In the world of cryptocurrency and blockchain, the limitations and inequities of the traditional financial system have restricted individual investors’ access to wealth-building opportunities. WhiteRock (WHITE) stands out as a platform that eliminates these barriers by tokenizing real-world assets (RWA) and democratizing the financial system. So, what exactly is WhiteRock, how does it work, and why is it gaining attention? Let’s explore in detail!

What is WhiteRock (WHITE)?

WhiteRock is a platform that tokenizes traditional financial assets (stocks, bonds, real estate, etc.) on the blockchain, enhancing global liquidity and bridging decentralized finance (DeFi) with traditional finance (TradFi). Announced in December 2024, WhiteRock is built on its proprietary blockchain, White Network, and enables 24/7 trading, instant settlement, and fractional ownership, making financial access possible for everyone. The platform is powered by the $WHITE token and the yield-bearing stablecoin $USDX. WhiteRock aims to create a transparent, efficient, and regulatory-compliant financial system, empowering individuals as investors.

WhiteRock’s mission is to dismantle the barriers of traditional finance, such as intermediaries and geographic restrictions, to provide global market access for all. The platform believes in the failure of banks and fiat currencies (particularly the U.S. dollar) and asserts that blockchain will become the primary source of liquidity. With this vision, it advocates that every asset (fiat, commodity, stock) can be tokenized on-chain.

WhiteRock’s Key Features

WhiteRock distinguishes itself in the financial world with its innovative technology and user-centric approach. Here are the platform’s core features:

1. Tokenization of Real-World Assets (RWA)

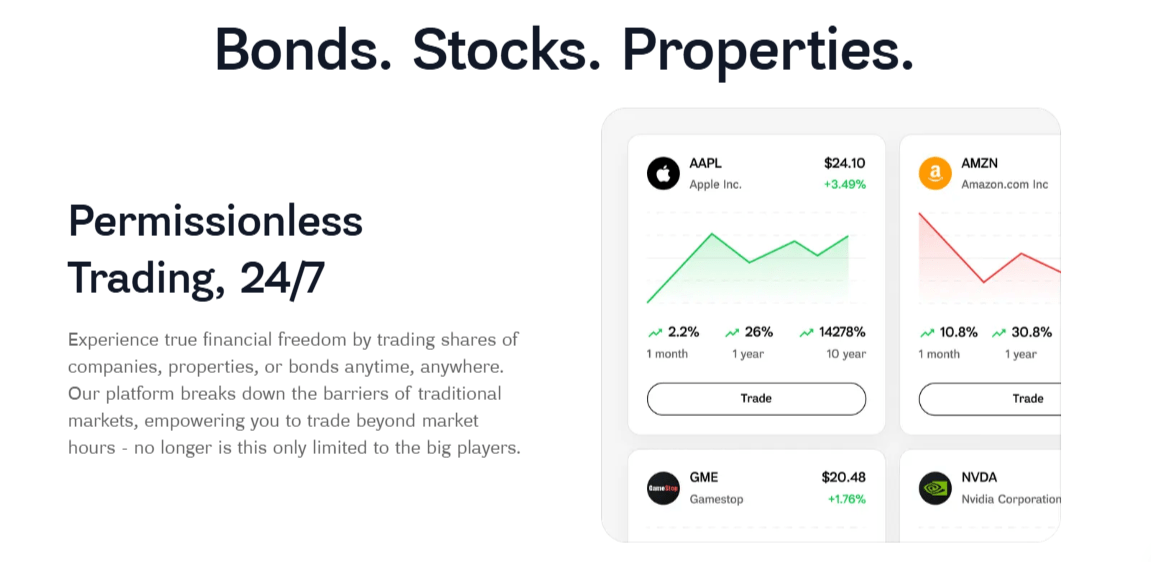

WhiteRock tokenizes the economic rights of stocks, bonds, real estate, derivatives, and other financial assets, creating digital representations on the blockchain. These tokens represent real ownership of the assets and are held in compliance with regulations. Users can trade these tokens in global markets 24/7 and invest with low capital through fractional ownership.

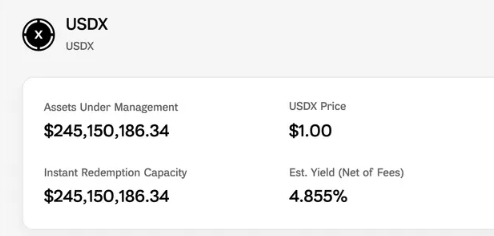

2. USDX: Yield-Bearing Stablecoin

USDX is WhiteRock’s stablecoin, pegged 1:1 to the U.S. dollar, with the unique feature of sharing investment profits directly with users:

-

Investment: USDX’s underlying assets are invested in U.S. Treasury bills, a secure investment vehicle.

-

Profit Distribution: Interest earned from Treasury bills is automatically added to USDX holders’ wallets via a rebasing mechanism.

-

Transparency and Trust: USDX is audited by Ernst & Young and rated by Moody’s, ensuring reliability.

-

Ease of Access: No staking or locking is required; simply holding USDX generates passive income.

3. Tokenized Stocks

WhiteRock makes investing easier by tokenizing traditional stocks on the blockchain:

-

Fractional Ownership: Purchase small portions of high-priced stocks to diversify portfolios.

-

24/7 Trading: Unlike traditional exchanges, WhiteRock enables trading at any time.

-

Fast Settlement and Low Costs: Instant settlement and a structure that eliminates intermediaries reduce transaction fees.

-

Global Access: Access stocks from exchanges like NYSE and Nasdaq without geographic restrictions.

