Ethereum treasury company FG Nexus (FGNX) has drawn significant attention in recent days after making major financial moves. The company’s decision to sell a portion of its holdings triggered a sharp decline in its stock price. Despite this, FG Nexus continues its strategic buyback program, focusing on long-term value growth.

FG Nexus Sold $31 Million Worth of Ethereum

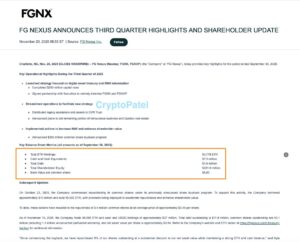

FG Nexus liquidated part of its Ethereum reserves, generating over $31 million in cash. By the end of September, the company had accumulated more than 50,000 ETH. It later sold 10,922 ETH, creating substantial liquidity to fund its share buyback program.

Even after the sale, the company still holds 40,005 ETH, valued at roughly $115 million. This places FG Nexus among the top public companies with large Ethereum treasuries.

Sharp Stock Decline: More Than 7% Daily Loss

Following the ETH sale announcement, FGNX stock tumbled more than 7% in a single day, expanding its monthly loss to 37%. Looking at a broader timeframe:

- The stock has lost over 85% in the past six months.

- It traded above $40 in August, but has fallen to $2.41 today.

This collapse has shaken short-term investor confidence, though the company argues that current levels represent a long-term opportunity.

FG Nexus has channeled proceeds from the Ethereum sale into an aggressive buyback plan:

- 4 million FGNX shares repurchased

- Average buyback cost: $3.94

- Current market price is far below this level, indicating the stock trades at a deep discount relative to the company’s net asset value (NAV).

CEO Defends the Strategy

FG Nexus President and CEO Kyle Cerminara commented:

“Since launching the buyback, we’ve repurchased 8% of our outstanding shares at a significant discount to NAV. Our ETH holdings and cash position remain strong, and we intend to continue buying shares as long as they trade below NAV.”

This signals clear confidence in long-term shareholder value.

ETHZilla and Other Firms Made Similar Moves

FG Nexus is not alone. In October, ETHZilla (ETHZ) sold $40 million in ETH to fund shareholder payments and buybacks. Other digital asset firms—including SharpLink Gaming—have followed similar strategies.

This reflects a growing trend:

Companies with depressed market-to-net-asset values (mNAV) use buybacks as a way to unlock shareholder value.

Recent Ethereum price declines have also played a role. ETH dropped to around $2,800, prompting treasury-heavy firms to:

- Reduce risk

- Strengthen liquidity

- Prepare for possible volatility

- Lock in profits before further downside

For companies holding large amounts of ETH, the dip made strategic sales more attractive.

FG Nexus Is Undergoing a Strategic Restructuring

While the ETH sale and steep stock decline seem negative at first glance, the company’s long-term strategy paints a different picture:

- The majority of ETH reserves remain intact

- Liquidity is increasing

- Stock buybacks continue aggressively

- Management aims to bolster long-term value

Despite short-term market volatility, FG Nexus’ approach may position the company strongly for long-term investors.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.