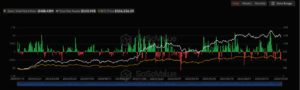

As of October 30, ETF data from the digital asset markets revealed a clear divergence in investor positioning. While Bitcoin and Ethereum spot ETFs saw weakening trading volumes, most investors preferred to remain cautious amid ongoing macroeconomic uncertainty particularly due to mixed signals from the Federal Reserve’s interest rate policy. This environment has led to a temporary slowdown in institutional fund inflows.

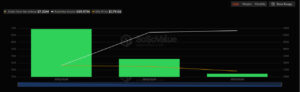

In contrast, Solana-focused ETF products managed to maintain steady investor interest despite the cautious market sentiment. Fund data shows that institutional investors continue to view Solana as a viable alternative Layer-1 solution and a tool for portfolio diversification. This trend is further supported by Solana’s rapidly growing DeFi and NFT ecosystem activity.

Outflows Continue in Bitcoin and Ethereum ETFs

Bitcoin ETFs recorded $488.43 million in outflows, signaling that investors are still avoiding short-term risk exposure. This marks one of the largest single-day outflows since September. Significant redemptions were reported particularly from the Grayscale Bitcoin Trust (GBTC) and Fidelity’s FBTC fund.

A similar picture emerged for Ethereum ETFs. A total net outflow of $184.31 million reflected investors’ continued cautious stance amid Federal Reserve uncertainty and broader macroeconomic risks. Notably, none of the Ethereum-focused ETFs including BlackRock’s ETHA fund recorded any net inflows, signaling a temporary pause in institutional demand for Ethereum-based investment products.

Solana ETFs Shine: Three Consecutive Days of Positive Inflows

Despite the overall outflow trend across the market, Solana ETFs continue to attract growing investor interest. According to data from October 30, Solana-focused funds recorded $37.33 million in net inflows, marking the third consecutive day of positive capital movement.

Analysts point to several key factors driving this increasing interest in Solana:

- High transaction speed and low cost advantage

- Expanding DeFi and NFT ecosystem activity

- Institutional portfolio diversification strategies

This trend suggests that Solana could become the fastest-growing Layer-1 asset in terms of institutional demand in 2025, strengthening its position as one of the leading alternatives to Ethereum in the blockchain ecosystem.

Stability in Bitcoin and Ethereum, Institutional Momentum in Solana

Data from October 30 clearly highlights a short-term divergence in the crypto ETF market. While Bitcoin and Ethereum funds recorded a combined $672 million in outflows, Solana funds managed to stay positive for three consecutive days thanks to strong institutional demand.

Although investors remain cautious overall, Solana’s rising institutional interest appears to be gaining lasting traction. ETF data indicates that market sentiment is no longer limited to Bitcoin and Ethereum, marking the beginning of a “multi-asset era” in the digital investment landscape.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.