The recent drop in Bitcoin price has significantly weakened investor confidence. Although support levels below $115,000 have been tested, there is no strong indication that the 2025 bull run has ended. Derivatives data suggest the market isn’t entirely bearish.

Bitcoin Derivatives and ETF Outflows Raise Confidence Concerns

On Friday, Bitcoin fell to $114,013 and traded at $113,383. This decline triggered $200 million in liquidations of leveraged long positions, damaging trust in BTC derivatives markets. Moreover, prices have failed to hold above $120,000 for three consecutive weeks, leading to a loss of confidence among investors.

Normally, monthly Bitcoin futures trade at a 5–10% premium over spot prices. The current 6% premium is the lowest in the past four weeks, indicating a decline in demand for leveraged bullish positions. While institutional interest remains high, market confidence is visibly lower.

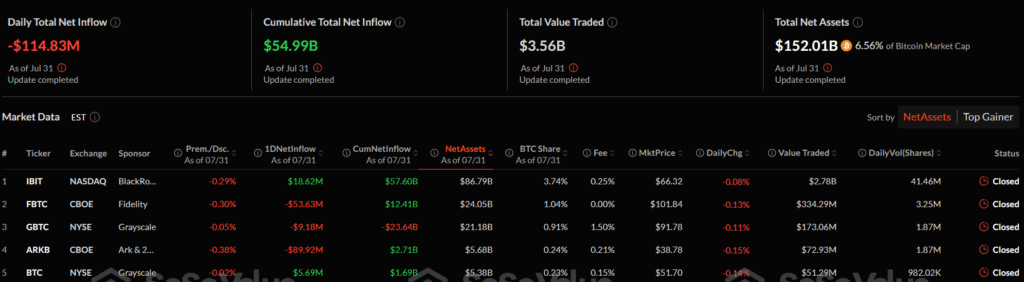

On July 31, spot Bitcoin ETFs saw a net outflow of $115 million, ending a five-day streak of net inflows. This further impacted investor sentiment. Meanwhile, Strategy (MSTR) announced a $4.2 billion stock offering on Thursday, which could help prevent large-scale Bitcoin sales and stabilize the derivatives market.

Bitcoin’s Correlation with Equities Increases

Bitcoin is only 7% below its record high of $123,182 from mid-July. Meanwhile, gold prices remain steady around $3,350. Once viewed as digital gold, Bitcoin has recently shown a strong correlation with equities amid global trade tensions. This correlation has risen above 70% over the past three weeks.

As a result, Bitcoin now behaves more like a high-risk tech stock rather than a safe-haven asset. Its market capitalization is comparable to that of Amazon and Google, highlighting the impact of U.S. tariff disputes and increased money supply on financial markets.

Investors have shifted to cash and short-term Treasury bonds due to a weakening labor market. Demand for 1-year U.S. Treasury notes reached a three-month high, driven by revised employment data and an increase in July’s unemployment rate to 4.2%.

BTC Options Between Neutral and Bearish Sentiment

It’s possible to monitor whether Bitcoin whales and market makers are reducing their leveraged long positions via the options market. In bearish conditions, put options typically carry a 6% or higher premium over call options. Currently, this premium difference is around 5%.

The delta skew of options has shifted from bullish to neutral-to-bearish since July 18. Additionally, the cost of protecting against a drop below the $114,000 support level has risen. This indicates decreasing confidence in Bitcoin’s ability to hold that level.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.