Bitcoin’s price slipped below the critical $87,000 level today, recording a short-term decline of around 1%. After moving sideways within the $85,000–$90,000 range in recent weeks, BTC has struggled to find strong support in this zone, prompting a cautious stance among market participants. This sideways movement reflects investors’ more controlled positioning amid short-term uncertainty and volatility. As year-end approaches, concerns over reduced holiday liquidity and the potential for sharper price swings are pushing investors to act more carefully.

China’s Mining Shutdowns Increase Supply Pressure

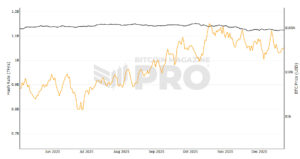

One of the key drivers behind the drop is the renewed pressure on Bitcoin mining operations in China. In particular, the shutdown of large mining facilities in the Xinjiang region reportedly forced around 400,000 miners offline in a short period. This sudden disruption caused an estimated 8% decline in Bitcoin’s hashrate, creating a tangible operational shock for the market.

Miners that go offline often face relocation, reinstallation, and rising operational costs. To cover these expenses, they may be forced to sell part of their Bitcoin holdings, generating real and direct selling pressure. This dynamic creates not merely speculative pressure, but a concrete liquidity impact that can push prices lower.

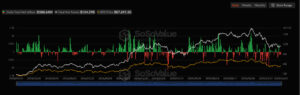

ETF Outflows Signal Institutional Rotation

Weakening institutional demand has also played a significant role in the price decline. Spot Bitcoin ETFs have recorded net outflows for three consecutive weeks. On December 23, total ETF outflows reached $188.6 million, led by BlackRock with $157.3 million, followed by Fidelity and Grayscale.

Analysts interpret these flows as a sign that institutions are temporarily reducing Bitcoin exposure and de-risking their portfolios. At the same time, some investors have shifted funds toward traditional safe havens such as gold, which has climbed above $4,400 amid rising demand. This rotation increases short-term liquidity pressure on Bitcoin and contributes to downward price movement.

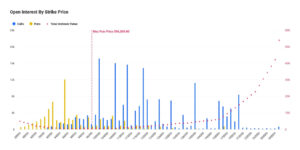

Large Options Expiry Fuels Volatility

Another major factor weighing on Bitcoin is the expiration of a significant batch of options contracts. More than $23.6 billion worth of BTC options, covering roughly 268,000 contracts, expired on Deribit this week. Such large expirations, especially during holiday periods with thin liquidity, tend to amplify price volatility.

As expiry dates approach, traders adjust positions through increased buying and selling, driving short-term fluctuations. Historically, Bitcoin often experiences choppy price action ahead of major option expiries, followed by a clearer directional move once the contracts are settled. This dynamic adds temporary uncertainty and selling pressure in the market.

What’s Next for Bitcoin?

While technical indicators still leave room for optimism, CryptoQuant analysts warn that if the current pressure persists, Bitcoin could revisit the $70,000–$56,000 range in the coming months. A stronger recovery may follow once these levels are tested. Overall, Bitcoin’s recent decline appears to be driven by political pressures, institutional fund rotation, and market mechanics rather than a collapse in long-term demand. Despite short-term volatility and caution, underlying interest in Bitcoin remains intact.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.