In early 2025 and into 2026, Bitcoin price behavior has moved noticeably away from the long-standing “digital gold” narrative. Its weakening correlation with physical gold and the US dollar has forced investors to reconsider how the asset should be classified in a macro framework. The real question is no longer what Bitcoin is in theory, but which macro regime is currently defining its behavior.

On January 28, the Federal Reserve held its policy rate steady at 3.5%–3.75%, reinforcing a data-dependent stance rather than signaling a clear easing cycle. Meanwhile, the IMF’s January 2026 outlook projects 3.3% global growth for the year, supported by technology investment and relatively accommodative financial conditions. In this environment, risk assets have not lost their footing entirely. Bitcoin’s shifting correlations offer insight into which identity is dominating.

Three Bitcoin Identities Competing for Control

Bitcoin appears to rotate between three distinct macro roles, depending on prevailing financial conditions.

1. Hedge Asset

In its hedge identity, Bitcoin would be expected to benefit from dollar weakness or from flows seeking a store-of-value alternative similar to gold. However, recent data suggest this role has faded. Bitcoin’s rolling 12-month correlation with gold peaked historically around +0.41 and has drifted close to zero since 2024. Likewise, its negative correlation with the US dollar, which approached –0.4 in 2022 and 2023, has weakened significantly in 2025 and early 2026. For now, the hedge narrative appears dormant rather than dominant.

2. High-Beta Technology Proxy

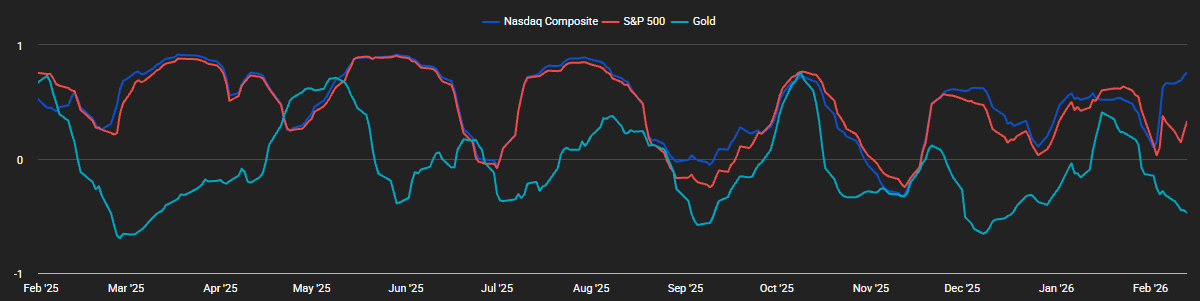

The stronger evidence currently supports Bitcoin behaving like a high-beta technology asset. Its correlation with the Nasdaq 100 has ranged between +0.35 and +0.6 in 2025 and early 2026. This implies that during risk-on sessions, Bitcoin amplifies gains in technology equities, while in selloffs it often declines more sharply. As long as growth holds and financial conditions remain supportive, this identity tends to prevail.

3. Liquidity-Sensitive Asset

Even when policy rates remain unchanged, liquidity conditions can shift. Rising real yields or tighter financial plumbing can pressure Bitcoin. Research suggests sensitivity to dollar real rates, similar to gold and emerging market currencies. Indicators such as the Federal Reserve’s balance sheet, reverse repo facility usage, and broader money supply provide measurable signals of tightening or easing. When liquidity contracts, Bitcoin often reprices quickly.

What to Watch Next

At present, Bitcoin most closely resembles a high-beta technology asset, with liquidity sensitivity acting as a secondary driver. However, a sustained rise in real yields could push it toward a duration-like, liquidity-driven identity. In a geopolitical or credit shock scenario, correlations across assets could initially spike, with any renewed hedge behavior emerging only if the dollar weakens and policy support expands.

Bitcoin’s so-called identity crisis is not philosophical. It is empirical. Correlations, real rates, ETF flows, and liquidity indicators will determine which macro role dominates next. The data will shift before the narrative does.