The cryptocurrency market has increasingly captured the attention of institutional investors, with interest growing steadily over recent years. Bitcoin and Ethereum have emerged as strategic assets not only for individual investors but also for major global corporations. Factors such as inflationary pressures, economic uncertainties, and declining returns from traditional financial instruments have driven companies to invest in cryptocurrencies like Bitcoin and Ethereum. These firms are incorporating digital assets into their balance sheets, viewing them as both a store of value and a gateway to future financial innovations. In 2024 and 2025, Bitcoin’s record-breaking price surges and Ethereum’s potential in DeFi (Decentralized Finance) and staking have accelerated institutional adoption. Companies in the U.S., Japan, and other major economies are treating these digital assets as a “digital reserve,” diversifying their portfolios. So, which companies are leading this race? Below is a detailed list of the top 10 companies holding the largest Bitcoin and Ethereum reserves.

Why Are Institutions Betting Big on Crypto?

Institutional interest in Bitcoin and Ethereum signals the mainstream acceptance of cryptocurrencies as a legitimate asset class. Bitcoin’s reputation as “digital gold” and Ethereum’s leadership in smart contracts and DeFi ecosystems make them prime choices for corporate treasuries. Regulatory clarity, particularly in the U.S., and the approval of spot Bitcoin and Ethereum exchange-traded funds (ETFs) in 2025 have made it easier for companies to invest. Additionally, firms are turning to these assets to hedge against inflation and protect cash reserves from devaluation. This trend spans beyond tech and finance sectors, with companies in regions like Japan embracing cryptocurrencies. The growing institutional adoption could further integrate crypto into the global financial system.

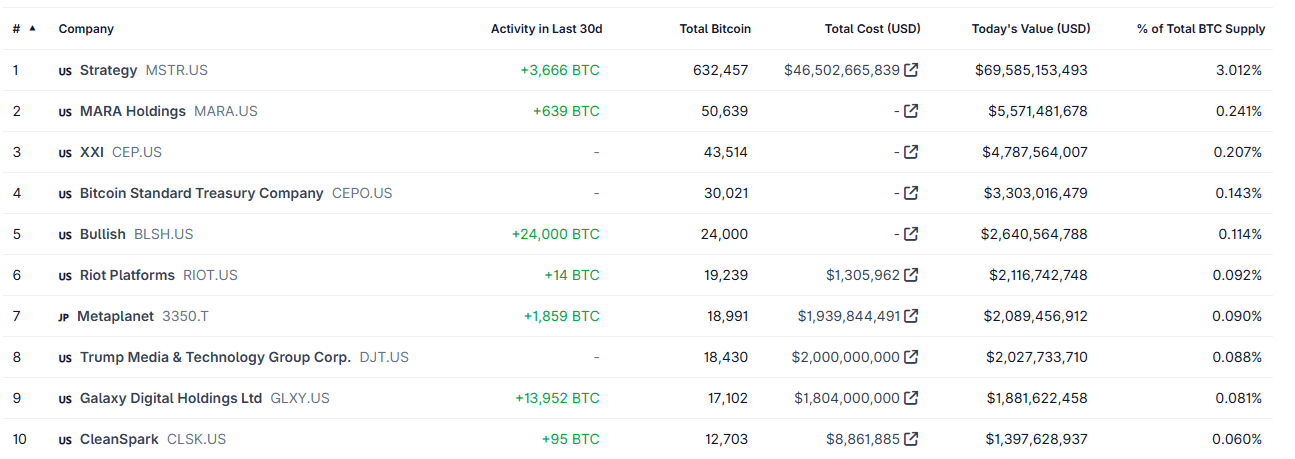

Top 10 Companies Holding the Most Bitcoin

Bitcoin remains the most popular cryptocurrency among institutional investors, thanks to its limited supply of 21 million coins and its role as a store of value. Many companies hold significant BTC in their treasuries. Below is the list of the top 10 companies with the largest Bitcoin holdings:

-

Strategy (MSTR.US)

-

Activity in Last 30 Days: +3,666 BTC

-

Total Bitcoin: 632,457 BTC

-

Total Cost: $46,502,665,839

-

Current Value: $69,585,153,493

-

-

MARA Holdings (MARA.US)

-

Activity in Last 30 Days: +639 BTC

-

Total Bitcoin: 50,639 BTC

-

Total Cost: Unknown

-

Current Value: $5,571,481,678

-

-

XXI (CEP.US)

-

Activity in Last 30 Days: –

-

Total Bitcoin: 43,514 BTC

-

Total Cost: Unknown

-

Current Value: $4,787,564,007

-

-

Bitcoin Standard Treasury Company (CEPO.US)

-

Activity in Last 30 Days: –

-

Total Bitcoin: 30,021 BTC

-

Total Cost: Unknown

-

Current Value: $3,303,016,479

-

-

Bullish (BLSH.US)

-

Activity in Last 30 Days: +24,000 BTC

-

Total Bitcoin: 24,000 BTC

-

Total Cost: Unknown

-

Current Value: $2,640,564,788

-

-

Riot Platforms (RIOT.US)

-

Activity in Last 30 Days: +14 BTC

-

Total Bitcoin: 19,239 BTC

-

Total Cost: $1,305,962

-

Current Value: $2,116,742,748

-

-

Metaplanet (3350.T)

-

Activity in Last 30 Days: +1,859 BTC

-

Total Bitcoin: 18,991 BTC

-

Total Cost: $1,939,844,491

-

Current Value: $2,089,456,912

-

-

Trump Media & Technology Group Corp. (DJT.US)

