The recent sharp pullback in Bitcoin price has coincided with notable changes in on-chain data, pointing to a shift in market structure. One of the most striking developments is the decline in the share of Bitcoin supply held by large investors, which has now fallen to its lowest level in the past nine months.

Decline Among Whale and Shark Wallets

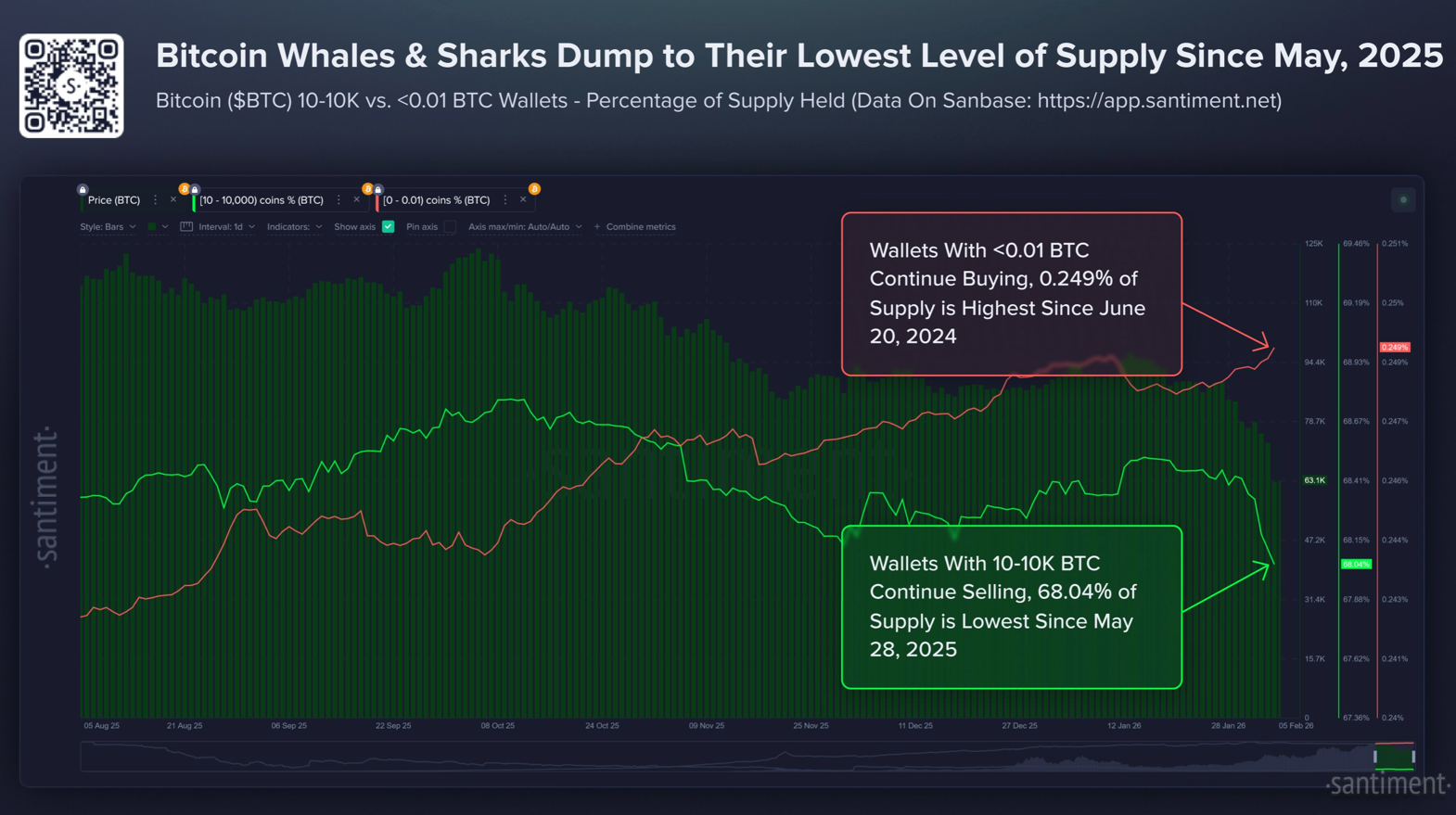

According to on-chain metrics, wallets holding between 10 and 10,000 BTC—commonly referred to as whale and shark wallets—now control approximately 68.04% of Bitcoin’s total circulating supply. This represents the lowest concentration observed since late May, when Bitcoin reclaimed the $100,000 level after several months below it.

Over the past eight days alone, these large holders have collectively reduced their positions by 81,068 BTC. During the same period, Bitcoin’s price dropped from around $90,000 to near $65,000, marking a decline of roughly 27%. At the time of writing, Bitcoin is trading at $64,792, having recently bounced from intraday lows slightly above $60,000.

Why Large Holder Behavior Matters

Market participants closely monitor the actions of large Bitcoin holders, as their accumulation or distribution patterns often provide insight into broader market sentiment. Sustained selling from this cohort is frequently interpreted as a sign that major players are de-risking or adjusting exposure amid rising uncertainty.

Caution is not limited to on-chain data alone. Commentary from industry analysts suggests that sentiment across the market has turned increasingly pessimistic, with many expecting further downside in the short term.

Fear Index Signals Extreme Pessimism

This cautious outlook is reflected in sentiment indicators. The Crypto Fear & Greed Index has fallen to a reading of 9 out of 100, its lowest level since mid-2022. That period coincided with severe market stress following the collapse of the Terra ecosystem, underscoring the intensity of current fear levels.

Retail Investors Continue Accumulating

While large holders have been reducing exposure, smaller investors appear to be moving in the opposite direction. Wallets holding less than 0.1 BTC—often referred to as “shrimp” wallets—have reached a 20-month high. This cohort now accounts for approximately 0.249% of Bitcoin’s total supply, equivalent to around 52,290 BTC.

Historically, periods where large holders distribute while retail investors aggressively accumulate have often aligned with the formation of bear market cycles. As a result, the current divergence between institutional-scale wallets and retail behavior adds an additional layer of complexity to Bitcoin’s near-term outlook, suggesting that both price action and investor psychology warrant close observation.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.