2025 stood out as an active yet cautious year for the cryptocurrency market. Despite record-level liquidations and high volatility, Bitcoin displayed relative resilience in the post-halving period. Nevertheless, the overall market performance throughout the year fell short of investor expectations. Experts note that this weakness was not limited to price action alone, but stemmed from a combination of structural market dynamics and macroeconomic factors such as interest rates, inflation, and global uncertainty.

Bitcoin’s Post-Halving Calm

Bitcoin typically experiences strong gains in the year following a halving. However, 2025 painted a different picture. Instead of explosive price movements, Bitcoin followed a relatively calm trajectory. According to Jan3 CEO and prominent Bitcoin advocate Samson Mow, this quiet period may be temporary; supply constraints and sustained demand could signal a major price move ahead.

Mow emphasized that record liquidations earlier in the year did not push Bitcoin significantly lower. While altcoins suffered sharp declines, Bitcoin managed to hold the $85,000–$95,000 range. This resilience suggests that Bitcoin was able to absorb selling pressure despite broader market stress.

Factors Keeping the Market Calm

According to Mow, Bitcoin’s limited upside performance was driven by several key factors:

- Profit-taking: Investors realized short-term gains.

- Whale rotations: Large investors’ movements contributed to sideways price action.

- ETF and “paper Bitcoin” trading: Activity that did not directly impact the spot market.

- Altcoin rallies: Ethereum and XRP posted notable gains earlier in the year, temporarily diverting capital away from Bitcoin.

Mow noted that the combination of these factors resulted in Bitcoin finding equilibrium rather than entering a sharp rally.

The Rise of Traditional Assets

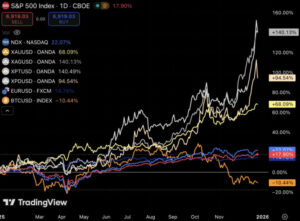

In 2025, gold and silver delivered strong performances driven by economic uncertainty and safe-haven demand. Gold rose around 12% year-to-date, while silver gained approximately 15%. Bitcoin, by contrast, moved sideways in a narrow 3–5% range. According to Markus Thielen, CEO of XWIN Research Japan and 10X Research, this trend indicates that investors favored traditional safe-haven assets and that institutional capital continued to lean toward physical assets.

Additionally, the BTC-to-gold ratio dropped by nearly 50% during 2025, falling from around 40 ounces in December 2024 to roughly 20 ounces. Analysts interpret this shift not as weakening Bitcoin demand, but as a reflection of gold’s exceptional strength.

Structural Challenges in the Market

The total crypto market capitalization declined by approximately 13% in 2025. From the all-time high of $4.4 trillion reached in October, the market fell by more than 32%, despite regulatory improvements and institutional participation. Analysts point to excessive leverage and persistent selling by long-term holders as contributing factors. Adam Kobeissi stated that the market is undergoing a structural transition amid historically high leverage levels, noting: “Crypto is no longer driven solely by short-term traders; it is facing deep structural changes.”

Long-Term Fundamentals and Outlook

Although prices underperformed in 2025, Pantera Capital’s Head of Content Erik Lowe described the year as a “year of fundamental progress.” According to Lowe, clearer regulatory frameworks, increasing institutional interest, and the expansion of tokenized real-world assets strengthened the foundation for long-term growth, despite short-term price pressure. These developments are seen as paving the way for a more sustainable market structure in the years ahead.

Meanwhile, Samson Mow and other analysts argue that Bitcoin’s relative calm post-halving does not signal weakness. Instead, they see a temporary balance between supply and demand. Given ongoing supply constraints and structural demand, this quiet phase could precede stronger price action in the future.

What Should Investors Expect?

The lessons of 2025 offer several key takeaways for investors:

- The market remains volatile, with cautious investor behavior prevailing.

- Portfolio diversification and risk management are critical.

- Assets with strong fundamentals, such as Bitcoin and Ethereum, stand out for long-term investment.

- Macroeconomic conditions and the strong performance of gold and silver may cap short-term crypto gains, but long-term growth potential remains intact.

In summary, the main reasons the crypto market remained weak in 2025 include high leverage, short-term selling pressure, the outperformance of safe-haven assets like gold and silver, and structural market changes. However, solid fundamentals and growing institutional interest continue to position the market for potential upside in 2026 and beyond.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.