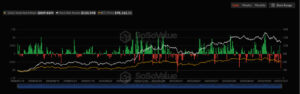

Bitcoin spent the day under the influence of broad market weakness, breaking below key support levels. The nearly 22% pullback from the $126,272 peak shows that investor risk appetite has dropped sharply. The price falling to $97,000 triggered a chain of liquidations in leveraged positions, and as selling pressure intensified, market volatility increased.

Latest Technical Outlook

Bitcoin’s sharp decline pushed the price down to the $96,000 region, which became the main support of the day. The price action struggling to stay above the 200 EMA indicates that the market remains under heavy pressure. Although the RSI falling into the oversold zone increases the likelihood of a short-term relief bounce, the overall trend still appears weak. Closing levels are critically important; a move above $97,500 could trigger an upward recovery, while a close below $96,000 could bring a deeper decline back onto the table.

Ethereum also weakened in parallel with Bitcoin, dropping to $3,101. Pressure in technical indicators and declining volume show that the market currently offers limited opportunity for buyers. The $3,400–$3,500 range stands out as a critical decision zone for ETH.

The Main Reasons Behind Today’s Drop

One of the most significant drivers of today’s sharp decline was the drop in stock prices of major crypto-linked companies. Leading firms in the sector such as Cipher Mining, Riot Platforms, Hut 8, and MARA recorded double-digit losses, weakening overall investor sentiment. Declines in the Nasdaq and S&P 500 indices further accelerated the flight from tech-heavy assets, adding extra pressure to the crypto market.

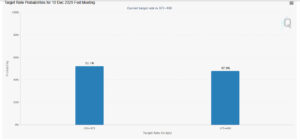

The weakening of expectations for a Fed rate cut also contributed to the decline. Recent comments from Fed officials have made it clear that the probability of “early easing” has dropped significantly, and expectations for rate cuts have meaningfully diminished. The Fear and Greed Index falling to 15 clearly shows how deep market anxiety and psychological deterioration have become.

In addition, rising ETF outflows further increased the pressure on Bitcoin. In recent days, spot Bitcoin ETFs have seen significant withdrawals, indicating that institutional investors are taking a cautious stance. The total outflow approaching $1 billion since November 12 weakened Bitcoin’s bullish momentum and added additional selling pressure to the market.

What’s Next for Bitcoin?

After reaching $126,000 earlier this year, Bitcoin has now entered a strong correction phase. Technically, it is trading near the oversold region, and there are early signs of a volume-based recovery. However, short-term direction will depend entirely on whether critical support levels hold.

If Bitcoin manages to stay above $98,000, there is a strong possibility of a rebound toward $107,000. But if the price continues to remain below this level, a deeper pullback toward the $90,000 region remains possible.

The Drop Was Driven by Multiple Factors

Today’s price action was the result of several negative dynamics hitting the market simultaneously: global tech stock sell-offs, Fed uncertainty, ETF outflows, institutional selling, and the breakdown of key technical levels. While the short-term outlook remains weak, the long-term uptrend is still intact, providing hope for the medium-term outlook.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.