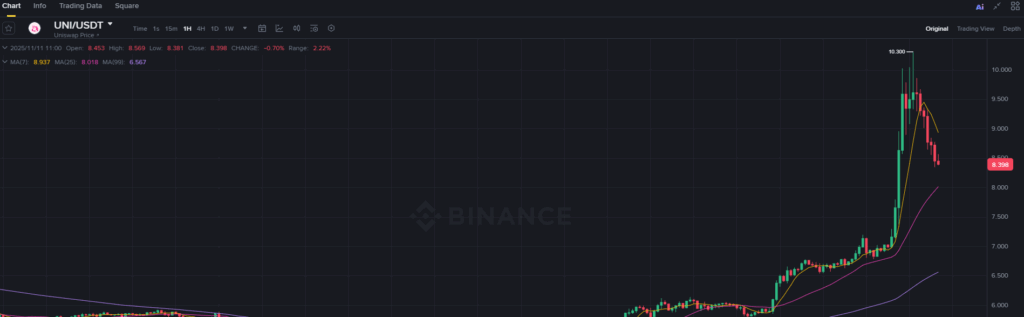

Uniswap (UNI) experienced a significant price surge following the implementation of the fee switch mechanism on November 9, 2025. Within 24 hours, UNI rose by 35.52% to reach $10.30. This increase is directly linked to investor confidence and the protocol’s long-term strategic developments.

The fee switch targets fraudulent pools on the Base chain. More than half of the total $208.07 billion trading volume was found to come from fake transactions. After activation, only $77.38 billion of legitimate volume remained. Additionally, the mechanism was integrated with UNI token burn process, reducing the token supply. This step enhanced market transparency and strengthened investor trust.

Institutional Investors Drive UNI Momentum

Institutional investors played an active role following the protocol changes. A total of 2.818 million UNI tokens were transferred via Coinbase Prime to Binance, OKX, and Bybit. Valued at approximately $27.08 million, this movement sparked market speculation and pushed UNI prices upward.

Although no official statement has been issued, blockchain analytics suggest that major investors, such as Variant Fund, could be behind the transfer. Institutional actions increase participation in Uniswap’s governance model, supporting decentralized decision-making in DeFi protocols.

Market Data and Investor Behavior

Uniswap’s current market capitalization stands at $5.93 billion. UNI rose 72.93% over the week, while its 90-day performance shows a 17.59% decline. Daily trading volume surged by 372.17%, and at the time of writing, UNI is trading at $8.42.

The fee switch and institutional token transfers have directly influenced market behavior. Eliminating fraudulent pools and implementing UNI burns boosted investor buying motivation. Furthermore, the “Growth Budget” and governance mechanisms strengthened community engagement. These changes reinforce UNI’s position as a leading decentralized exchange.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.