked for 1–24 months to mint αTHQ, which offers:

- Higher emission yields

- Revenue share from protocol fees

- Incentivizes long-term commitment

- Delegation (αTHQ → Agents) αTHQ holders can delegate their tokens to specific agents:

- Increases the agent’s transaction capacity

- Delegators receive fee discounts

- Misbehaving agents face slashing

This creates direct economic accountability for both agents and investors.

Security & Governance Approach

As an AI-based protocol, Theoriq has designed a multi-layered security architecture:

- Staking and slashing penalties

- Regular audits and bug bounty programs

- Community-based dispute resolution

- AI + human oversight systems

- Transparent security reporting

In the long term, dedicated AI Safety Evaluator modules are planned.

Roadmap

Phase 1: Staking Core – Mainnet staking launch, sTHQ minting, base security layer.

Phase 2: Lock-Up & Security – AlphaLocker activation, αTHQ creation, slashing enabled.

Phase 3: Delegation & Agent Modules – Agent delegation, on-chain fee sharing, new agent modules.

Future Phases: Full decentralization, insurance reserves, new reward models, multi-chain expansion.

Who Can Participate in the Theoriq Ecosystem?

Theoriq appeals to a wide range of profiles:

- Stakers: Earn from network security

- Delegators: Support agents → earn fee discounts & rewards

- Liquidity Providers: Deposit into AI-managed vaults

- Agent Developers: Build and monetize their own agents

- Institutional Investors: Use swarms for capital optimization

Theoriq Backers & Partners

Theoriq has strong institutional backing. Key partners and supporters include:

Partners: OG, Chainlink, Bondex, Filecoin Foundation, Codigo, Truflation, IoTeX, Space and Time, LayerZero, Google Cloud, io.net, Nosana, Masa, AWS, Parasail, AltLayer, Swan, Grass, Nosana

Investors: Hypersphere, Antalpha, HashCIB, Chainlink, IOSG, Foresight Ventures, HashKey Capital, Figment Capital, Alumni Ventures, HTX, Construct Ventures, Stateless Ventures, HackVC, Inception, LongHash Ventures

This lineup shows the project enjoys strong support both technically and institutionally.

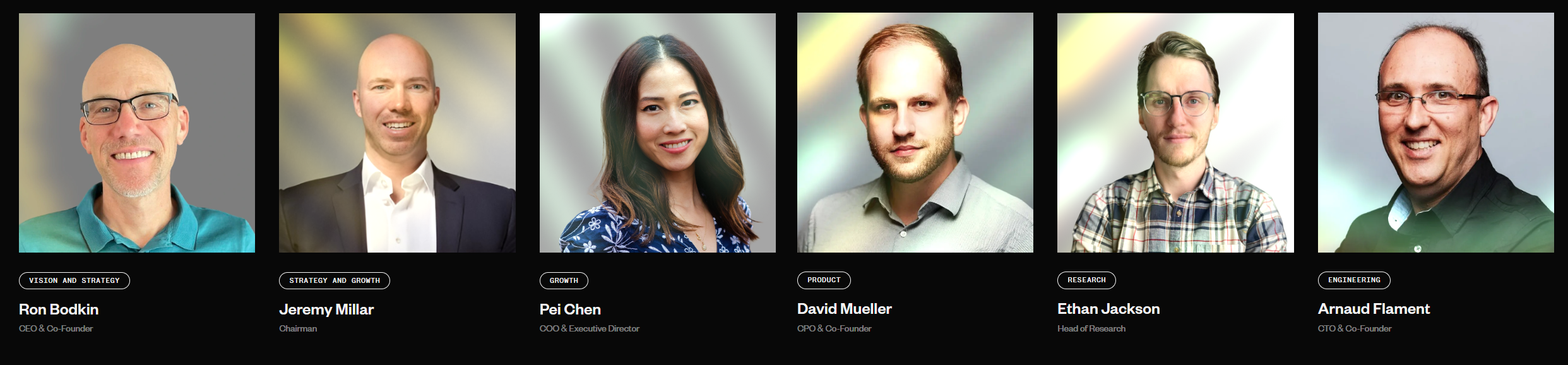

Theoriq Team

The project is led by an experienced, cross-disciplinary team:

- Ron Bodkin – CEO & Co-Founder (Vision & Strategy)

- Jeremy Millar – Chairman (Growth)

- Pei Chen – COO & Executive Director

- David Mueller – CPO & Co-Founder (Product)

- Ethan Jackson – Head of Research

- Arnaud Flament – CTO & Co-Founder (Engineering)

Official Links

In the comment section, you can freely share your comments and opinions about the topic. Additionally, don’t forget to follow us on Telegram, Youtube and Twitter for the latest news and updates.