The leading cryptocurrency, Bitcoin, started the new week with a selling pressure. After giving back most of the gains made following last week’s U.S. Federal Reserve (Fed) interest rate cut, Bitcoin fell below the $90,000 level, redirecting investor attention to downside risks. This pullback in price has reinforced the cautious sentiment in the market and highlights the ongoing short-term search for direction.

Bitcoin Drops Below $89,000

In early trading this week, Bitcoin (BTC) slipped below $89,000, trading around $88,800. Over the past 24 hours, BTC lost approximately 2%, with the overall market maintaining a cautious tone. Experts note that low liquidity conditions and upcoming macroeconomic events are key factors contributing to this weak outlook.

Ethereum (ETH), in contrast, showed relative resilience. Despite broader market pressure, ETH maintained its position around $3,100, benefiting from sustained demand and limited selling pressure, and outperformed Bitcoin over the past seven days.

Liquidity Constraints and BoJ Concerns Weigh on Bitcoin

Market participants identify declining liquidity and the potential for a Bank of Japan (BoJ) interest rate hike as primary pressures on Bitcoin. Although no official decision has been made, investors are adopting a risk-averse stance based on historical precedent. Analysts point out that after previous BoJ rate hikes, Bitcoin prices dropped between 23% and 31%. Japan, being one of the largest foreign holders of U.S. Treasury bonds, adds concern that tighter monetary policy there could pressure global risk assets, including cryptocurrencies.

Crypto analyst Ali Martinez noted that Bitcoin’s technical outlook has weakened. He identified $89,000 as a critical support level and $86,000 as the next significant support. If $86,000 fails to hold, selling pressure could intensify, potentially leading to a deeper and sharper correction.

Option Selling and Low Volatility Limit Upward Moves

Jeff Park, Head of Bitwise Alpha, explained that Bitcoin’s upside potential is being suppressed by ongoing option selling from long-term holders. Early Bitcoin investors selling call options on their holdings keep price movement in a narrow range and suppress volatility. Implied volatility, which rose to around 63% at the end of November, has fallen to roughly 44% in recent weeks. This low-volatility environment makes it difficult for Bitcoin to start a strong and sustained upward trend.

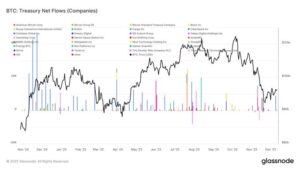

Another notable factor is the discrepancy between Bitcoin ETF options and spot crypto exchange options. For ETFs like iShares Bitcoin Trust (IBIT), demand for bullish positions remains strong, whereas the same optimism is not yet clearly visible in the spot crypto market. This highlights a divergence in expectations between traditional investors and long-term crypto holders. Despite selling pressure on price, on-chain data presents a more balanced picture. Glassnode data shows that digital asset treasury (DAT) companies have resumed Bitcoin purchases, which had previously slowed, contributing to extended sideways price action.

When Could the Trend Change?

According to Jeff Park, two main conditions could trigger a stronger Bitcoin price move: a slowdown in option selling by long-term holders, or a significant increase in demand for Bitcoin ETF options. Otherwise, given current macro uncertainty and market structure, Bitcoin is likely to remain under pressure for some time. In the short term, Bitcoin is fluctuating below $90,000, with BoJ rate expectations, low liquidity, option selling pressure, and declining volatility making it difficult for investors to find clear direction. Upcoming macroeconomic events and central bank signals will be decisive for Bitcoin’s next move.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.