During yesterday’s sharp sell-off, Bitcoin dropped more than 5%, triggering roughly $250 million in liquidations of leveraged positions. This aggressive move briefly weakened investor sentiment and pushed the market into a risk-off mode. However, despite the volatility, the rapid decline in selling pressure, the renewed strength in institutional demand, and emerging positive macro expectations led to a significant recovery in Bitcoin. As a result, BTC regained upward momentum today. Behind this rebound are strong macro signals, including notable moves from traditional financial institutions and improving expectations regarding Fed policies.

Goldman Sachs’ $2 Billion ETF Move

Goldman Sachs is preparing to acquire Innovator Capital Management for approximately $2 billion, signaling a new level of institutional interest in crypto-backed ETF products. Innovator offers defined outcome ETFs that provide indirect exposure to Bitcoin, and these products are particularly favored by traditional investors seeking low-risk entry into crypto.

This acquisition positions Goldman to play a much more active role in the rapidly growing crypto ETF ecosystem. Consequently, it is noted that Bitcoin’s acceptance within traditional finance is accelerating.

Vanguard’s Surprise Crypto Expansion

After years of staying away from crypto, Vanguard has now allowed trading of spot Bitcoin, Ethereum, XRP, and Solana ETFs on its platform. The move marks a highly critical turning point for the market. Considering that Vanguard serves over 50 million customers, this decision effectively opens a massive new liquidity channel to the crypto market. Experts state that this development will accelerate institutional adoption and strengthen confidence in crypto.

Trump Signals Kevin Hassett as Potential Fed Chair, Boosting Markets

U.S. President Donald Trump’s signal that Kevin Hassett is a “potential Fed Chair” triggered a rapid return of risk appetite. Hassett is known for a more dovish approach favoring quicker interest rate cuts which has led markets to believe the easing cycle could accelerate in 2026.

Economists note that if Hassett were to take office, markets could expect:

- faster rate cuts,

- a weaker dollar,

- increased liquidity,

- and bullish effects for Bitcoin and altcoins.

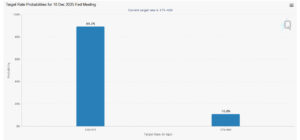

Fed Easing Signals Support Crypto

Recent statements from Fed officials indicate that “inflation is now on a more controlled path” and that “the aggressive tightening phase may be nearing its end.” This has triggered a clear shift in market expectations. According to CME’s FedWatch Tool, the probability of rate cuts in December and January has risen to 89.2%. This high probability reflects a strong pricing-in of expectations that the Fed will adopt a more accommodative monetary policy in the coming period.

These emerging easing signals on the macro front are revitalizing risk appetite, playing a critical role in strengthening demand for Bitcoin. Investors are positioning themselves with the belief that lower rates and greater liquidity will positively impact the crypto market.

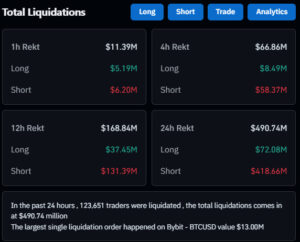

$418 Million in Short Liquidations in 24 Hours

Another key factor behind Bitcoin’s recovery was the $418 million in short liquidations over the past 24 hours. This wave of liquidations caused a rapid price spike and triggered cascading liquidations, helping fuel the rally. In short, the removal of short positions expanded Bitcoin’s upside potential.

Conclusion

The main catalysts behind Bitcoin’s rise today include:

- Goldman Sachs expanding its ETF reach,

- Vanguard enabling crypto ETF trading and boosting adoption,

- Increased Fed easing expectations following Trump’s remarks on Kevin Hassett,

- and the accelerating pace at which traditional finance is opening up to crypto.

Collectively, these developments show that despite ongoing volatility, institutional adoption is accelerating and Bitcoin is forming a stronger foundation for mid-term upside.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.