-

Activity in Last 30 Days: –

-

Total Bitcoin: 18,430 BTC

-

Total Cost: $2,000,000,000

-

Current Value: $2,027,733,710

-

-

Galaxy Digital Holdings Ltd (GLXY.US)

-

Activity in Last 30 Days: +13,952 BTC

-

Total Bitcoin: 17,102 BTC

-

Total Cost: $1,804,000,000

-

Current Value: $1,881,622,458

-

-

CleanSpark (CLSK.US)

-

Activity in Last 30 Days: +95 BTC

-

Total Bitcoin: 12,703 BTC

-

Total Cost: $8,861,885

-

Current Value: $1,397,628,937

-

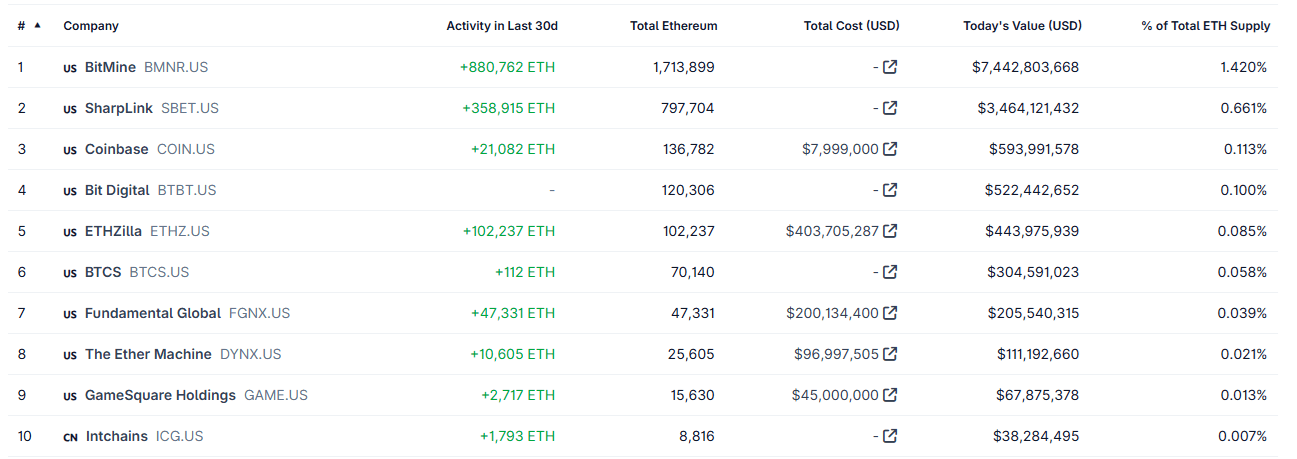

Top 10 Companies Holding the Most Ethereum

Ethereum’s smart contract capabilities and dominance in the DeFi ecosystem make it a favorite among institutional investors. Staking and DeFi yields have further enhanced its appeal as a treasury asset. Below are the top 10 companies with the largest Ethereum holdings:

-

BitMine (BMNR.US)

-

Activity in Last 30 Days: +880,762 ETH

-

Total Ethereum: 1,713,899 ETH

-

Total Cost: Unknown

-

Current Value: $7,442,803,668

-

-

SharpLink (SBET.US)

-

Activity in Last 30 Days: +358,915 ETH

-

Total Ethereum: 797,704 ETH

-

Total Cost: Unknown

-

Current Value: $3,464,121,432

-

-

Coinbase (COIN.US)

-

Activity in Last 30 Days: +21,082 ETH

-

Total Ethereum: 136,782 ETH

-

Total Cost: $7,999,000

-

Current Value: $593,991,578

-

-

Bit Digital (BTBT.US)

-

Activity in Last 30 Days: –

-

Total Ethereum: 120,306 ETH

-

Total Cost: Unknown

-

Current Value: $522,442,652

-

-

ETHZilla (ETHZ.US)

-

Activity in Last 30 Days: +102,237 ETH

-

Total Ethereum: 102,237 ETH

-

Total Cost: $403,705,287

-

Current Value: $443,975,939

-

-

BTCS (BTCS.US)

-

Activity in Last 30 Days: +112 ETH

-

Total Ethereum: 70,140 ETH

-

Total Cost: Unknown

-

Current Value: $304,591,023

-

-

Fundamental Global (FGNX.US)

-

Activity in Last 30 Days: +47,331 ETH

-

Total Ethereum: 47,331 ETH

-

Total Cost: $200,134,400

-

Current Value: $205,540,315

-

-

The Ether Machine (DYNX.US)

-

Activity in Last 30 Days: +10,605 ETH

-

Total Ethereum: 25,605 ETH

-

Total Cost: $96,997,505

-

Current Value: $111,192,660

-

-

GameSquare Holdings (GAME.US)

-

Activity in Last 30 Days: +2,717 ETH

-

Total Ethereum: 15,630 ETH

-

Total Cost: $45,000,000

-

Current Value: $67,875,378

-

-

Intchains (ICG.US)

-

Activity in Last 30 Days: +1,793 ETH

-

Total Ethereum: 8,816 ETH

-

Total Cost: Unknown

-

Current Value: $38,284,495

-

Why Bitcoin and Ethereum?

The surge in institutional interest in Bitcoin and Ethereum stems from their unique advantages. Bitcoin’s limited supply and status as a store of value provide a hedge against inflation. Ethereum, with its smart contracts, DeFi applications, and staking yields, offers a dynamic financial ecosystem. In 2025, celebrating its 10th anniversary, Ethereum has seen over 1% of institutional purchases directed toward ETH, driven by regulatory clarity and DeFi’s programmable yield potential. Companies are not only treating these assets as investments but also integrating them into operational strategies, shaping the future of financial markets.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.