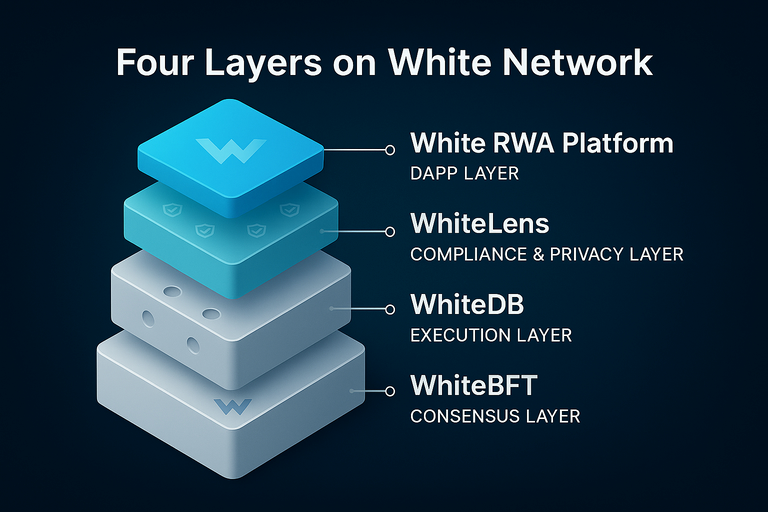

4. White Network and WHITENET Token

White Network is WhiteRock’s high-performance proprietary blockchain, delivering over 200,000 TPS (transactions per second) with instant settlement. The WhiteBFT consensus mechanism, inspired by HotStuff, is optimized to complete transactions in milliseconds. WHITENET is the network’s native gas token, used for transactions, trading, and compliance checks. It also supports validator collateral and governance functions.

5. Regulatory Compliance and Privacy

WhiteRock offers a globally compliant platform:

-

KYC/AML: Users meet KYC/AML requirements using zero-knowledge proofs, preserving privacy.

-

WhiteLens: Users can conduct transactions in transparent or private pools, with auditability for regulators.

-

Licensed Brokerage: WhiteRock collaborates with custodians like StoneX to ensure the security of tokenized assets.

6. Global Liquidity Pool

WhiteRock consolidates liquidity from different markets into a single on-chain platform. This enables better price discovery, lower slippage, and tighter spreads. Users can utilize DeFi tools like spot trading, margin positions, or borrowing.

How WhiteRock (WHITE) Works

WhiteRock’s operations are built on asset tokenization and a user-focused ecosystem:

-

User Registration and Wallet Creation: Users easily sign up with web2 credentials and create WhiteRock’s self-custodial Web3 wallet.

-

KYC/AML Verification: Users undergo KYC/AML checks to comply with regulations.

-

Asset Tokenization: Traditional financial institutions or individuals deliver assets to WhiteRock, which are tokenized after compliance audits.

-

USDX and Transactions: Users deposit funds in USDT, which are converted to USD via Coinbase Prime. Tokenized assets can be traded, used as collateral, or added to liquidity pools on the WhiteRock platform.

-

Profit Distribution: USDX holders automatically receive Treasury bill yields through the rebasing mechanism.

WhiteRock’s Benefits to Stakeholders

-

Individual Investors: Access global markets with low capital, 24/7 trading, and passive income opportunities.

-

Institutional Investors: Liquid and tokenized assets on a high-speed, regulatory-compliant platform.

-

Token Holders: $WHITE is used for platform transactions and governance, while $WHITENET supports network operations.

-

Regulators: A transparent and auditable system ensures compliance.

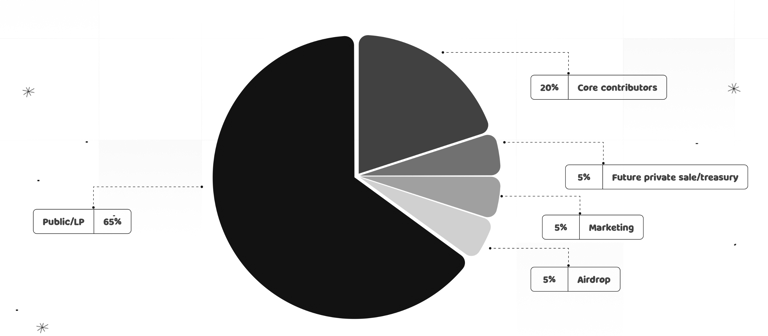

WhiteRock (WHITE) Tokenomics

The $WHITE token forms the foundation of the WhiteRock ecosystem:

-

Total Supply: 1 trillion (1,000,000,000,000)

-

Distribution:

-

65%: Public/Liquidity Pools

-

20%: Core contributors (2-year cliff, 60-month vesting)

-

5%: Airdrop

-

5%: Marketing

-

5%: Future private sale/treasury

-

-

WHITENET: The gas token for White Network, supporting transactions and validator collateral/governance functions.

WhiteRock Roadmap

WhiteRock follows a phased plan to transform the financial ecosystem:

-

Phase 1 (Live): Tokenized stocks, bonds, $WHITE, and $USDX with active trading infrastructure.

-

Phase 2: Lending platform, using tokenized assets as collateral.

-

Phase 3: $USDX DeFi integrations and yield optimization.

-

Phase 4: WhiteX (high-speed DEX) and full White Network integration.

-

Phase 5: Tokenization of real estate, intellectual property, and commodities.

WhiteRock Team

WhiteRock is led by an experienced leader. Maxime Pizzolitto (Founder) shapes the platform’s vision and drives the integration of traditional finance with blockchain.

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.