The crypto market started the new day with a strong upward move. Over the past 24 hours, total market capitalization increased by 77 billion USD, reaching 3.13 trillion USD. Bitcoin holding above the 93,000 USD level, along with parallel gains in Ethereum and XRP, created a broadly positive market sentiment. So why did the crypto market rise today, and what are the main drivers behind this move?

Crypto Market Turns Green: Total Value Reaches 3.11 Trillion USD

The total crypto market capitalization (TOTAL) posted a notable increase over the last 24 hours. The broad-based rally was not limited to Bitcoin alone; altcoins—and especially memecoins—also benefited from fresh capital inflows.

The next key resistance level stands at 3.14 trillion USD. A clear breakout above this level could strengthen market confidence and open the door for a move toward the 3.20 trillion USD zone. However, global macro risks remain on the table. Any negative developments from traditional markets could push TOTAL back below the 3.09 trillion USD support level.

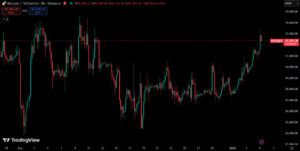

Bitcoin Breaks Above 93,000 USD: Is 95,000 USD the Next Target?

At the time of writing, Bitcoin is trading around 92,400 USD. The 93,471 USD resistance level is being closely watched as a key short-term threshold. A clean breakout and confirmation of this level as support would be critical for trend continuation.

“Reclaiming the 95,000 USD level would significantly boost market confidence.”

— Market analysts

If Bitcoin manages to break above 95,000 USD, the psychological 100,000 USD level could once again come into focus. In the short term, however, profit-taking remains a risk. In the event of a sell-off, Bitcoin could retreat to 91,511 USD or even 90,000 USD.

Ethereum and XRP Join the Rally

Ethereum showed steady gains, supported by rising on-chain transaction volumes and stable levels of staked assets. As the second-largest crypto asset, Ethereum’s resilience highlights that investor interest is not limited to short-term trades but also extends to long-term infrastructure-focused projects.

XRP stood out with a gain of over 5%, becoming one of the day’s top performers. Rising volume and strong buying pressure suggest that XRP’s move was driven not only by speculation but also by increased overall risk appetite in the market. Renewed positioning by altcoin investors further supported XRP’s momentum.

One of the notable factors behind today’s rally was timing. While traditional financial markets were closed, crypto remained one of the few major markets open. With limited alternatives, buying interest shifted toward digital assets. This once again highlighted how crypto’s 24/7 trading structure allows it to react quickly to changes in global sentiment.

Short Liquidations Accelerated the Rally

The sudden price surge also triggered sharp moves in the derivatives market. According to Coinglass data, approximately 263.44 million USD in liquidations occurred over the past 24 hours, with 197.43 million USD coming from short positions. This indicates that a significant portion of the rally was fueled by short covering.

Will the Rally Continue?

The crypto market has started the day on a strong note, but the real test will come when traditional markets reopen. As long as Bitcoin remains above 91,000 USD, the upward momentum could be maintained. Otherwise, prices may move sideways or experience short-term pullbacks. For now, the outlook is positive—but the next few trading sessions will be crucial in determining the market’s direction.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.